First sustainability statements through the eyes of the enforcer

In 2025, first group of large public-interest entities published the first sustainability statements in accordance with the European Sustainability Reporting Standards (ESRS). The Financial Supervisory Authority (FIN-FSA) reviewed the sustainability statements of 20 companies, focusing on the enforcement priorities of the European Securities and Markets Authority (ESMA). The companies were credit institutions, insurance companies and employee pension insurance companies as well as non-financial sector listed companies. The review of the statements particularly assessed whether the companies have disclosed their double materiality assessment process in accordance with the ESRS. The reporting of the materiality assessment process by the companies participating in the study was mainly compliant with the standards, which shows that the new method of implementing materiality assessment has been well adopted, despite the challenges of first preparation. The structure of the sustainability statements also mainly followed the requirements of the ESRS.

The experience gained from the first round of ESRS reporting provides companies with a good foundation to develop reporting so that it better meets investor expectations and supports the key goal of sustainability reporting, which is to disclose the management of sustainability aspects related to business. Companies are requested to take into account the observations and recommendations presented in this article in their future sustainability statements to ensure transparency and comparability.

Enforcers’ work guided by ESMA’s priorities and Omnibus

The Omnibus I proposal, adopted by the European Commission in February 2025, includes changes to the scope of the Corporate Sustainability Reporting Directive (CSRD) with regard to undertakings subject to sustainability reporting. The Commission proposal also eases the reporting requirements of the ESRS. Furthermore, the CSRD has not yet been implemented in all EU Member States, which means that the reporting and enforcement environment is not fully harmonised. For more information, see the article in this Market Newsletter Compliance with sustainability data enforcement guidelines progressing gradually in Europe.

As a result of the above, ESMA published in June a statement on the first years of supervision. The FIN-FSA has also adjusted its enforcement actions. For example, the emphasis of enforcement is on listed companies that will remain subject to the reporting obligation. The actions of the FIN-FSA in the first year, however, were even more affected by the fact that reporting was new to all parties, meaning that the application practices for the ESRS were not established and European enforcers did not have previous experience of ESRS enforcement. These factors will impact the FIN-FSA’s approach for several years to come.

In its enforcement of listed companies’ sustainability reporting, the FIN-FSA follows ESMA’s guidelines on the enforcement of sustainability information, which define, among other things, the enforcement methodology and process to ensure consistency in enforcers’ decisions. In addition, the enforcement priorities determined annually by ESMA and national enforcers are central to the FIN-FSA’s enforcement.

In addition to ESMA’s enforcement guidelines, sector-specific expertise is utilised in the enforcement of the sustainability reporting of credit institutions, insurance companies and employee pension insurance companies. Enforcement of sustainability reporting is integrated with prudential supervision of ESG risks in banking and insurance supervision.

FIN-FSA’s review of first sustainability statements

The FIN-FSA reviewed the sustainability statements of 20 companies. The companies were credit institutions, insurance companies and employee pension insurance companies as well as non-financial sector listed companies. The review of the 2024 sustainability statements particularly assessed whether the companies have described their double materiality assessment process in accordance with the ESRS. The assessment utilised a set of questions developed in collaboration with ESMA and national enforcers, focusing on the following issues:

- the process of identifying and assessing material impacts, risks and opportunities

- using the due diligence process to support the materiality assessment

- the input data used (e.g. data sources and assumptions) in the materiality assessment

- consultation of stakeholders as part of the materiality assessment and

- use of qualitative and quantitative thresholds.

In addition, the FIN-FSA’s observations were reviewed in discussions with a number of non-financial sector listed companies. The goal was to provide the FIN-FSA with more in-depth information about the companies’ basis for preparation and to hear about the companies’ experiences in preparing the first sustainability statements.

Observations on the reporting of the double materiality assessment process

The reporting of the double materiality assessment process by the companies participating in the study was mainly compliant with the standards. Below is a more detailed description of the FIN-FSA’s observations on the implementation of the double materiality assessment process and its transparency as well as the structure of the sustainability statement.

- Standard phrases directly from the ESRS have been used in descriptions of the double materiality assessment process. Some of the reporting entities provided detailed and company-specific descriptions, while others almost directly quoted the text of the ESRS. In these cases, the standard text does not provide sufficient information about the reporting entity’s own process. The ESRS require a transparent description of the process, including input data, thresholds and assumptions. (ESRS 2 IRO-1 paragraph 53)

- There was variation in reporting the process of identifying and assessing material impacts, risks and opportunities (IRO). Most of the reporting entities defined thresholds for materiality. The criteria used to determine the thresholds were mostly not reported, however. A number of the reporting entities also used an illustrative matrix to present their results. The ESRS require descriptions of the processes by which IROs are identified, assessed and prioritised. (ESRS 2 IRO-1 paragraph 53)

- There was a widespread in the number of IROs and material topics between reporters. Some of the reporting entities had only IROs defined at the company level, while some reported in more detail IROs for different business functions. Topics should be defined at a sufficiently detailed level to allow for the presentation of policies, actions and targets for each topic. The number of material topics affects the number of data requirements to be reported. The use of thresholds in the ESRS, allows for a more precisely defined set of material topics. (ESRS 2 IRO-1 paragraph 53, ESRS 2 MDR-T)

- The due diligence process was most often reported only in table form. Descriptions of the double materiality assessment process, however, most often did not include the due diligence process as part of the input data as required by the ESRS. (ESRS 2 GOV-4 and ESRS 1 Chapter 4)

- Stakeholder consultation was mostly reported comprehensively. However, some of the reporting entities did not disclose the methodology used to conduct stakeholder consultations. The ESRS require a statement on whether and how the process covers stakeholder consultation. (ESRS 2 IRO-1 paragraph 53)

Observations on the structure of sustainability statements

The structure of the statement is a key factor in terms of the accessibility, readability and understandability of the reported information. The ESRS require that the sustainability statement be clearly structured, which supports the accessibility of the information.

- The structure of the sustainability statements mainly followed the requirements of the ESRS. However, taxonomy tables, for example, are not always presented at the beginning of the environmental section as required by the ESRS. (ESRS 1 Appendix D)

- In the headings, references to the ESRS sections aided navigation. Standard references in the heading, subheading or text supported the accessibility of the information. ESMA notes that including a reference in connection with reported information improves the accessibility of the information. The ESRS require that the structure support readability and understandability. (ESRS 1 paragraph 111)

- Presenting the information in table form improved the readability of the statement. For example, brief descriptions of IROs presented in table form and their relevance to the company’s own operations or value chain, their time horizons and objectives, and stakeholders, clarified reporting. The ESRS emphasise that information should be presented in a way that facilitates understanding of sustainability statements (ESRS 1 Appendix B), and tables are an effective way to meet this requirement.

- The requirements were mainly followed in presenting references and additional information. References to other parts of the management report, for example, are only permitted if the information has been subject to at least the same level of assurance as the sustainability statement. Additional information, on the other hand, may be disclosed, for example, in the notes to the annual report, but it must not substitute for the core information in the sustainability statement. (ESRS 1 paragraphs 114 and 120)

ESMA recommendations for preparing sustainability statements

In October, ESMA published a report Materiality Matters, which is based on observations made by ESMA and national enforcers on the reporting of double materiality assessment processes. The report includes an analysis of sustainability reporting by 91 companies in 23 countries. An assessment of six Finnish non-financial listed companies is included in the results.

The ESMA report urges companies to

- avoid boilerplate disclosures in the description of their double materiality assessment process and provide clarity on the basis and judgments on which the materiality assessment has been made.

- map their material IROs with ESRS topic-specific sustainability factors (ESRS 1 AR16) and use ESRS terminology to describe them.

- identify and report entity-specific IROs in addition to ESRS requirements.

- disclose adopted policies, actions and targets (or indicate their absence) as well as metrics for each material sustainability matter, including entity-specific matters.

- ensure that the overall objective of sustainability reporting is met (i.e. describe material IROs and how they are managed).

- increase the usability of reported information by linking material IROs to topic-specific information requirements.

Enforcement of sustainability statements in 2026

In 2026, enforcement of sustainability statements will continue, applying the same enforcement priorities as this year: description of the double materiality assessment process as well as the scope and structure of the sustainability statement. The FIN-FSA will continue to pay particular attention to the transparent reporting of the double materiality assessment process.

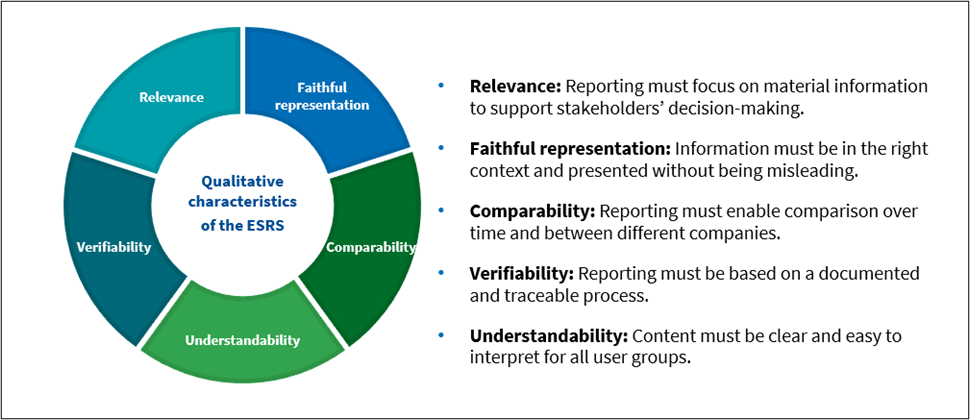

Although the ESRS are subject to change, the qualitative characteristics of information remain unchanged in their main principles and continue to be key requirements for sustainability reporting.

Figure 1. Qualitative characteristics of the ESRS (ESRS 1 Appendix B)

For further information, please contact:

- Niina Turri, Chief Specialist, niina.turri(at)finanssivalvonta.fi, tel. +358 9 183 5040

- Laura Heinola, Senior Specialist, laura.heinola(at)finanssivalvonta.fi, tel. +358 9 183 5354.