Supervision responsive to changing operating environment

The Finnish financial sector remained solvent despite the weakening of the operating environment. Changes in the operating environment are described in more detail in the chapter “State and risks of the financial sector”.

The FIN-FSA supervised, on an enhanced basis, credit risks, the situation of the funding market and liquidity risks, IT and cyber risks, market risks and valuation concerns, risk management and control systems as well as listed companies’ periodic and ongoing disclosure obligation.

The credit losses and volume of non-performing loans in the banking sector remained moderate, but the uncertainty of the operating environment increases the risks of growth of credit losses and non-performing loans in the longer term. Furthermore, the dependency of the banking sector on market-based funding exposes Finnish banks to changes in financial market sentiment and underscores the importance of liquidity management.

The situation also remained stable in the insurance sector despite the uncertain performance of the investment markets. Insurance companies’ result and solvency are sensitive to changes in the investment markets, however. In supervision, particular attention was paid to, among other things, how the higher level of interest rates and inflation affect both solvency and profitability.

The FIN-FSA’s strategy for 2023−2025 was updated at the end of the review year to reflect changes in the operating environment. The strategy highlights four strategic themes: proactive and predictable supervision, utilisation of digitalisation on operations, flexible and adaptable organisation as well as leadership that supports expertise.

Elevated risks in the operating environment were reflected in macroprudential decisions and communications in the review year

FIN-FSA began gradual reinstatement of macroprudential buffer requirements

The structural systemic risks of the Finnish credit institution sector have remained significant, warranting the application of structural macroprudential buffer requirements. During the review year, the FIN-FSA assessed the possibilities and alternatives to restore structural buffer requirements to strengthen the resilience of the Finnish banking sector.

During the review year, the FIN-FSA assessed that an adequate overall level of macroprudential buffer requirements in a neutral cyclical environment would be close to the pre-COVID level or slightly above it. The assessment is based on the FIN-FSA’s and Bank of Finland’s joint stress test calculations for the credit institution sector as well as research literature on the adequacy of capital requirements for credit institutions. In spring 2020, the FIN-FSA removed the systemic risk buffer requirements on Finnish credit institutions and eased the O-SII1 buffer requirements on OP Financial Group to alleviate the impacts of the COVID pandemic. Due to the reduction of the buffer requirements at an early stage of the COVID pandemic, the total amount of the macroprudential buffer requirements for the Finnish credit institution sector fell short of the overall level considered adequate in the review year.

A number of international authorities recommended a strengthening of the credit institution sector’s resilience to disruptions in the review year. In September, the European Systemic Risk Board (ESBR) issued a general warning of the risks to the financial system in the EU, highlighting the need to preserve or enhance the resilience of the financial system. The Governing Council of the European Central Bank (ECB) issued a like-minded statement in November. In addition, in the autumn, the International Monetary Fund (IMF) issued a recommendation, in the context of its Financial Sector Assessment Programme regarding the Finnish financial system and its risks, that the systemic risk buffer requirement in Finland should be raised as circumstances allow.

In June 2022, the FIN-FSA Board decided to raise the O-SII buffer requirements of two nationally significant institutions for the Finnish financial system by 0.5 percentage point. The higher requirements took effect at the beginning of 2023. Furthermore, the FIN-FSA communicated in December that it is preparing to activate a systemic risk buffer requirement of no more than 1% to strengthen the resilience of the credit institution sector in the first quarter of 2023. Before taking the final decision, the Board will assess whether the requirements for the activation of the systemic risk buffer have been met as well as the impacts of the requirement and expected economic developments on the credit institution sector and lending.

FIN-FSA issued updated recommendation on housing loan applicants’ maximum debt-servicing burden to contain the growth of household indebtedness

Elevated risks in the operating environment emphasise the importance of the resilience and preparedness of the financial sector and its customers. The historically high indebtedness of households relative to disposable income was already identified a long time ago as one of the main structural vulnerabilities of the Finnish financial system. Household indebtedness also continued to rise in the review year and it is expected to continue to rise in the coming years if the economy and interest rates develop as projected. As financing conditions become tighter, living expenses rise and the economy weakens, the ability of indebted households in particular to service their debts and maintain consumption may be impaired.

In the review year, the FIN-FSA kept the maximum loan-to-collateral (LTC) ratio, i.e. the loan cap, unchanged at 85% for other than first-home buyers. The loan cap was reduced by five percentage points in 2021. The purpose of the more stringent maximum LTC than the statutory baseline level is to curb the growth of household indebtedness and to ensure that mortgage borrowers have sufficient financial buffers against higher debt-servicing burdens and living costs and lower collateral values.

In the review year, in addition to the macroprudential decisions, the FIN-FSA participated in the preparation of legislation aimed at containing household indebtedness and, in June, the Government submitted its proposal to the Parliament on the legislation. The proposed legislative amendments were adopted by the Parliament on 27 January 2023 and will enter into force on 1 July 2023. In accordance with the legislative reform, in new construction, housing company loans will be subject to a 60% limit relative to the debt-free price of the apartments being sold. In addition, the maturity of housing company loans used in connection with new construction will be limited to no more than 30 years, and there cannot be any amortisation-free periods during the five first years after the completion of the building. In addition, the maximum repayment period of housing loans will be capped at 30 years.

The FIN-FSA has also repeatedly emphasised the need to include in Finnish legislation a debt limit tied to household income, such as the maximum debt-to-income ratio that was included in the initial proposal by the working group of the Ministry of Finance. The ESRB and the IMF have recommended the inclusion of income-based macroprudential tools in Finnish legislation.

In addition to the inclusion of binding income-based macroprudential tools in legislation, the ESRB has urged Finnish authorities to apply non-binding measures aimed at borrowers so as to contain indebtedness until binding tools are in force. Since the end of September 2020, the FIN-FSA has, in connection with making the quarterly macroprudential decision, urged lenders to exercise caution in granting loans that are very large relative to the borrower’s income or have a longer repayment period than normal.

In accordance with a recommendation initially issued by the FIN-FSA in 2010, lenders must assess borrowers’ repayment capacity carefully also in a scenario where the interest rate is 6% and the loan repayment period is 25 years. The FIN-FSA elaborated on its previous recommendation in June 2022. In the decision, banks are recommended to consider in addition to the 25-year repayment period and 6% interest rate that that loan applicants’ total loan-servicing costs under the above premises should, as a rule, be less than 60% of their net income. In September, the FIN-FSA gave more detailed guidelines on the implementation of the recommendation. The recommendation entered into force at the beginning of 2023.

The purpose of the more specific recommendation is to contain household indebtedness and to secure households’ debt-servicing and consumption capacity in the context of an economic shock. The previous recommendation was revised as household indebtedness has continued to rise despite earlier recommendations. In an interim assessment published by the ESRB, the FIN-FSA’s previous recommendation was considered only partly in line with the ESRB recommendation.

The calibration of the recommendation reflects the intent not to restrict current loan granting practices significantly. The FIN-FSA’s revised recommendation does not eliminate lenders’ discretion in credit decisions, as it allows limited deviation from the established maximum debt service-to-income burden based on the lender’s assessment and discretion. The FIN-FSA recommends that credit decisions in excess of the maximum debt service-to-income burden of 60% should be preceded by a particularly careful assessment of the borrower’s payment capacity, and the lender should also make the credit decision at an escalated decision-making level. As an indicative reference value, the proportion of new housing loans exceeding the 60% stressed debt-service-to-income burden should be capped at 15% of the euro amount of new housing loans granted by a given lender during a calendar year.

Banking supervision

The FIN-FSA analysed the impacts of Russia’s war of aggression in particular on banks’ credit risks. A thematic review of the classification of non-performing corporate credit and impairments by banks under direct FIN-FSA supervision as well as bank-specific inspections supported the view that, in this area, Finnish banks have broad difficulties in complying with regulations. The shortcomings were related, for example, to the identification of forborne loans, valuation practices regarding collateral posted by problem customers, and the assessment of expected credit losses. Banks have been urged to rectify the shortcomings, and the implementation of corrective actions will be monitored as part of regular supervisor assessments.

The supervision of banks under the ECB’s supervision (SI banks) is based on the ECB’s2 banking supervision priorities. The most significant of these priorities for Finnish banks were the impacts of the energy crisis and preparation for climate risks. The ECB published the results of the climate stress tests in July. ESG factors (Environmental, Social and Governance) have been considered in the SREP for SI banks in accordance with the ECB’s guidance.

The FIN-FSA targeted inspections of internal models for prudential calculation extensively at banks applying such models. These inspections lent support to the view that many banks continue to have significant shortcomings in compliance with regulations on internal models. Therefore, the benefits that can be drawn from using the models have been limited by the supervisor’s decisions raising the risk weights applicable by banks in prudential calculation.

A thematic review of the work of the boards of directors of banks under the FIN-FSA’s direct supervision revealed shortcomings in how the board challenges proposals submitted by executive management, determines the risk appetite and ensures the effectiveness of control functions.

Authorisations entitling banks to carry out mortgage banking activities under new legislation on mortgage banks were granted. Banks remained active in restructuring arrangements – mergers among the member banks of amalgamations continued and banks moved from one banking group to another. Fellow Bank commenced operating in April 2022. The FIN-FSA granted the authorisations and amendments to authorisations required by the changes.

The Government submitted to Parliament a legislative proposal on the monitoring of Finnvera’s financial risks and the FIN-FSA’s related new supervisory duties. However, handling of the proposal was not finalised by the end of the Parliament’s spring 2023 session, and it will therefore lapse at the end of the present parliamentary term.

As of 1 July 2023, responsibility for the supervision of registered lenders and credit intermediaries will be transferred to the FIN-FSA, in accordance with the legislation adopted by Parliament to contain household indebtedness. The FIN-FSA prepared for the transfer of supervisory responsibility and this work will continue in early 2023.

Supervision of the insurance sector

A thematic review of the implementation of the Self-employed Persons’ Pension Act (YEL) pointed to significant shortcomings in the processes for the determination of confirmed income. The decisions made by pension providers were primarily consistent with the application made by the entrepreneur and they failed to show adequate case-specific discretion to ensure that the level is compliant with regulations. All institutions have taken corrective actions, but implementation will require both technological adjustments and investment in human resources, and therefore the changes will take some time. The implementation will be monitored as part of part of ongoing supervision. Parliament adopted the amendments to the Self-employed Persons’ Pension Act to support the implementation of the Act, and the amendments entered into force on 1 January 2023.

The FIN-FSA monitored compliance with the handling deadlines of claims in statutory non-life insurance classes on an enhanced basis, among other things through reporting adopted at the beginning of the year. Although the situation has improved somewhat, all firms are not yet in full compliance with the requirements of the law. Company-specific supervisory actions have been initiated based on monitoring.

The supervisor monitored the returns on the investment operations and the solvency of life and non-life insurance companies as well as actors in the employee pension sector on a quarterly basis. In addition, stress tests on market risks were conducted in the employee pension sector. In the autumn, the FIN-FSA prepared a thematic review of insurance institutions’ own risk and solvency assessments (ORSA) with respect to the organisation of investment activities and risk management. The thematic review suggested insurance institutions’ ORSAs demonstrated at least an average level with respect to investment risks. The findings and input material of the thematic review will be utilised in insurance institution-specific supervisory actions.

In a thematic review of the corporate governance of unemployment funds, shortcomings were identified in their operations. Already in the review year, the supervisor targeted inspections at the identified shortcomings, which concerned, for example, the governance policies, the good repute and professional competence of management, and outsourcing. The targeted supervision will continue in 2023.

The FIN-FSA met the supervised entities considered most significant from a risk-based perspective in order to map the actions caused by Russia’s war of aggression and the elevated risks. Direct exposures to Russia, Belarus and Ukraine are minor.

The supervision by an authorised representative at Elo Mutual Pension Insurance Company ended. The FIN-FSA decided that the supervision by an authorised representative at Elo Mutual Pension Insurance Company can be closed. The company took significant actions during the term of the authorised representative to develop its corporate governance system. The FIN-FSA considered that the management of the company’s affairs had improved to the effect that the authorised representative’s supervision could be brought to an end.

The European Insurance and Occupational Pensions Authority (EIOPA) conducted stress tests of institutions for occupational retirement provision (IORP) regarding the effects of climate change. The stress tests demonstrated that European IORPs are materially exposed to transition risks. The impact of the climate stress on the assets of Finnish IORPs included in the test was slightly lower than average.

The handling of sustainability and climate risks in ORSA3 was mapped based on a supervision framework adopted in 2021 (IAIS). The development of regulation and supervision models continues within the ESAs4.

During the review year, there were meetings with supervised entities on topical supervision questions with representatives of life and non-life insurance companies and unemployment funds. In addition, representatives of key stakeholder groups were met on a regular basis.

Capital markets supervision

The FIN-FSA monitored listed companies’ disclosures regarding the impacts of Russia’s war of aggression on an enhanced basis. The enhanced monitoring of listed companies in a weak financial position continued. As a result of Russia’s war of aggression, some companies planning an IPO postponed their listing to a later point in time, but this was not significantly evident in the number of prospectuses processed. Financial reporting was challenging in several companies affected by Russia’s war of aggression or its indirect impact. In addition, Finnish management companies closed their Russian funds.

In July, ESMA5 published a peer review on the prospectus scrutiny and approval process by national supervisors. The remedial action proposal given to the FIN-FSA was concerned with the implementation of the so-called four-eyes principle and the fact that there is no cooling-off period after the end of employment relationship.

During the review year, the FIN-FSA took steps to develop the first artificial intelligence-based tool to support prospectus supervision.

The energy crisis experienced in Europe and collateral requirements imposed on counterparties in the electricity derivatives markets in the review year also affected the activities of FIN-FSA-supervised entities and listed companies. The FIN-FSA participated in pan-European actions seeking to identify short- and long-term resolutions to the problems.

The supervisor continued to issue interpretation guidance on sustainable finance and provide advice to supervised entities and investors. The development of the supervision of sustainability reporting continued, taking new European and international draft standards into account.

A thematic review of investment funds found that the cost structures were clear and simple. Management companies had room for development, for example in that they lacked written pricing guidelines and no clear view of internal pricing could be formed.

The FIN-FSA made a thematic review of the valuation of UCITS and non-UCITS funds’ assets. The thematic review was part of a common supervisory action coordinated by ESMA. The thematic review concluded that the valuation processes of fund assets were mainly at a reasonable level. The main shortcomings were related to the fund asset valuation methodologies applicable in exceptional market circumstances. The FIN-FSA has required the institutions concerned to take corrective actions. The FIN-FSA reports on the findings and conclusions to ESMA and will follow up on the corrective actions taken by the firms.

The prudential supervision of investment firms under the new regulatory framework (IFR/IFD6) has begun. The first reports on investment firms’ financial standing under the new regulation have been received (as at 31 December 2022), and ongoing supervision has been launched. The assessment of capital adequacy in connection with applications for new authorisations and the handling of owner control notifications was aligned in the spring with the new requirements.

Anti-money laundering supervision

The FIN-FSA supervised the sanctions imposed due to Russia’s war of aggression on a proactive basis. Following the entry into force of a legislative amendment pending in Parliament, the FIN-FSA will have the authority for code-of-conduct supervision concerning the sanctions. Even though the amendments are not yet in force, the FIN-FSA has supervised, within the scope of its current authority, how entities under its supervision are complying with the sanctions imposed due to Russia’s war of aggression. The entry into force of sanctions legislation has been delayed, but it will take place in spring 2023.

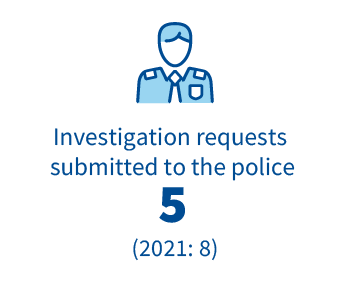

Inspections and thematic reviews proceeded according to plan. During the year, five previously initiated anti-money laundering inspections were finalised and one inspection is still in progress. Two new inspections were launched in the autumn. The inspection capacity of the Anti-Money Laundering division is approximately five inspections in a 12-month timeframe.

The FIN-FSA management group adopted the supervision strategy for anti-money laundering in December. The inherent risk assessment of anti-money laundering and counter-terrorist financing was completed in the spring, and the sector-specific risk assessment of the credit institution sector in the autumn. In the FIN-FSA’s view, the highest inherent risk of both money laundering and terrorist financing is related to products and services enabling the fast transfer of funds. A particularly elevated risk is associated with international fund transfers involving several service providers. The sector-specific risk assessments of capital market and virtual currency providers have been completed for internal use. A summary of the risk assessment of money laundering and terrorist financing concerning capital market participants was published in February 2023. A thematic review of unwarranted restriction of banking services for high-risk clients (de-risking) was published in the autumn of the year under review.

Ongoing supervision will focus on, among other things, participation in overall assessments of domestic banks, the work of supervisory colleges established for significant cross-border supervised entities and participation in handling new registration and authorisation applications.

Standardisation of inspection activities was an important operational development area in 2022. Another development item and focus area in the review year was the development of risk-based activities and the definition of a minimum level of supervision in the supervision strategy.

Regulations and guidelines elaborating on anti-money laundering legislation are complete and will be published after the entry into force of the legislative reform in spring 2023.

Supervision of cyber and ICT risks

Due to Russia’s war of aggression, the FIN-FSA monitored cybersecurity and the operability of payment systems on an enhanced basis. Towards the end of 2022, denial-of-service attacks on Finnish banks increased. Banks were able to ward them off effectively, however, and they did not have a significant impact on online banking services.

The Ministry of Finance, the Financial Stability Authority, the Bank of Finland and the Financial Supervisory Authority together created backup daily payment facilities. The FIN-FSA participated in the preparation of legislation and card payment solutions. Contingency preparations in the domestic financial market infrastructure continue into 2023.

In 2022, an inspection of an individual payment institution concerning ICT and cyber risks as well as a thematic review of ICT and cyber risks in investment firms were completed. As a result of the thematic review of IT and information security risks in investment firms, it was found that these risk management processes have been defined and that the firms have organised the components of IT and information security management appropriately, taking the extent of their operations into account.

In autumn, the FIN-FSA commenced inspections of ICT and cyber risks in two banking groups. These were completed in February and March 2023, respectively. In addition, thematic reviews were initiated to map the ICT outsourcing chains in the financial sector (to be completed in April 2023) and banks’ practices concerning fraud and compensation with respect to payment services (to be completed in April 2023).

1 O-SII = Other Systemically Important Institutions (credit institutions significant for the national financial system).

2 ECB = European Central Bank.

3 ORSA = Own Risk and Solvency Assessment.

4 ESAs = European Supervisory Authorities.

5 ESMA = European Securities and Markets Authority.

6 IFR/IFD = Investment Firms Regulation and Directive.