Borrowing

What are the risks associated with borrowing?

One way of assessing the risks is to divide factors affecting risks into two groups depending on whether they affect

- your own ability to service the loan (e.g. unemployment or a rise in interest rates) or

- the value of collateral (e.g. a fall in housing prices).

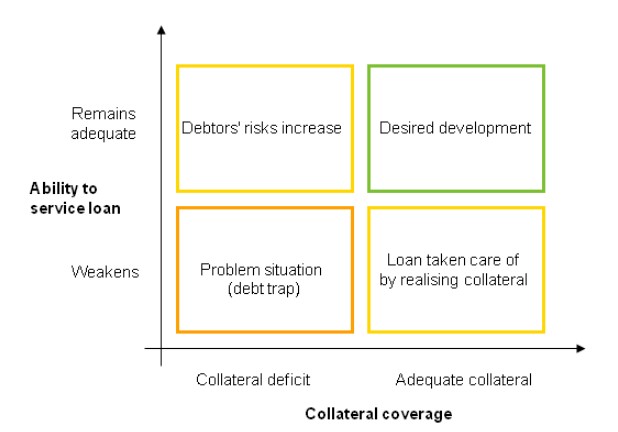

The following figure illustrates the consequences of different options:

The situation is straightforward when the value of collateral and your ability to service the loan remain unchanged (the situation in the top right hand corner).

The risk increases if the value of the collateral falls. The situation remains manageable, however, if your loan servicing ability remains unchanged (the situation in the top left hand corner). A decline in the value of collateral alone generally has no direct impact if your capacity to service the loan remains unchanged. If the decrease in collateral value is not due to actions of the provider of collateral, the bank cannot require additional collateral.

If, however, your loan servicing ability is impaired to such an extent that you can no longer meet your repayment obligations, you need to realise your collateral – for example sell your house/apartment (situation in the bottom right hand corner).

In the most serious scenario, both your solvency and collateral cover weaken (situation in the bottom left hand corner). In that case, you can no longer clear the debt by realising collateral, and as a borrower you descend into a debt trap. The debt trap risk is further increased by a small share of self-financing relative to the loan, i.e. low advance saving for the house/apartment.

What is loan protection insurance?

To manage risks in the event of an adverse change in your income, banks sell loan protection insurance provided by insurance companies to safeguard loan repayment. The insurance can be taken as protection against, for example, unemployment, death or illness.

What do I need to establish before I purchase loan protection insurance?

Before taking out loan protection insurance, it is advisable to establish the following:

- What types of risk can you and should you provide for with loan protection insurance? Various kinds of loan protection insurance are available: some, for example, offer insurance in the event of death or insurance to cover unemployment, permanent or temporary unemployment due to disability, or permanent disadvantage through accident.

- On what kind of terms and conditions is it possible to receive compensation from the loan protection insurance? For example, compensation for permanent disadvantage may require the disadvantage to be severe.

- For how long is it possible to receive compensation from the loan protection insurance? For example, payment of compensation in unemployment insurance due to disability and in unemployment insurance may be limited to a maximum of 12 months, and unemployment insurance may require new employment for a minimum of 6 months before new compensation is paid.

- What is the cost of the loan protection insurance relative to the potential insurance compensation?

- What alternatives do you have to loan protection insurance? Are complementary statutory and voluntary protection arrangements and insurances adequate relative to family income and assets? It is worth remembering that loan protection insurance is often tied to servicing the loan. In other words, if the loan protection insurance is needed, compensation must be used for servicing the loan

Can I prepare for surprising changes at home?

You can also prepare for changes in income and expenditure through your own proactive measures: you can keep a separate buffer fund in the loan servicing account or in another account that provides a better yield. When you are in a favourable financial situation, you can increase the buffer fund by paying into the account more than one loan repayment instalment.

An adequate buffer also enables “instalment-free” months, when the instalments are taken entirely from the buffer fund without you needing to transfer new money into the account.

What should I pay close attention to in the loan agreement?

For a loan applicant, the essential terms and conditions are

- the expenses arising from the loan

- the repayment method and repayment schedule

- the grounds for amending the terms and conditions of the loan (e.g. changing the interest rate basis as well as premature amortisation and repayment of the loan) and

- the grounds for calling in the loan.

A loan agreement may also lead to obligations other than loan repayment, which you should be aware of before entering into the agreement. Such an obligation may be, for example, your obligation to provide information on a change in your financial position.

It is worthwhile ensuring that all agreed terms and conditions are documented in a written loan agreement. In this way, you will avoid potential later difficulties in producing evidence. You must also ensure that you receive from the lender copies of the loan agreement (promissory note), the repayment schedule and the collateral agreement, if any. These documents must be kept in a safe place.

Can I change the loan repayment schedule?

It may be possible to change the repayment schedule during the loan period. You may be able, for example, to agree with the bank on instalment-free periods, during which only loan interest is paid.

If you wish to provide for this possibility, agree on this when negotiating the loan and document it in the loan agreement. If your financial position changes, you should always contact the bank.