Financial Supervisory Authority in brief

The Financial Supervisory Authority (FIN-FSA) is the authority for the supervision of Finland's financial and insurance sectors. Its supervised entities include banks, insurance companies and authorised pension insurers, as well as others active in the insurance business, investment firms, fund management companies, and the stock exchange. 95% of our activities are funded by the supervised entities; the remaining 5% comes from the Bank of Finland.

Administratively, the FIN-FSA operates in connection with the Bank of Finland, but in its supervisory work, it takes its decisions independently. At the end of the review year, the FIN-FSA’s personnel amounted to 244. Our office is located in Helsinki.

The objective our activities is the stable operation of credit, insurance and pension institutions and other supervised entities required for the stability of the financial markets. Another objective is to safeguard the best interests of the insured and to maintain public confidence in the operation of the financial markets. Furthermore, we seek to foster compliance with good practices in the financial markets and public awareness of the financial markets. These objectives and tasks have been laid down in the Act on the Financial Supervisory Authority.

We work in the interests of the users of banking, insurance and investment services.

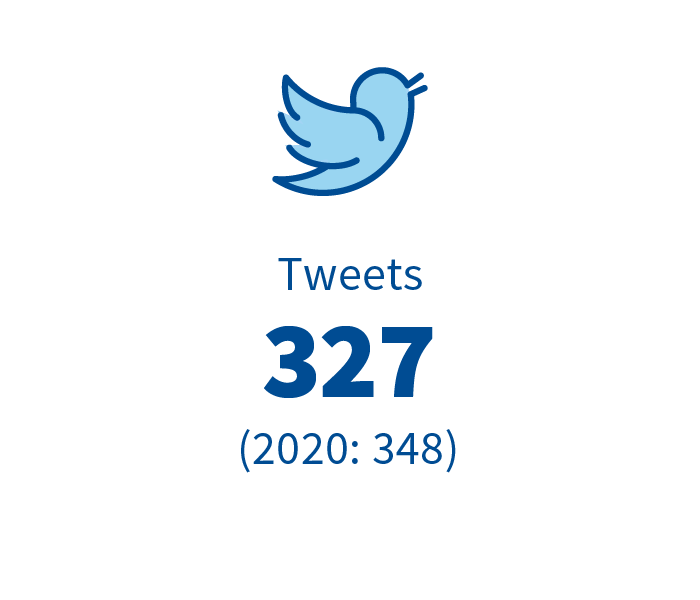

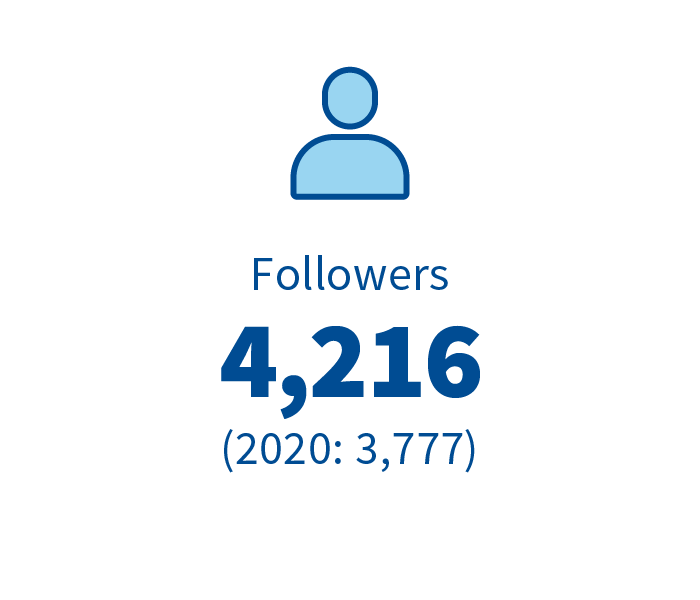

The account monitors communications by the EU’s financial supervisory authorities as well as tweets on, among other things, public presentations by FIN-FSA staff, job vacancies and themes relating to the protection of banking and insurance customers.

Top tweets were on the following topics:

Wiseling Oy not authorised by FIN-FSA to provide investment services

Financial Supervisory Authority withdraws authorisation of Privanet Securities Ltd

Macroprudential decision: Loan cap stays at 85%, lenders recommended to apply caution to granting loans that are long and large relative to income