1. Summary

The Corporate Sustainability Reporting Directive (CSRD)1 brings with it standardised requirements for the disclosure of information, covering a wide range of sustainability topics. New information quality requirements raise sustainability information alongside financial statement information in significance. This means obligations for companies and their responsible parties to also create processes and controls that support the reliability of sustainability information, ensure sufficient resourcing and enhance expertise about the content of the new requirements. Audit committees have an important role to play in the successful implementation of sustainability reporting.

In order to promote the high-quality implementation of the European Sustainability Reporting Standards (ESRS)2, the Financial Supervisory Authority (FIN-FSA) conducted a survey to map the readiness of audit committees and the preparedness of companies for upcoming sustainability reporting. The survey was sent to most of the listed companies and to some FIN-FSA supervised entities, all of which will prepare the sustainability report required by the CSRD as part of the 2024 management report. The survey provided the FIN-FSA with useful information on how companies are preparing for the implementation of sustainability reporting. In the survey and in this report, the term audit committee refers to an audit committee, another committee carrying out the tasks of an audit committee, or the full board of directors carrying out the tasks of an audit committee.

The results of the survey show that audit committees are aware of the new broad regulatory framework for sustainability reporting. Companies are, however, at very different stages in the implementation of sustainability reporting. Some companies are well advanced in their preparations and aim to start the reporting process on 1 January 2024, but for other companies the timetable seems challenging.

In this report, the FIN-FSA draws attention to the following aspects, among others:

- Audit committees should have a sufficiently in-depth understanding of the CSRD and particularly the ESRS (see chapter 6 and chapter 12).

- Audit committees have a key role in preparing for sustainability reporting (see chapter 7 and chapter 14).

- An important task of audit committees is to monitor and assess the determination of materiality and to support the board of directors in this area (see chapter 8).

- Audit committees should closely monitor the progress of the sustainability reporting implementation project (see chapters 9–11).

- Audit committees have an important role in the selection of the sustainability reporting assurance provider, in the monitoring and assessment of assurance, and in dialogue (see chapter 13).

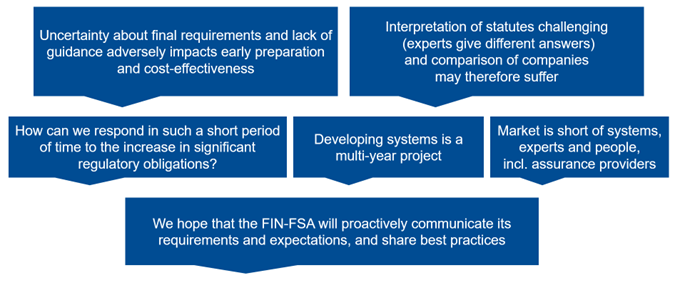

Audit committees have identified a number of challenges in preparing for sustainability reporting (see chapter 15). The FIN-FSA considers the concerns raised to be justified and shares the views of the audit committees.

Figure 1. Examples of challenges identified by audit committees

Preparation of harmonised enforcement of sustainability reporting is under way in Europe. The European Securities and Markets Authority (ESMA) is issuing guidelines to national competent authorities on the enforcement of sustainability information. The guidelines are based on guidelines on enforcement of financial information, so the enforcement of sustainability reporting will generally be similar to the already established IFRS enforcement for listed companies. ESMA will publish a public consultation on its guidelines in early 2024.

Enforcement of sustainability reporting is currently being launched by the FIN-FSA. The launch will involve, among other things, situation mapping, such as this audit committee survey. No decisions have yet been taken on the practical arrangements for enforcement and it will be established over the coming years. The enforcement of listed and unlisted banks’ and insurance companies’ sustainability reporting is carried out by FIN-FSA’s Banking and Insurance Supervision departments.

1 DIRECTIVE (EU) 2022/2464 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting.

2 For more information, see the Commission’s website: https://finance.ec.europa.eu/news/commission-adopts-european-sustainability-reporting-standards-2023-07-31_en.