Availability of basic banking services

Survey of availability and pricing of basic banking services

Based on its survey of the availability and pricing of basic banking services, the Financial Supervisory Authority (FIN-FSA) considers that, in 2023, the right of customers to basic banking services as specified in law was fulfilled appropriately in main respects. According to the FIN-FSA’s assessment, basic banking services continued to be readily available and, for the most part, reasonably priced. The data used in the survey are based on the situation as at 31 December 2023.

The FIN-FSA continues to find relevance in its previous recommendations for banks. Banks must safeguard affordable access to services for customers unable to use digital services and the availability of personal customer service at a reasonable price for anyone needing it. It is important that banks ensure the availability of cash services throughout the country.

Retail customers have a legal right to basic banking services provided by deposit banks. These services include a payment account, a means by which the account can be accessed (such as a debit card), an online banking service and a means of strong electronic identification.

On a regular basis, the FIN-FSA conducts a survey of the availability and pricing of basic banking services, as specified in the Act on Credit Institutions. The survey data for 2023 are mainly based on information on bank service prices and bank branches obtained from the consumer payment account comparison website (in Finnish) and Bank of Finland statistics.

You can read the FIN-FSA’s full report on the availability and pricing of basic banking services here (pdf, only available in Finnish).

Based on its survey of the availability and pricing of basic banking services, the Financial Supervisory Authority (FIN-FSA) considers that, overall, the right of customers to basic banking services as specified in law was fulfilled appropriately. Basic banking services were readily available and, for the most part, reasonably priced. However, the service offering is focused on banks’ digital service channels and other services provided via remote channels, which also constitute the main service channel of most bank customers for managing their daily banking matters.

In the conclusions of the survey, the FIN-FSA draws banks’ attention to, among other things, safeguarding affordable access to services for customers who do not use digital services, improving the availability of personal customer service, and the importance of the accessibility of and digital support for digital service channels.

Branch network and availability of cash

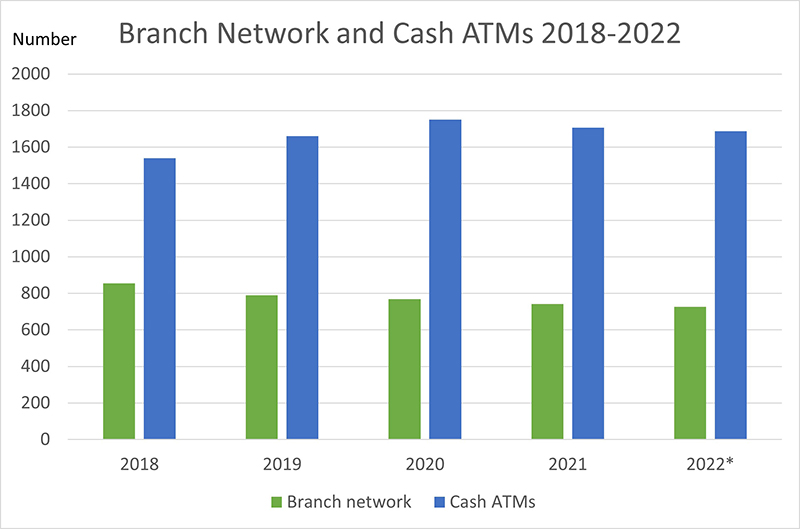

The total number of bank branches continued to fall during 2022. The number of branches serving personal customers was 726 at the end of the year. Banks justify the reduction in the number of branches largely on the basis of a decline in demand for branch services in certain geographical areas and on customers’ transition to using digital service channels.

In addition to branch closures, access to personal service is adversely affected by limited branch service hours and appointment booking practices. Around 46% of branches served customers full-time and the rest were open on a limited basis. Just over 70% of all branches provided cash services, but in some branches cash services have been time-restricted by setting service hours that are shorter than the branch’s opening hours.

In 2021, unlike in previous years, the number of ATMs started to decline, and the slight fall in the number of ATMs continued in 2022. At the end of 2022, there were a total of 1,687 ATMs in Finland.

In addition to ATMs and bank branches, it is also possible to withdraw cash at the checkouts of certain retail outlets and kiosks. Some banks also offer customers the option of ordering cash by post.

*In 2022, the way of counting branches and ATMs changed.

The total number of branches includes S-Bank’s customer service points in regional cooperative stores (2022: 94), the number of which was previously reported separately in the surveys.

The total number of ATMs includes those of all companies offering cash dispensing services in Finland. Previously, the surveys monitored the development of the number of Automatia Pankkiautomaatit Oy and Nokas CMS Oy ATMs.

Pricing

The prices charged for basic banking services rose in 2022. However, the price increases were bank-specific and some banks did not make any changes to the pricing of basic banking services during 2022. In service-specific prices, there are significant and larger differences than before between the various banks.

| Service | 2019 | 2020 | 2021 | 2022 |

| Payment account (EUR/month) | Price range | Price Range | Price range | Price range |

| Account maintenance | 2,00-4,00 | 2,00-4,00 | - | 0,00-10,00 |

| Online service of payment account | 2,00-3,00 | 1,00-4,50 | - | 2,00-5,00 |

| Account information | ||||

| Account statement (EUR/item/month) | free | free | free | free |

| Statement of transaction from an ATM (EUR/item) | 0,00-1,50 | 0,00-1,50 | 0,00-1,50 | 0,30-2,00 |

| Payment cards (EUR/month) | ||||

| Online debit card | 2,00-6,00 | 2,00-6,00 | 2,00-7,00 | 2,00-10,00 |

| Offline debit card | 2,00-6,00 | 2,00-6,00 | 0,00-7,00 | 2,00-7,00 |

| Payment of invoices (EUR/item) | ||||

| In cash at a branch | 0,00-8,00 | 0,00-8,00 | 4,00-7,00 | 5,00-6,50 |

| By credit transfer at a branch | 2,50-7,00 | 2,50-7,00 | 2,50-7,00 | 3,00-8,00 |

| By payment ATM | 0,00-3,00 | 0,00-2,25 | 0,00-2,75 | 0,00-3,50 |

| Direct debit | free | free | free | free |

| Payment services envelope | 1,00-5,50 | 1,00-6,00 | 1,00-6,00 | 1,00-6,00 |

The basic banking services survey examines the so-called list prices reported by banks to the independent consumer payment account comparison website, i.e. the prices of services without various customer or customer-group discounts or benefits. As a general rule, the report states the ranges of prices charged by all of the banks included in the survey for different services. When assessing the level of fees for various services, it is necessary to take into account that some banks productise the services included in basic banking services into service packages, the pricing of which is cheaper for the customer than the separate pricing of services. The terms and conditions for accessing these service packages and various discounts vary from bank to bank.

Accessibility of digital service channels and digital support

Banks report that they have made a wide range of accessibility improvements to digital service channels in the last few years, and this work continued in the banks during 2022. The accessibility of banks’ digital service channels serves all customers, but a particular goal of accessibility improvements to digital service channels is to make it easier for as many different user groups as possible, for example older people, people with disabilities and other customers with special needs, to use banks’ digital services.

Banks also provide diverse digital support to their customers, mostly free of charge. Through accessibility improvements and digital support, banks are giving a wider range of customers the opportunity to access digital service channels, independent of service hours and at lower prices.

Service options for customers who do not use digital services

For some customers, despite the support available, digital services are not an option for managing their banking matters and there are still various service options available for these customers who do not use digital channels. In addition to the services offered in the branch channel, customers can use, for example, payment envelopes, direct debits and the possibility to empower another person to handle banking on their behalf. With the exception of changes in the availability of branch services, there were no significant changes in alternative services to digital service channels during 2022.

The FIN-FSA considers it important that banks continuously assess the adequacy of non-digital services. It is equally important that banks provide information and advice on available services in an effective and accessible way.

Customers can survey for themselves the appropriate service options by considering their own banking arrangements and needs and by comparing the costs of the services available. The independent consumer payment account comparison website (in Finnish) can be used to help compare services. In addition, it is recommended that customers explore with their own bank what kind of service options the bank has to offer in, for example, situations where it is not possible to use digital service channels. Moreover, the service ranges and channels of different banks may vary, so comparing banks can be useful for the customer in finding a service package that suits them.

Objective of basic banking services surveys and information sources

Once a year, the FIN-FSA conducts a survey of basic banking services, with a particular focus on availability and pricing. One of the aims of the survey is to ensure that the right of consumer customers to obtain the basic banking services specified in the Act on Credit Institutions is fulfilled in practice. In the survey of basic banking services, the FIN-FSA examines, among other things, the extent of the branch and cash distribution network, the pricing of basic banking services and the availability of digital services.

The survey data for 2022 are mainly based on information on bank service prices and bank branches obtained from the consumer payment account comparison website (in Finnish), Bank of Finland statistics, feedback from customers and stakeholders, and a questionnaire given to banks in connection with the survey.

You can read the FIN-FSA’s full report on the availability and pricing of basic banking services here (pdf, only available in Finnish).

In its survey of basic banking services for 2021, the Financial Supervisory Authority (FIN-FSA) considers that, overall, the right of customers to basic banking services as specified in law is being fulfilled appropriately. As a rule, basic banking services are readily available, but the range of services is increasingly accessible as various online and remote services. Banks must ensure that adequate and affordable basic banking services are also available to customers who do not use digital services.

The overall level of fees charged for basic banking services increased in 2021. Banking is still least expensive for users of digital banking services. The price of paying a bill in non-digital service channels varies greatly from bank to bank. The highest prices can be considered to be so expensive that they may jeopardise the availability of services at a reasonable cost for people who have no possibility to access digital service channels.

The COVID-19 pandemic has further reduced the availability of branch services. The reduction in the number of branches and the decline in their service hours have in some cases affected customers to the extent that queuing times in branches have become unreasonably long. The FIN-FSA therefore urges banks to address the issue of reasonable queuing times.

Objective of basic banking services surveys and information sources

Once a year, the FIN-FSA conducts a survey of basic banking services, with a particular focus on availability and pricing. One of the aims of the survey is to ensure that the right of customers to obtain basic banking services under the Act on Credit Institutions is fulfilled in practice. In order to assess the availability of services, the FIN-FSA examines, among other things, the extent of the branch and cash distribution network, the pricing of basic banking services and the availability of digital services.

With regard to the availability and pricing of services, the survey is based on information obtained from the consumer payment account comparison website (in Finnish) as well as feedback from customers, stakeholders and supervised entities. As part of the survey of basic banking services, the FIN-FSA continued the review it carried out in 2019–2020 of adjustments made to the digital services channels utilised in providing basic banking services. The adjustments are aimed at improving the availability and usability of services.

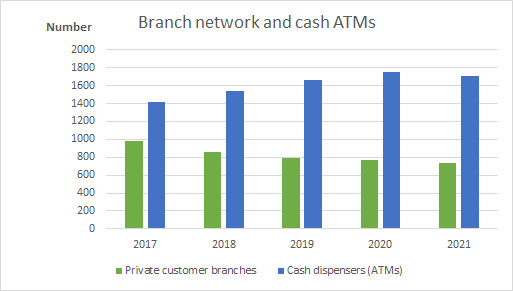

Branch network and availability of cash

The branch network and the service hours of branches continued to decline in 2021, as in previous years. The branch network contracted at around the same rate as in previous years, and the number of branches serving personal customers was 740 at the time of the survey. Only 28% of branches serving customers full-time offer cash services throughout their opening hours. The proportion of banks providing a full-time service has not changed from the previous survey. Nearly a third of all branches do not provide cash services at all.

In 2021, unlike in previous years, the number of cash ATMs began to decline slightly. The reduction in the number of bank branches and restrictions on service hours also adversely affected the availability of cash. However, cash is still an important or even the only available payment method for some consumers, and there are also certain service situations where cash may be the only payment method that can be used. On the other hand, cash distribution channels have diversified in recent years, as the possibility to withdraw cash from store checkouts is supplementing ATM and branch distribution.

On average, Finns have reasonable access to cash services, but there are considerable regional differences. According to a study conducted by the Bank of Finland, Finns live on average just over three kilometres from the nearest ATM. According to the same study, however, nearly 2% of the population, i.e. more than 100,000 Finns, have a journey of more than 20 kilometres to the nearest ATM. This significantly impairs these individuals’ accessibility to cash. In March 2022, the FIN-FSA submitted an initiative to the Ministry of Finance requesting that the Ministry assess the adequacy of existing legislation and possible needs for changes to ensure adequate availability of cash withdrawal services nationwide.

Pricing

Overall, the level of fees charged for basic banking services increased in 2021. When assessing the level of fees for various services, however, it is necessary to take into account that some banks productise the services included in basic banking services into service packages, the pricing of which is cheaper for the customer than the separate pricing of services. The terms and conditions for accessing these service packages vary from bank to bank.

In 2021, banks priced cash services in much the same way as at the time of the previous survey, when unrestricted free cash withdrawals from ATMs became subject to charge at all banks.

| Service | 2020 | 2021 | ||

| Most common price | Range | Most common price | Range | |

| Account statement (€/item/month) | free | free | free | free |

| Statement of transaction from an ATM (€/item) | 0.75–1.20 | 0.00–1.50 | 1.00–1.50 | 0.00–1.50 |

| Online debit card (€/month) | 2.50–3.00 | 2.00–6.00 | 4.00–5.00 | 2.00–7.00 |

| Offline debit card (€/month) | 2.50–3.00 | 2.00–6.00 | 2.50–5.00 | 2.00–7.00 |

| Payment of invoices (€/item) | ||||

| In cash at a branch | 5.00–6.00 | 0.00–8.00 | 5.00–6.00 | 4.00–7.00 |

| By credit transfer at a branch | 5.00 | 2.50–7.00 | 5.00 | 2.50–7.00 |

| By payment ATM | 1.00–2.25 | 0.00–2.25 | 1.00–2.75 | 0.00–2.75 |

| Direct debit | free | free | free | free |

| Payment services envelope | 2.00–2.50 | 1.00–6.00 | 2.50–4.00 | 1.00–6.00 |

Banking services in a digitalising society

As a rule, basic banking services are still readily available, but the service offering is increasingly focused on online transactions and other services provided via remote channels. At the same time, there is increasing awareness of banks’ responsibility to provide services and advice also to those customers for whom the transition to online transactions has proved to be problematic. Banks have continued development of digital banking services by making adjustments to promote better usability of services and accessibility of content, and they also maintain various support services for those customers who need guidance in the use of digital services. In the opinion of the FIN-FSA, these measures are moving in the right direction, and adjustments should continue to be made as part of the ongoing development of services.

The COVID-19 pandemic has had an impact on the provision of basic banking services. As a result of the pandemic, banking services, like the services of the rest of society, shifted to be increasingly handled remotely. Some of the remote services and support for the use of services launched during the pandemic and originally planned to be temporary have also remained part of the banks’ permanent range of services.

As the range of banking services becomes increasingly focused on digital service channels, customers can survey for themselves appropriate service options by considering their own banking arrangements and service needs and comparing the costs of the services available. The independent consumer payment account comparison website (in Finnish) can be used to help compare services. In addition, it is recommended that customers explore with their own bank the kind of service options the bank has to offer in situations where, for example, using a debit card or online banking is not possible. Some banks, for example, offer the option to pay bills or make direct debit agreements via their telephone customer service.

You can read the FIN-FSA’s full report on the availability and pricing of basic banking services here (pdf, only available in Finnish at the moment).

Once a year, the Financial Supervisory Authority (FIN-FSA) conducts a survey of basic banking services, with a particular focus on availability and pricing. One of the aims of the survey is to ensure that the right of customers to obtain basic banking services under the Act on Credit Institutions is fulfilled in practice. In order to ensure the availability of services, the FIN-FSA examines, among other things, the extent of the branch and cash distribution network, the affordability of prices and the availability of digital services.

With regard to the availability and pricing of services, the survey is based on information obtained from the consumer payment account comparison website (in Finnish) and feedback from customers, stakeholders and supervised entities. In connection with the annual survey of basic banking services, this year a survey was conducted on the effects of the coronavirus pandemic on the provision of basic banking services and on customer behaviour. At the same time, a review was conducted of new adjustments introduced by banks to digital services, mainly with regard to improvements in the availability and usability of services.

The FIN-FSA considers that banking services will follow the general digitalisation trend in society, and that a divergence has arisen in their supply and pricing. Banking for consumers accustomed to electronic services is becoming increasingly efficient, but there is a risk that banking for special groups not accustomed to electronic services as well as banking for the elderly will become less accessible and more expensive than average.

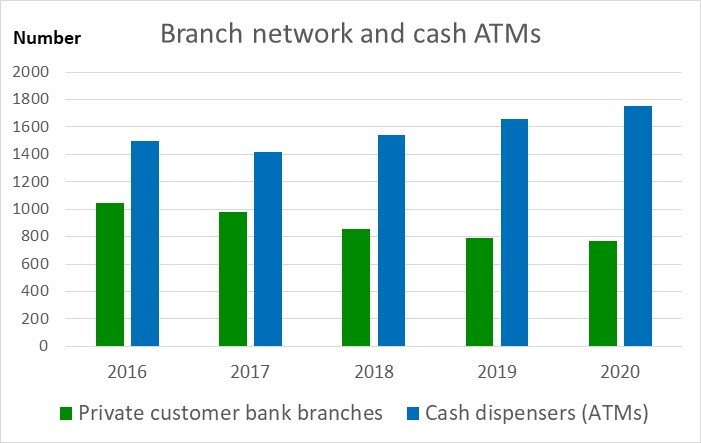

Branch network and availability of cash

The reduction in the branch network has continued, and this year there were 769 branches providing services to retail customers. The number of branches providing cash services on a full-time basis has also decreased. Only around 28% of branches serve customers full-time and also provide cash services throughout their opening hours. One-in-five branches provide no cash services at all.

The number of cash ATMs, on the other hand, has increased from last year by just under 100. In addition to withdrawals from ATMs and branches, cash can also be withdrawn using cashback services at thousands of retail outlets.

Pricing

Pricing of basic banking services has remained largely unchanged in recent years, but prices for some individual services have risen. The biggest change in costs concerns cash withdrawals from ATMs, which are no longer offered free of charge by any bank on an unlimited basis.

| Service | 2019 | 2020 | ||

| Most common price | Range | Most common price | Range | |

| Account statement (€/item/month) | free | free | free | free |

| Statement of transaction from an ATM (€/item) | 0.75–1.20 | 0.00–1.50 | 0.75–1.20 | 0.00–1.50 |

| Online debit card (€/month) | 2.50–3.00 | 2.00–6.00 | 2.50–3.00 | 2.00–6.00 |

| Offline debit card (€/month) | 2.50–3.00 | 2.00–6.00 | 2.50–3.00 | 2.00–6.00 |

| Payment of invoices (€/item) | ||||

| In cash at a branch | 5.00–6.00 | 0.00–8.00 | 5.00–6.00 | 0.00–8.00 |

| By credit transfer at a branch | 5.00 | 2.50–7.00 | 5.00 | 2.50–7.00 |

| By payment ATM | 0.50–1.00 | 0.00–3.00 | 1.00–2.25 | 0.00–2.25 |

| Direct debit | free | free | free | free |

| Payment services envelope | 2.00–2.50 | 1.00–5.50 | 2.00–2.50 | 1.00–6.00 |

Availability of banking services and changing service arrangements

In its 2019 survey of basic banking services, the FIN-FSA reviewed digital service adjustments, which the banks have continued to introduce this year. Most commonly, the adjustments made to digital banking services are designed to serve the visually impaired. Banks’ online services are being renewed to improve accessibility, and changes have been made to the websites to make them clearer for screen readers. In general, the level of adjustments to online and mobile banking continues to vary between banking groups.

In spring 2020, the availability of banking services provided at branches deteriorated due to the coronavirus pandemic. For a long time now, the digitalisation of banking services has been changing the nature of services and service channels but, due to the pandemic, the development of the use of digital services has taken a rapid leap forward.

In the longer term, the shifting of services for customers accustomed to digital services increasingly towards electronic service channels instead of branch channels will mean more freedom of choice in banking services in the form of new digital features. Those customer groups who consider the transfer of customer services online to be problematic have increasingly encountered barriers to banking transactions due to temporary closures of the branch network.

Customers can survey for themselves the appropriate service options by considering their own banking arrangements and needs and by comparing the costs of the services available. The independent consumer payment account comparison website (in Finnish) can be used to help compare services. In addition, it is worth enquiring with your own bank about the kind of banking arrangements the bank offers in situations where, for example, using a debit card or online banking is not possible. Some banks, for example, offer the option of paying bills or making direct debit agreements via their telephone customer service.

You can read the FIN-FSA's full report on the availability and pricing of basic banking services here (pdf, only available in Finnish at the moment).

Once a year, the Financial Supervisory Authority (FIN-FSA) conducts a survey of basic banking services, with a particular focus on availability and pricing. One of the aims of the survey is to ensure that the right of customers to obtain basic banking services under the Act on Credit Institutions is fulfilled in practice. In order to ensure the availability of services, the FIN-FSA examines, among other things, the extent of the branch and cash distribution network, the affordability of prices and the availability of digital services.

With regard to availability and pricing, the survey is based on information obtained from the consumer payment account comparison website (in Finnish) and feedback from customers, stakeholders and supervised entities. In addition, this year the FIN-FSA has surveyed how banks have ensured the availability of basic banking services, namely the extent to which the banks’ digital and non-digital banking services are also available to older people and special groups, for example.

The FIN-FSA considers that, overall, the right of customers to obtain basic banking services under the Act on Credit Institutions is appropriately fulfilled. There are, however, specific issues related to the availability and pricing of basic banking services that have emerged as a result of the strong digitalisation of banking services.

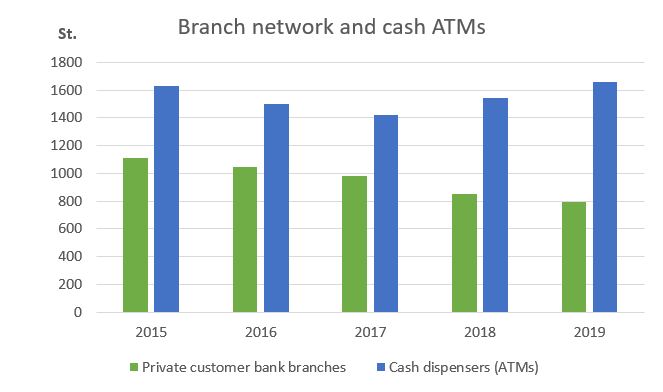

Branch network and availability of cash

The branch network has been significantly reduced in recent years, and this year there were 790 branches providing services to retail customers. The number of branches providing cash services on a full-time basis has also decreased. Only around 27% of branches serve customers full-time and also provide cash services throughout their opening hours. One-in-five branches provide no cash services at all.

The number of cash ATMs, on the other hand, has increased slightly from last year by over 100. Cash can also be withdrawn using cashback services at thousands of retail outlets.

Pricing

Pricing of basic banking services has remained largely unchanged in recent years, but the most common prices for some individual services have risen. This year’s survey examines pricing in more detail by taking into account the pricing ranges of services in full, in addition to the most common prices. There are relatively large differences between banks, particularly in the prices of payment service transactions.

| Service | 2017 | 2018 | 2019 |

|

|

|

Most common price | Range | ||

| Account statement (€/item/month) | free | free | free | free |

| Statement of transaction from an ATM (€/item) | 1,00-1,49 | 1,00-1,49 | 0,75-1,20 | 0,00-1,50 |

| Online debit card (€/month) | 2,00-2,49 | 2,00-2,49 | 2,50-3,00 | 2,00-6,00 |

| Offline debit card (€/month) | 2,00-2,49 | 2,50-2,99 | 2,50-3,00 | 2,00-6,00 |

|

Payment of invoices (€/item)

|

7,00-7,49 |

5,00-6,49 |

5,00-6,00 |

0,00-8,00 |

|

5,00-5,49 | 5,00-5,49 | 5,00 | 2,50-7,00 |

|

1,00-1,49 | 0,50-1,49 | 0,50-1,00 | 0,00-3,00 |

|

free | free | free | free |

|

2,00-2,49 | 2,00-2,49 | 2,00-2,50 | 1,00-5,50 |

Availability of banking services and choice of banking arrangements

Digital banking services can be considered to have expanded many customer groups’ opportunities to access banking services anywhere, anytime – and the FIN-FSA welcomes this development. However, banks must ensure, where appropriate, that reasonable adjustments – i.e. changes and arrangements – are made to digital services to improve their availability and usability.

There are differences between banks in the level and extent of adjustments made and in advice about digital services. Banks often make adjustments designed for visually impaired people, in particular, and some online and mobile banks also support the use of various technical aids. Banks generally provide advice through standard channels of communication, such as branches, telephone customer service and online banking. In addition, some banks have also organised specific advisory events outside their branch localities. Advocacy organisations representing special groups do not, however, consider the adjustments and advisory services to be in all respects sufficient.

Customers can survey for themselves the appropriate service options by considering their own banking arrangements and needs and by comparing the costs of the services available. The independent consumer payment account comparison website (in Finnish) can be used to help compare services. In addition, it is worth enquiring with your own bank about the kind of banking arrangements the bank offers in situations where, for example, using a debit card or online banking is not possible. Some banks, for example, offer the option of paying bills or making direct debit agreements via their telephone customer service.

You can read the FIN-FSA's full report on the availability and pricing of basic banking services here (pdf, only available in Finnish at the moment).

Annual survey of basic banking services

Once a year, the FIN-FSA conducts a survey of basic banking services, with a particular focus on availability and pricing. One of the aim of the survey is to ensure that the right of customers to obtain basic banking services under the Act on Credit Institutions is met in practice and that this is not impaired by, for example, unfair pricing.

The 2018 survey is based mainly on pilot material available on the consumer payment account comparison website, launched on 31 October 2018, supervisory observations as well as feedback from customers, interest groups and supervised entities. The price and branch data were collected from the website's pilot material in October 2018 and covered a total of 212 banks.

An overall assessment by the FIN-FSA shows that the right of customers to obtain basic banking services under the Act on Credit Institutions is met appropriately overall. The availability of basic banking services is generally good. Digital online and mobile services are still developing strongly and are used extensively. It is however important that banks ensure the availability of basic banking services at fair prices and as an alternative to digital banking services.

Branch network

There were 854 bank branches providing services for retail customers. The number of branches serving retail customers has decreased in recent years. The cash services of these branches have also been reduced further, with nearly half of such branches providing only limited cash services and about 20% providing no cash services at all.

The availability of cash at bank branches is partly compensated by the increasing number of cash ATMs and the cashback services at retail stores.

Digital banking services

Digital online and mobile banking services are part of the wider digitalisation trend in society. Many banks have demonstrated initiative in tailoring their services to accommodate various user groups, and are increasingly offering guidance and support to facilitate the use of digital banking services and to lower the threshold of using these services.

Pricing

The most common prices charged for banking services have changed only marginally from the previous year. The total costs that customers pay for banking services are determined to a considerable extent by the particular pricing model that applies to the customer relationship. Many banks offer their customers service packages that incorporate discounts given on the basis of, for example, the customer's age or the degree to which the customer concentrates his or her financial dealings with the bank.

Pricing of basic banking service

|

Service |

Price |

Price |

Price |

| Account statement | free | free | free |

| Statement of transactions from an ATM |

1.00–1.49 /month |

1.00–1.49 /month |

1.00–1.49 /month |

| Debit card 1) | 2.50-2.99 /month |

2.00–2.49 /month |

2.00–2.49 /month |

| Payment of invoices

|

5.00–6.49 |

7.00–7.49 |

7.00–7.49 |

|

5.00–5.49 |

5.00–5.49 |

5.00–5.49 |

|

0.50–1.49 |

1.00-1.49 |

0.50–0.99 |

|

free |

free |

free |

|

2.00–2.49 |

2.00–2.49 |

2.00–2.49 |

1) At most banks (approx. 75%) offline debit cards are not available.

2) At most banks (approx. 80 %) this service is not available.

Choice of banking arrangements

The availability of services and the costs of using them are also determined by the particular choices made by bank customers. Customers should therefore carefully consider the type of banking arrangements they need and compare the types of service available and the related fees. For comparing services, customers may for example refer to the independent consumer payment account comparison website (in finnish), where they can compare the most common payment account services provided by banks, the related prices and banks’ branch networks. It is also advisable to find out what other services and options are available elsewhere than in bank branches (e.g. for payment of invoices or for cash withdrawal) and the prices of those services.

After making such comparisons, it will be easier to select the most suitable and affordable arrangements for everyday banking. If the use of a payment card or access to online banking is out of the question due to, for example, illness, disability or some other reason, customers can contact their own bank and discuss alternative banking arrangements.

Branch network and availability of basic banking services

There were 979 bank branches providing services for retail customers. The number of branches serving retail customers has decreased in recent years. The cash services of these branches have also been reduced, with approximately 30% of such branches providing only limited cash services and about 15% providing no cash services at all.

The number of cash dispenser ATMs, self-service points (customer terminals) and payment ATMs has also decreased. The number of cash dispenser ATMs has been reduced mainly in the cities and larger towns.

Pricing

The most common prices charged for banking services have not changed significantly from the previous year. The total costs that customers pay for banking services are determined to a considerable extent by the particular pricing model that applies to the customer relationship. Many banks offer their customers service packages that incorporate discounts given on the basis of, for example, the customer's age or the degree to which the customer concentrates his or her financial dealings with the bank.

Pricing of basic banking service

|

Service |

Price |

Price |

Price |

| Account statement | free | free | free |

| Statement of transactions from an ATM |

1.00–1.49 /month |

1.00–1.49 /month |

1.00–1.49 /month |

| Online debit card (such as Visa Electron) | 2.00–2.49 /month |

2.00–2.49 /month |

2.00–2.49 /month |

| Debit card | 2.00–2.49 /month |

2.00–2.49 /month |

2.00–2.49 /month |

| Payment of invoices

|

7.00–7.49 |

7.00–7.49 |

7.00–7.49 |

|

5.00–5.49 |

5.00–5.49 |

5.00–5.49 |

|

1.00-1.49 |

0.50–0.99 |

0.50–0.99 |

|

free |

free |

free |

|

2.00–2.49 |

2.00–2.49 |

2.00–2.49 |

1) At most banks (approx. 80%), this service is not available.

Choice of banking arrangements

The availability of services and the costs of using them are also determined by the particular choices made by bank customers. Customers should therefore carefully consider the type of banking arrangements they need and compare the types of service available and the related fees. It is also advisable to find out what other services and options are available elsewhere than in bank branches (e.g. for payment of bills or for cash withdrawal) and the prices of those services.

After making such comparisons, it will be easier to select the most suitable and affordable arrangements for everyday banking. If the use of a payment card or access to online banking is out of the question due to, for example, illness, disability or some other reason, customers can contact their own bank and discuss alternative banking arrangements.

What are basic banking services?

Retail customers are entitled to basic banking services provided by deposit banks. These services include a payment account with basic features, the means by which the account can be used (e.g. debit card and online banking ID), the facility to withdraw cash and to make payments, and an electronic means of identification. Basic banking services do not include accounts with an overdraft facility or a range of credit cards.

Deposit banks process applications by retail customers for a basic payment account without undue delay and at the latest within 10 banking days. As a rule, a deposit bank may refuse to open a basic payment account and to provide related services only for reasons pertaining to money laundering regulations. This may be the case if, for example, the bank cannot reliably ascertain the identity of the customer.

The right to basic banking services only applies to retail customers and not to, for example, companies and associations.

Annual survey of basic banking services

Once a year, FIN-FSA conducts a survey of banking services, with a particular focus on the availability and pricing of basic banking services. One of the aims of the survey is to ensure that the right of customers to obtain basic banking services under the Act on Credit Institutions is met in practice and that this is not impaired by, for example, unfair pricing.

The survey is based on monitoring observations and feedback received from the markets, and also on an enquiry sent to deposit banks and branches of foreign credit institutions offering basic banking services. The survey is conducted annually and is based on the situation at the beginning of March. This year a total of 229 banks responded to the survey, which was based on the situation prevailing on 1 March 2017.

Availability

There were 1,048 bank offices providing services for private customers. The number of private customer offices has decreased in recent years, and the provision of cash services in offices has also been reduced: about 30% of private customer offices provide only limited cash services and some 15% do not provide these services at all.

Bank office network and availability of banking services

The number of cash dispensers and payment ATMs has also decreased. Cash dispensers have been reduced mainly in large cities. The number of customer terminals has increased slightly, after a significant contraction in recent years.

Bank office network and availability of banking services:

- bank offices 1,048

- payment terminals 497

- customer terminals 432

- ATMs 1,497

Pricing

The prices of the most common banking services have largely remained unchanged. The total cost that a customer pays for banking services is affected considerably by different pricing models pertaining to customer relationships: many banks offer their customers service packages, where pricing is affected by discounts based on, for example, concentration of financial dealings or customer’s age.

Pricing of basic banking service

|

Service |

Price |

Price |

Price |

| Account statement | free | free | free |

| Statement of transactions from an ATM |

1.00–1.49 /month |

1.00–1.49 /month |

1.00–1.49 /month |

| Online debit card (such as Visa Electron) | 2.00–2.49 /month |

2.00–2.49 /month |

2.00–2.49 /month |

| Debit card | 2.00–2.49 /month |

2.00–2.49 /month |

1.50-1.99 /month |

| Payment of invoices

|

7.00–7.49 |

7.00–7.49 |

6.00–6.49 |

|

5.00–5.49 |

5.00–5.49 |

5.00–5.49 |

|

0.50–0.99 |

0.50–0.99 |

0.50–0.99 |

|

free |

free |

free |

|

2.00–2.49 |

2.00–2.49 |

1.50-1.99 |

1) For the majority (about 75%) of banks, not included in the selection of services.

Choice of banking arrangements

Bank customers can also, through their choices, influence the availability of services and the costs of using them. It pays to consider the possible banking arrangements and needs and to compare available service types as well as the fees involved. It is also advisable to explore newly available banking arrangements and services outside of bank offices (for example for paying of bills and withdrawing of cash) and the prices of those services.

After making those comparisons it is easier to choose the most appropriate and favourable daily banking arrangements. If use of a payment card or access to online banking is out of the question due to, for example, illness, disability or some other reason, it is wise to contact your own bank and discuss alternative banking arrangements.

What are basic banking services?

Basic banking services refer to normal deposit accounts, account facilities (for example online debit card with verification of the account balance in real time, in connection with a transaction) and execution of payment orders. Basic banking services do not include, for example, accounts with overdraft facility or credit cards.

A bank may decline to open an ordinary deposit account only if there is a weighty reason. The reason must relate to the customer, his or her previous behaviour, or an apparent lack of need for the customer relationship. In addition, the Act on Detecting and Preventing Money Laundering and Terrorist Financing may preclude the provision of basic banking services in certain situations.

The right to basic banking services only applies to natural persons, not to, for example, companies and associations.

Annual review of basic banking services

Once a year, FIN-FSA conducts a review of basic banking services, with a particular focus on the availability and pricing of those services. One of the aims of the review is to ensure that customers’ right to basic banking services under the Credit Institution Act is realised in practice and that such realisation is not impaired by, for example, unfair pricing.

The review is based on both supervision observations and feedback from the markets as well as an enquiry sent to deposit banks and branches of foreign credit institutions offering basic banking services. The review is conducted annually on the basis of the situation at the beginning of March. This year the review was based on the situation as at 1 March 2016, and a total of 234 banks responded.

Payment Account Directive also affects basic Finnish banking services

In the future, the Payment Account Directive will also lay down the contents of basic banking services. Among other things, the Directive addresses services, pricing and price presentation related to so-called basic bank accounts. The Directive will be transposed into national law in 2016.

Banks must guide customers in choosing appropriate services

On the basis of an annual review, the Financial Supervisory Authority (FIN-FSA) assesses the availability and pricing of basic banking services offered to private customers. The 2015 review is based on information as of the beginning of March.

Availability

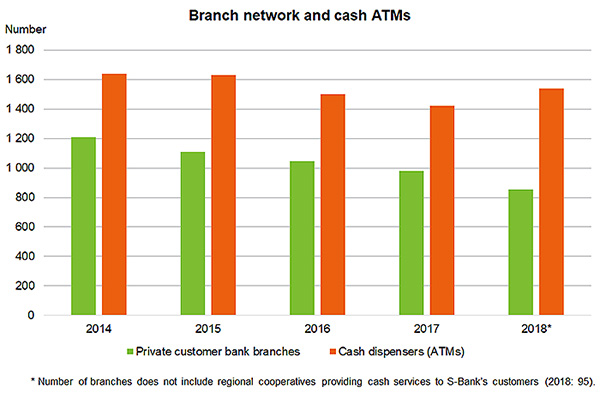

There were 1,109 bank offices providing services for private customers. In recent years, the number of private customer offices has decreased by about 100 per year. The cash services provided by bank offices for private customers have also been reduced: about 40% of private customer banks provide only limited cash services or none at all.

Bank office network and availability of banking services:

- bank offices 1,109

- payment terminals 531

- customer terminals 407

- ATMs 1,630

The number of cash dispensers (ATMs) has remained almost unchanged. The number of ATMs for payment of bills has also remained approximately unchanged. By contrast, the number of customer terminals has decreased significantly from the previous year, to less than half of the number in 2014.

Pricing

The prices of some basic banking services have risen in recent years. The total costs that customers pay for banking services are affected considerably by different pricing models pertaining to customer relationships: most banks offer their customers service packages, whose pricing is influenced by discounts based on, for example, concentration of financial dealings or customer’s age.

Pricing of basic banking service

|

Service |

Price |

Price |

Price |

| Account statement | free | free | free |

| Statement of transactions from an ATM |

1.00–1.49 /month |

1.00–1.49 /month |

0.50–0.99 /month |

| Online debit card (such as Visa Electron) | 2.00–2.49 /month |

2.00–2.49 /month |

2.00–2.49 /month |

| Debit card | 2.00–2.49 /month |

1.50-1.99 /month |

1.50-1.99 /month |

| Payment of invoices

|

7.00–7.49 |

6.00–6.49 |

6.00–6.49 |

|

5.00–5.49 |

5.00–5.49 |

3.50-3.99 |

|

0.50–0.99 |

0.50–0.99 |

0.50–0.99 |

|

free |

free |

free |

|

2.00–2.49 |

1.50-1.99 |

1.00–1.49 |

1) For the majority (about 75%) of banks, not included in the selection of services.

Choice of banking arrangements

Bank customers can also, through their choices, influence the availability of services and the costs of using them. It pays to consider the possible banking arrangements and needs and to compare available service types as well as the fees involved. It is also advisable to explore newly available banking arrangements and services outside of bank offices (for example for paying of bills and withdrawing of cash) and the prices of those services.

After making those comparisons it is easier to choose the most appropriate and favourable daily banking arrangements. If use of a payment card or access to online banking is out of the question due to, for example, illness, disability or some other reason, it is wise to contact your own bank and discuss alternative banking arrangements.

What are basic banking services?

Basic banking services refer to normal deposit accounts, account facilities (for example online debit card with verification of the account balance in real time, in connection with a transaction) and execution of payment orders. Basic banking services do not include, for example, accounts with overdraft facility or credit cards.

A bank may decline to open an ordinary deposit account only if there is a weighty reason. The reason must relate to the customer, his or her previous behaviour, or an apparent lack of need for the customer relationship. In addition, the Act on Detecting and Preventing Money Laundering and Terrorist Financing may preclude the provision of basic banking services in certain situations.

The right to basic banking services only applies to natural persons, not to, for example, companies and associations.

Annual review of basic banking services

Once a year, FIN-FSA conducts a review of basic banking services, with a particular focus on the availability and pricing of those services. One of the aims of the review is to ensure that customers’ right to basic banking services under the Credit Institution Act is realised in practice and that such realisation is not impaired by, for example, unfair pricing.

The review is based on both supervision observations and feedback from the markets as well as an enquiry sent to deposit banks and branches of foreign credit institutions offering basic banking services. The review is conducted annually on the basis of the situation at the beginning of March. This year the review was based on the situation as at 1 March 2015, and a total of 248 banks responded.

Payment Account Directive also affects basic Finnish banking services

In the future, the Payment Account Directive will also lay down the contents of basic banking services. Among other things, the Directive addresses services, pricing and price presentation related to so-called basic bank accounts. The provisions of the Directive will be implemented in national legislation in 2016.

As a rule, basic banking services still readily available

Basic banking services are for the most part still readily available. However, the number of bank branches for personal customers and the number of customer terminals has declined. Changes in the pricing of services have generally affected the prices of individual services. FIN-FSA assesses the availability and pricing of basic banking services offered to personal customers in an annual review. This year, the survey was based on the situation as at the beginning of March.

Decline in the number of branches and customer terminals

The number of bank branches serving personal customers totalled 1,208, representing a decline of about a hundred from the previous year (1,319). The number of self-service facilities – i.e. customer terminals – declined by almost two hundred.

The reduction in branches for personal customers and the services provided may locally compromise the availability of banking services, particularly for customers who do not have a payment card or access to online banking. This is often the case e.g. for older customers. FIN-FSA is monitoring developments in the availability of basic banking services.

The number of different service points providing banking services was as follows:

- bank offices 1,208

- payment terminals 571

- customer terminals 964

- ATMs 1,640

Pricing of basic banking services

About two thirds of banks have revised the pricing of their basic services since the previous survey (1 March 2013). The changes were generally increases in prices of individual services. FIN-FSA considers it important that fees charged for basic banking services be affordable and that banks instruct their customers on the selection of suitable services.

The pricing of services depends to a considerable degree on different pricing models relating to the type of customer relationship. Most banks offer their customers different service packages whose pricing includes discounts, for example based on the concentration of personal finances or the customer’s age.

Most commonly, the fees charged for basic banking services were as follows:

|

Service |

Price |

Price |

| Account statement | free | free |

| Statement of transactions from an ATM |

1.00–1.49 /month |

0.50–0.99 /month |

| Debit card (online) | 2.00–2.49 /month |

2.00–2.49 /month |

| Debit card | 1.50-1.99 /month |

1.50-1.99 /month |

| Payment of invoices

|

6.00–6.49 |

6.00–6.49 |

|

5.00–5.49 |

3.50-3.99 |

|

0.50–0.99 |

0.50–0.99 |

|

2.50-2.99 |

2.50-2.99 |

|

free |

free |

|

1.50-1.99 |

1.00–1.49 |

1) For the majority (about 75%) of banks, not included in the selection of services.

2) For the majority (about 55%) of banks, included in the monthly payment for online services.

Selection of ways to handle one’s banking business

Banking customers can affect the costs of their banking services by their own choices. It therefore pays to consider what one wants from their banking business and to compare

- the availability and quality of the services provided by different banks,

- fees charged by them for their services and

- any other services potentially available.

Based on such a comparison, one can choose the most appropriate way to handle one’s banking business. It is also advisable to explore the new possibilities for banking and service points outside bank branches, and at what prices these services are offered.

The Payment Accounts Directive will also affect banking services in Finland

The European Parliament has adopted a so-called Payment Accounts Directive (PAD) which will govern the content of basic banking services. The PAD must be transposed into national law within two years after its entry into force. The PAD lays down rules relating e.g. to the services offered, the pricing of services and the provision of fee information.

What are basic banking services?

Basic banking services refer to normal deposit accounts, account facilities (e.g. online debit card verifying the account balance in real time in connection with a transaction) and execution of payment orders. Basic banking services do not include, for example, accounts with an overdraft facility or credit cards.

A bank may decline to open an ordinary deposit account only if there is a weighty reason. The reason must relate to the customer or their previous behaviour, or that there is apparently no real need for the customer relationship. In addition, the Act on the Prevention and Clearing of Money Laundering may preclude the provision of basic banking services in some situations.

The right to basic banking services applies only to natural persons, not, for example, to companies or associations.

Annual review of basic banking services

Once a year, FIN-FSA conducts a review of basic banking services, with a particular eye to the availability and pricing of these services. One of the aims of the review is to ensure that customers’ right to basic banking services under the Credit Institution Act is realised in practice and that such realisation is not impaired by, for example, unfair pricing.

The review is based on both supervision observations and feedback received from the markets as well as a survey sent to deposit banks and branches of foreign credit institutions offering basic banking services. The survey is conducted annually on the basis of the situation in March. This year, the survey was based on the situation as at 1 March 2014, and a total of 255 banks responded.

Further decline in bank branches for personal customers; however, as a rule, basic banking services are still readily available

FIN-FSA assesses the availability and pricing of basic banking services offered to personal customers in an annual review. According to the review conducted in March 2013, the number of bank branches for personal customers has continued to decline and the prices for certain banking services have risen.

FIN-FSA considers that basic banking services are, as a rule, still readily available. As regards the pricing of services, FIN-FSA has called particular attention to the processing fee charged for paying an invoice in cash.

Further decline in number of branches

The number of bank branches serving personal customers totalled 1,319, representing a decline of about a hundred from the previous year (1,411). The number of customer terminals showed a similar decline.

The number of different service points providing banking services was as follows:

- bank offices 1,319

- payment terminals 578

- customer terminals 1,149

- ATMs

1,646

1,646

FIN-FSA considers that basic banking services are, as a rule, still readily available. On the other hand, the reduction of branches for personal customers and, for example, the restriction of cash services at branches may locally compromise the availability of banking services, particularly if the customer does not have access to a payment card or online banking. This is often the case for older customers, for example. FIN-FSA continues to actively monitor developments in the availability of services.

A bank may decline to provide basic banking services only if there is a weighty reason. As the most common reason for declining to open an account, banks cited insufficient documentation for identification of the customer. No incidents have come to FIN-FSA's attention where a bank has declined to provide basic banking services without a valid reason.

The most expensive way to pay an invoice is in cash over the counter

The pricing of basic banking services has changed in a majority of banks: about two thirds of banks have revised the pricing of their basic services since 1 March 2012, and about two thirds also disclosed price revisions already planned for after 1 March 2013. Most of the revisions were price increases, but some reductions had also been made.

For example, paying an invoice in cash at a bank branch most commonly cost EUR 6.00–6.49, against EUR 5.00–5.49 a year earlier. Although the highest fees for paying an invoice in cash were reduced from as much as EUR 12 the previous year to EUR 7–8, FIN-FSA still considers that a fee of EUR 7–8 may compromise the availability of basic banking services at a reasonable price.

Customers can also choose from several alternative and more affordable methods of paying invoices, such as online banking or a payment service envelope, although the prices for these services are also showing signs of increasing. Direct debit continues to be a free-of-charge way to pay an invoice in every bank.

The monthly fees charged for some payment cards, and in some cases also for online banking, have also risen.

Less than half of banks responding to the survey (115 banks) offered a service package including basic banking services, and its monthly price varied from zero to EUR 5.49 depending on the payment card selected. The most common price for a service package was EUR 2.50–2.99 per month.

The pricing of services depends to a considerable degree on different pricing models relating to the type of customer relationship. Most banks offer their customers different service packages whose pricing includes discounts, for example based on the concentration of personal finances or the customer's age.

Most commonly, the fees charged for basic banking services were as follows:

|

Service |

Price |

Price |

| Account statement | free | free |

| Statement of transactions from an ATM |

0.50–0.99 /month |

0.50–0.99 /month |

| Debit card (online) | 2.00–2.49 /month |

1.50-1.99 /month |

| Debit card | 1.50-1.99 /month |

1.50-1.99 /month |

| Payment of invoices

|

6.00–6.49 |

5.00–5.49 |

|

3.50-3.99 |

3.50-3.99 |

|

0.50–0.99 |

0.50–0.99 |

|

2.70 |

2.50 |

|

free |

free |

|

1.00–1.49 |

1.00–1.49 |

Selection of ways to conduct one’s banking business

Banking customers can affect the costs of their banking services by their own choices. It therefore pays to compare the fees charged by banks for services, the availability and quality of the services provided and any other services potentially available, and choose the individually most appropriate way to conduct one’s banking business based on the comparison. It is also advisable to explore what kind of new possibilities for banking and service points outside bank branches are available, and at what prices these services are offered.

What are basic banking services?

Basic banking services refer to normal deposit accounts, account facilities (eg online debit card verifying the account balance in real time in connection with a transaction) and execution of payment orders. Basic banking services do not include, for example, accounts with an overdraft facility or credit cards.

A bank may decline to open an ordinary deposit account only if there is a weighty reason. The reason must relate to the customer or their previous behaviour, or that there is apparently no real need for the customer relationship. In addition, the Act on the Prevention and Clearing of Money Laundering may preclude the provision of basic banking services in some situations.

The right to basic banking services applies only to natural persons, not, for example, to companies or associations.

Annual review of basic banking services

Once a year, FIN-FSA conducts a review of basic banking services, with a particular eye to the availability and pricing of these services. One of the aims of the review is to ensure that customers’ right to basic banking services under section 134 of the Credit Institutions Act is realised in practice and that such realisation is not impaired by, for example, unfair pricing.

The review is based on both supervision observations and feedback received from the markets as well as a survey sent to deposit banks and branches of foreign credit institutions offering basic banking services. The survey is conducted annually on the basis of the situation in March. This year, a total of 272 banks responded.

Decline in the number of personal customer bank branches, focus of attention on invoice payment fees

The Financial Supervisory Authority (FIN-FSA) conducted a survey on the availability and pricing of basic banking services. According to the survey, the number of personal customer bank branches and payment ATMs has declined, but basic banking services can still be accessed without difficulty. As for the pricing of services, FIN-FSA has paid attention to the fees some banks charge for payment of invoices in cash.

Decline in the number of personal customer bank branches may impair the availability of banking services in some localities

The number of personal customer bank branches and payment ATMs has declined, and cash services have been reduced in several personal bank branches where cash services are provided only during a part of the business day. Consequently, the availability of banking services may have weakened in those localities, particularly for customers who do not use online banking services or payment cards.

The number of different service points providing banking services was as follows:

- bank offices 1,411

- payment terminals 599

- customer terminals 1,246

- ATMs 1,678

Payment of invoices in cash over the counter is the most expensive option

Some banks charge as much as EUR 7–12 for making an invoice payment in cash over the counter. Such a high fee endangers the customers' right to obtain basic banking services at a reasonable price, and therefore FIN-FSA recommends that banks adjust these prices. The fees for payment services or online services had not otherwise changed significantly compared to 2011, and the payment of invoices via direct debit is still free of charge.

Annual survey of basic banking services

FIN-FSA surveyed the availability and pricing of basic banking services as at the start of March 2012. A total of 282 banks responded to the survey. The previous survey directed at deposit banks providing basic banking services was carried out at the same time of the year 2011. Besides the survey responses, account was taken of other inspection observations on the availability and pricing of services, and feedback from the market.

One of the purposes of the survey on basic banking services is to ensure that customers’ rights to basic banking services under section 134 of the Credit Institutions Act are realised and that such realisation is not impaired by, for instance, unreasonable pricing. Basic banking services refer to normal deposit accounts, account facilities (one of each per person) and execution of payment orders. The right to basic banking services applies only to natural persons, not eg to companies or associations.

See also

- Survey on basic banking services 2012 (in Finnish only)

For further information, please contact

- Timo Peltonen, Head of Division, tel. +358 10 831 5551

Asiakas voi usein vaikuttaa valinnoillaan peruspankkipalveluista maksamiinsa maksuihin

Finanssivalvonta arvioi vuosittaisen kyselyn avulla henkilöasiakkaille tarjottavien peruspankkipalveluiden hinnoittelua ja saatavuutta. Kyselyn lisäksi Finanssivalvonta saa tietoja pankkipalvelujen hinnoittelusta ja saatavuudesta pankkien asiakkailta ja useilta sidosryhmiltään.Uusimman kyselyn perusteella peruspankkipalveluita on edelleen hyvin saatavissa, vaikkakin laskunmaksuautomaattien määrä on vähentynyt ja käteisen rahan saantia on joissain pankkien toimipisteissä supistettu esimerkiksi tarjoamalla käteispalveluja vain joinakin viikonpäivinä tai tiettyyn kellonaikaan. Sen sijaan palvelumaksu laskun maksamisesta käteisellä pankin tiskillä voi joissakin tilanteissa muodostua kohtuuttomaksi.

Pankkikonttoreiden määrä ennallaan, laskunmaksuautomaattien määrä vähentynyt

Edelliseen kyselyyn verrattuna merkittävin muutos on asiakaspäätteiden ja erityisesti laskunmaksuautomaattien väheneminen. Toisaalta saataville on tullut uusia, pankkikonttorien ulkopuolisia asiointimahdollisuuksia ja palvelupisteitä. Pankkiasiointi on myös siirtynyt enenevässä määrin verkkopankkeihin, ja ostokset maksetaan yhä useammin käteisen rahan sijaan erilaisilla maksukorteilla. Käteisautomaattiverkosto on suhteellisen harva, mutta käteisautomaattien lukumäärä on säilynyt ennallaan useita vuosia. Myöskään pankkikonttoreiden lukumäärä ei ole muuttunut olennaisesti.

Erilaisia pankkipalveluja tarjoavia asiointipisteitä oli seuraavasti:

- pankkikonttoreita 1 532

- laskunmaksuautomaatteja 789

- asiakaspäätteitä 1 263

- käteisautomaatteja 1 690

- muita palvelupisteitä 1 093

Finanssivalvonnan tietoon ei ole tullut peruspankkipalvelujen saatavuuteen liittyviä ongelmia taikka että peruspankkipalvelujen tarjoamisesta olisi perusteettomasti kieltäydytty. Peruspankkipalvelujen voidaankin katsoa olevan edelleen hyvin asiakkaiden saatavilla.

Kallein laskunmaksutapa on käteismaksu pankin tiskillä

Kyselyyn vastanneista pankeista noin puolet ilmoitti hintoihin tulleen korotuksia 1.3.2010 jälkeen (56 % eli164 pankkia). Muutokset koskivat pääosin erilaisten korttien hinnoittelua.

Laskun maksaminen suoraveloituksena oli edelleen kaikissa pankeissa maksuton. Muutoin edullisin laskunmaksutapa oli verkkopankki, jonka yleisin kuukausimaksu oli 2,50 euroa. Peruspankkipalvelut sisältävä palvelupaketti oli palveluvalikoimassa yli puolella selvitykseen vastanneista pankeista (54 % eli 157 pankilla), ja palvelupaketin kuukausihinta vaihteli maksuttomasta 5,00 euroon pakettiin valitusta kortista riippuen. Palvelujen hinnoitteluun voivat vaikuttaa huomattavasti erilaiset kanta-asiakasohjelmat ja asiakasryhmäkohtaiset paketit.

Kallein laskunmaksutapa oli yhä maksaminen käteisellä pankin konttorissa: sen hinta oli enimmillään oman pankin konttorissa 7,00 euroa ja vieraan pankin konttorissa 8,00 euroa laskulta. Finanssivalvonta arvioi 7,00–8,00 euron palvelumaksun laskun käteismaksusta voivan muodostua joissakin tilanteissa kohtuuttomaksi. Finanssivalvonta julkaisee palvelumaksuista valvottavatiedotteen ja kiinnittää muutamien pankkien huomiota palvelumaksun mahdolliseen kohtuuttomuuteen. Vaihtoehtoisia, asiakkaan kannalta edullisempia laskunmaksutapoja on kuitenkin tarjolla (esimerkiksi verkkopankki, maksupalvelu ja suoraveloitus). Asiakkaiden kannattaa itse aktiivisesti selvittää ja vertailla tarjolla olevia palveluja.

Pankkipalveluista veloitettavat maksut olivat yleisimmin:

|

Palvelu |

Hinta 2011 |

| Tiliote | maksuton |

| Tapahtumakysely automaatilla | 0,50–0,99 euroa/kysely |

| Automaattikortti | 0,50–0,99 euroa/kk |

| Pankkikortti | 1,50-1,99 euroa/kk |

| Visa Electron tms. | 1,50-1,99 euroa/kk |

| Laskunmaksu

|

5,00–5,49 euroa/lasku |

|

3,50-3,99 euroa/lasku |

|

0,50–0,99 euroa/lasku |

|

2,50 euroa/kk |

|

5,00 euroa/lasku |

|

maksuton |

|

1,00-1,49 euroa/lasku |

Euroopan komissio on antanut suosituksen tavanomaisista maksutileistä

Euroopan komissio on antanut kuluvan vuoden heinäkuussa tavanomaista maksutiliä koskevan suosituksen. Asiakkaan näkökulmasta suositus ei aiheuta Suomessa olennaisia muutoksia peruspankkipalveluihin, joiden saanti on jo turvattu lainsäädännöllä. Suositus kuitenkin asettaa jäsenvaltioille velvoitteen määritellä kohtuuhintaisen palvelumaksun suuruus suosituksessa esitettyjen kriteerien pohjalta.

Mitkä peruspankkipalvelut?

Peruspankkipalveluilla tarkoitetaan tavanomaista talletustiliä, tilinkäyttövälinettä (esimerkiksi ns. on-line debit-korttia) sekä maksutoimeksiantojen hoitamista. Peruspankkipalveluita eivät ole esimerkiksi luotolliset tilit tai erilaiset luottokortit.

Pankki voi kieltäytyä avaamasta tavanomaista talletustiliä vain, jos kieltäytymiselle on painava peruste. Perusteen tulee liittyä asiakkaaseen tai hänen aiempaan käyttäytymiseensä taikka siihen, ettei asiakassuhteelle ilmeisesti ole todellista tarvetta (esimerkiksi asiakkaalla on jo tili toisessa pankissa). Myös rahanpesun estämisestä ja selvittämisestä annettu laki saattaa estää peruspankkipalvelujen tarjoamisen joissakin tilanteissa.

Oikeus peruspankkipalveluihin koskee vain luonnollista henkilöä, ei sen sijaan esimerkiksi yrityksiä tai yhdistyksiä.

Vuosittainen selvitys peruspankkipalveluista

Finanssivalvonta tekee kerran vuodessa pankkipalveluita koskevan kyselyn peruspankkipalveluja tarjoaville talletuspankeille ja ulkomaisten luottolaitosten sivukonttoreille. Kyselyn avulla seurataan erityisesti peruspankkipalveluiden hinnoittelua ja saatavuutta. Selvityksen yhtenä tavoitteena on varmistua siitä, että luottolaitoslain 134 §:ssä säädetty asiakkaan oikeus peruspankkipalveluihin toteutuu eikä säännöksen tuoman oikeuden toteutumista vaikeuteta esimerkiksi kohtuuttomalla hinnoittelulla.

Kysely tehdään vuosittain maaliskuun alun tilanteesta. Kuluvan vuoden kyselyyn vastasi yhteensä 292 pankkia. Kyselytutkimuksen lisäksi selvityksessä on otettu huomioon myös muut saatavuutta ja hinnoittelua koskevat valvontahavainnot sekä markkinoilta saatu palaute.

Lisätietoja antaa

- toimistopäällikkö Timo Peltonen, puhelin 010 831 5551

Availability of basic banking services as before, no major changes in pricing

According to the view of the Financial Supervisory Authority (FIN-FSA), basic banking services continue to be readily available, and there have been no major changes in pricing, compared with 2009.

A comparison with the previous survey does not reveal any essential changes or problems in the availability of services. FIN-FSA has no knowledge of unfounded refusals to provide services.

Some minor price increases

About 68% of the respondents, ie deposit banks providing basic banking services, reported price increases during the period under review. However, the increases usually affected certain individual products. Most increases have occurred in fees for Visa Electron and bank cards. Price increases may reflect an effort to guide customers towards opting for new types of payment cards compliant with the Single European Payments Area (SEPA).

All banks still provide free payment of bills through direct debit. Otherwise, online payment continues to be the most favourable alternative for payment of bills, and the usual monthly fee is EUR 2.50. Payment of bills in cash over the counter is still the most expensive alternative. The highest price for cash payment at the customer’s own bank branch was EUR 7.00 per invoice.

A total of 148 banks, ie slightly below 50% of deposit banks that responded to the enquiry, include a basic banking service package in their service. The monthly fee for the package ranges from EUR 0.00 to EUR 5.00, depending on the card linked to the package.

Most common prices

|

Service |

Price 2010, |

| Account statement | free |

| Statement of transactions from an ATM |

0.50/month |

| ATM card | 1.00/month |

| Bank card | 1.10-1.50/month |

| Visa Electron etc | 1.10-1.50/month |

| Payment of bills

|

4.60-5.00/invoice |

|

3.10-3.50/invoice |

|

0.60–1.00/invoice |

|

2.50/month |

|

0-5.00 |

|

free |

|

1.10-1.50/invoice |

Number of offices and devices

- bank offices 1,524

- payment terminals 1,253

- customer terminals 1,372

- ATMs (Otto and Nosto) 1,707

FIN-FSA surveyed the availability and prices of basic banking services as at the start of March 2010. The previous enquiry directed at deposit banks providing basic banking services was carried out at the corresponding time in 2009. Besides the enquiry responses, account was also taken of other inspection observations on the availability and pricing of services, and feedback from the market.

One of the purposes of the survey on basic banking services is to ensure that customers’ rights to basic banking services under section 134 of the Credit Institutions Act are realised and that such realisation is not impaired by, for example, unfair pricing. Basic banking services refer to normal deposit accounts, account facilities and execution of payment orders. The right to basic banking services applies only to natural persons, not eg to companies or associations.

Prices and availability of basic banking services unchanged

According to the Financial Supervisory Authority (FIN-FSA), the availability of basic banking services is still good and no significant changes have occurred in the prices. Presently basic banking services are supplied in various packages for regular customers and comprising several services, which may affect the prices of the services and the transparency and comparability of pricing.

Compared to the previous survey, no significant changes in the availability have occurred and neither have problems with availability been observed in any other sense. FIN-FSA has not heard of any groundless refusal to supply services.

Prices broadly unchanged

Also, there have been no major changes in the pricing compared to the previous survey in 2008. Mostly rises have occurred in, for example, monthly fees for additional Visa cards and some individual fees. All banks still provide free payment of bills through direct debit. Apart from that, online payment is the most favourable alternative for payment of bills and the monthly fee is usually EUR 2.50. Payment of bills in cash over the counter is still the most expensive alternative. The highest price for cash payment was EUR 6.60–7.00 per invoice.

Most common prices

|

Service |

Price 2009, |

| Account statement | free |

| Statement of transactions from an ATM |

0.50/month |

| ATM card | 0.60-1.00/month |

| Bank card | 0.60-1.00/month |

| Visa Electron etc | 0.60-1.00/month |

| Payment of bills

|

4.60-5.00/invoice |

|

2.60-3.00/invoice |

|

0.60–1.00/invoice |

|

2.10.-2.50/month |

|

3.60-4.00 |

|

free |

|

0.60-1.00/invoice |

Number of offices and devices

- bank offices 1,552

- payment terminals 1,436

- customer terminals 1,405

- ATMs 1,650

FIN-FSA studied the availability and prices of basic banking services on the basis of the situation at the beginning of March 2009. The previous enquiry directed to deposit banks providing basic banking services was carried out at the corresponding time 2008. Not only were the enquiry responses considered in the survey but also inspection observations on the availability of services and the pricing of them as well as feedback from the market.

One purpose of the survey on basic banking services is to ensure that customer rights to such services according to section 134 of the Credit Institutions Act are implemented and that the implementation is not impaired through, for example, discriminating pricing. Basic banking services refer to normal deposit accounts, account facilities and execution of payment orders. The rights to basic banking services concern only natural persons but do not, by contrast, comprise, for example, companies and associations.

Pankkipalveluja edelleen hyvin saatavilla ja palvelujen hintataso kohtuullinen

Rahoitustarkastus (nykyinen Finanssivalvonta) selvitti peruspankkipalvelujen hinnoittelua ja saatavuutta vuoden 2007 maaliskuun alun tilanteesta. Edellinen kysely peruspankkipalveluja tarjoaville talletuspankeille tehtiin vuoden 2006 heinäkuussa. Kyselytutkimuksen lisäksi selvityksessä on otettu huomioon myös muut saatavuutta ja hinnoittelua koskevat valvontahavainnot sekä markkinoilta saatu palaute.

Peruspankkipalveluja koskevan selvityksen yhtenä tavoitteena on varmistua siitä, että luottolaitoslain 134 §:ssä säädetty asiakkaan oikeus peruspankkipalveluihin toteutuu eikä säännöksen tuoman oikeuden toteutumista vaikeuteta esim. kohtuuttomalla hinnoittelulla. Peruspankkipalveluilla tarkoitetaan tavanomaista talletustiliä, tilinkäyttövälineitä sekä maksutoimeksiantojen hoitamista. Oikeus peruspankkipalveluihin koskee vain luonnollista henkilöä, ei sen sijaan esimerkiksi yrityksiä tai yhdistyksiä.

Hinnoittelusta

Edelliseen selvitykseen verrattuna hinnoissa on tapahtunut jonkin verran muutoksia, jotka pääsääntöisesti olivat pieniä korotuksia. Tililtäotto omalta tililtä samoin kuin tilillepano omalle tilille omassa konttorissa sekä laskun maksaminen suoraveloituksena ovat edelleen maksuttomia palveluja. Kallein peruspankkipalvelu on laskun maksaminen käteisellä pankin konttorissa ja korkein hinta oli 6,10–6,50 euroa/lasku. Oheisesta taulukosta ilmenevät palveluista yleisimmin veloitetut hinnat.

Fivan käsityksen mukaan peruspankkipalveluja on edelleen saatavissa kohtuulliseen hintaan. Vaikka yksittäistä maksua olisi jossain tapauksissa pidettävä suurena, on otettava huomioon, että vaihtoehtoisia edullisempia toimintatapoja on olemassa. Laskunmaksun osalta on edelleen tarjolla useita vaihtoehtoja, joista suoraveloitus on kaikilla pankeilla maksuton. Lisäksi useilla pankeilla on palvelupaketteja erityisryhmille kuten nuorille ja senioreille.

Yleisimmin veloitetut palveluhinnat 1.3.2007

|

Palvelu |

Hinta 2007 |

Pankit kpl

|

| Tiliote | maksuton | 285 |

| Tapahtumakysely automaatilla | 0,50 euroa/kysely | 203 |

| Automaattikortti | 0,60-1,00 euro/kk | 167 |

| Pankkikortti | 0,60-1,00 euroa/kk | 191 |

| Visa Electron -kortti tms. | 0,60-1,00 euroa/kk | 226 |

| Laskunmaksu

|

4,60-5,00 euroa/lasku |

110 |

|

2,60-3,00 euroa/lasku |

142 |

|

0,60–1,00 euroa/lasku |

147 |

|

2,10-2,50 euroa/kk |

|

|

maksuton |

61 |

|

maksuton |

kaikki |

|

0,60-1,00 euroa/lasku |

187 |

Palvelujen saatavuudesta