8. Boards have been kept informed about the new regulations

The FIN-FSA asked companies to list the topics pertaining to sustainability matters that the audit committee has submitted to board of directors’ meetings for discussion and/or decision (question 3). Of the companies that responded to the survey, around three-quarters have a separate audit committee or other committee whose tasks include preparation of corporate responsibility or sustainability reporting. An analysis of the responses from these committees is given below.

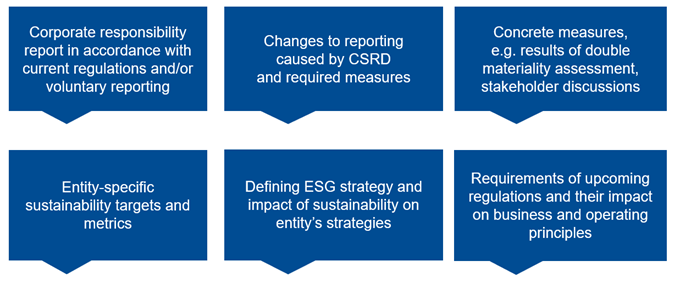

Figure 8. Examples of responses to question 3

Based on the answers, in addition to the corporate responsibility report in accordance with current regulations, any voluntary sustainability reporting requires discussion and/or decision by the board of directors. In addition, the boards of around one half of the companies have reviewed the reporting requirements under the new regulations and have monitored regulatory developments.

Around one third of respondents stated that the board of directors had discussed the changes brought by the CSRD to the company’s reporting as well as the measures required by the implementation of the CSRD. The responses include, for example, the following concrete measures:

- “Discussions have taken place on, among other things, the double materiality assessment to be carried out, listening to stakeholders, and steps towards an ESG strategy.”

- “Topics such as green finance framework, science-based target initiative submission, embedding sustainability criteria to capex assessment.”

Many respondents stated that the company’s board of directors had decided on sustainability targets. The responses outlined, among other things, that the board deals with the company’s climate work and monitors the achievement of targets regularly and that “the company’s board approved the priorities, targets and metrics of the company’s corporate responsibility programme in 2021”. One answer stated that “short- and long-term targets and corporate responsibility policies have been decided at the board level”.

Based on the responses, a number of companies have either updated old strategies (e.g. sustainability strategy) or prepared completely new ones (e.g. energy strategy) in connection with the implementation of the CSRD. In addition, the following aspects, among others, were highlighted in the responses:

- “The Board has reviewed and approved the results of the double materiality assessment as part of the strategy review.”

- “The AC has brought some operational/strategic sustainability risk management issues to the Board of Directors’ attention.”

- “Sustainability is part of the annual Board of Directors’ strategy process. This includes e.g. business strategies, decarbonisation, R&D, sustainability targets, and reporting frameworks.”

According to the answers, the materiality assessment has been or will be discussed at the board level. The materiality assessment may be included in the board’s other topics, while some of the responses explicitly mention the materiality assessment, for example “the board has discussed the materiality assessment of sustainability” and “the essential sustainability matters and metrics proposed on the basis of the materiality assessment will be brought to the board for decision”.

According to the understanding obtained by the FIN-FSA, audit committees have extensively brought topics related to sustainability matters to board meetings. In the view of the FIN-FSA, audit committees have an important role in supporting the effective work of the board of directors in relation to sustainability matters.

The materiality criterion is given significant weight in most of the sustainability reporting standards. Audit committees have an important role to play in monitoring and assessing the determination of materiality and in supporting the board of directors particularly in this area, as the level of materiality affects the quality and reliability of information provided to investors.1

1 Further information about the survey of audit committees regarding materiality in financial statement reporting and auditing can be found in the Market Newsletter 2/2021, p. 11–15, and FIN-FSA’s event for listed companies 2022 presentation, slides 72–77 (in Finnish).