The objective of the Financial Supervisory Authority’s strategy for 2026–2028 is effective and active supervision – in 2026, supervision will emphasise preparing for extreme economic phenomena and ensuring the operational reliability of digital services

With its renewed strategy, the Financial Supervisory Authority (FIN-FSA) is aiming for even more effective and active supervision. A risk-based approach remains the guiding factor for supervision. In 2026, the emphasis of supervisory priorities will be on the operation of digital services and preparing for extreme economic and market phenomena. In addition to the annual priorities, there will be continuous monitoring of solvency, good governance and codes of business conduct.

From the beginning of 2026, the FIN-FSA will be guided by a renewed strategy. The FIN-FSA’s continuing objective is to be a proactive and predictable supervisor. The strategy’s priorities will guide the FIN-FSA in conducting active, effective supervision that takes digital development into account and in strengthening its ability to change in its internal activities.

The supervisor's work will also be guided by renewed values: reliability, independence, togetherness and effectiveness. According to section 1 of the Act on the Financial Supervisory Authority, the FIN-FSA’s mission is “We ensure financial stability and confidence in the financial markets and enhance the protection of customers and investors and insured benefits”.

“We seek supervisory effectiveness through risk-based prioritisation whereby we specifically focus supervision on where it has the greatest impact. We cannot supervise everything all the time, but we naturally react and target supervision when we observe that an area’s significance and risk levels are increasing or in some area there are significant shortcomings requiring supervisory action,” says Tero Kurenmaa, Director General of the FIN-FSA.

“We actively monitor developments in the operating environment. The digitalisation of the work and environment of supervised entities, together with artificial intelligence and cyber-resilience regulations, make it a supervisory priority.”

In 2026, supervision will focus on the operation of digital services and the financial preparedness of supervised entities

In 2026, supervision will focus particularly on the operation of digital services. This includes both digital resilience and cybersecurity as well as the security of digital services.

“The operation and use of financial sector services are completely dependent on the reliable functioning of digital channels. With this priority, the FIN-FSA will focus its supervision on digital resilience and mitigating risks related to the use of digital customer channels,” says Jyri Helenius, Deputy Director General of the FIN-FSA. Helenius heads the supervision steering group coordinating the supervisory work of the FIN-FSA.

In 2026, a further priority is preparing for extreme economic and market phenomena. This priority will be implemented through supervisory actions to ensure the adequacy and risk resilience of supervised entities’ own preparedness, and by monitoring, analysing and anticipating negative development trends in the operating environment and their impact on the financial sector and supervision. Operating environment risks remain exceptionally high due to, among other things, the geopolitical and trade situation and the high valuation levels of US technology companies.

Implementation of this supervisory priority was supported by an operating environment analysis by the FIN-FSA analysts that examined the effects of expected and weaker-than-expected economic development on the Finnish financial sector. The work was based on the Bank of Finland’s baseline forecast and EBA and EIOPA stress test scenarios. In addition, an assessment was made of the impacts of possible but highly unlikely negative scenarios (i.e. tail-risk scenarios). These scenarios relate, for example, to a general mistrust in US investment targets, Russia’s war of aggression and hybrid influence, and the adverse effects of sovereign indebtedness.

“Although extreme chains of events are unlikely, we seek to use supervision to ensure that the financial sector is prepared and able to cope even in such situations. Ensuring this is an important part of societal resilience,” emphasises Helenius.

Inspections and thematic assessments in the various supervisory sectors

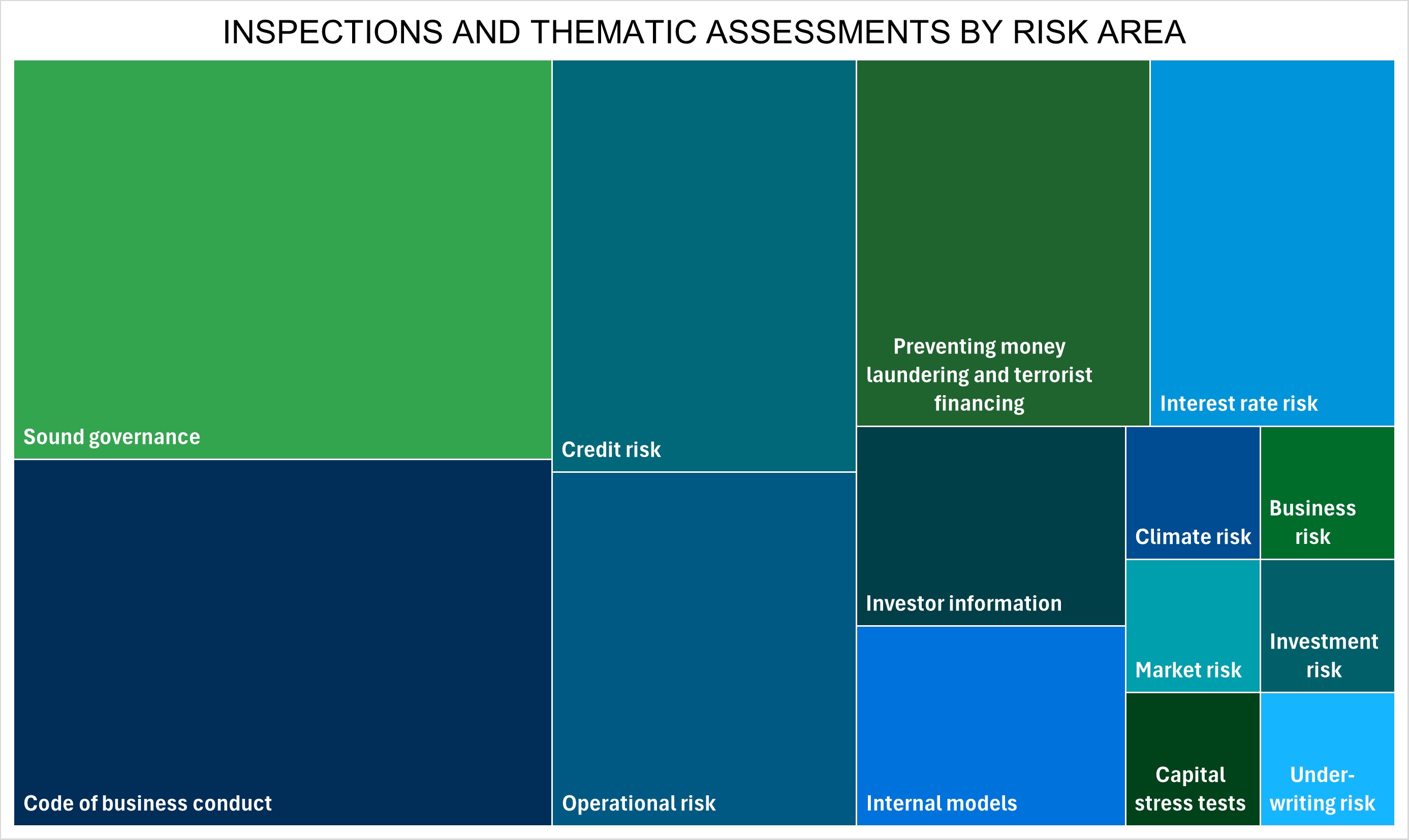

Each year, the FIN-FSA carries out a number of inspections of individual supervised entities as well as thematic assessments of groups of supervised entities in accordance with its supervisory priorities. In addition to our annual priorities, we continuously monitor solvency, good governance and codes of business conduct.

The priorities of European supervisors and the risk-based approach also guide the FIN-FSA’s inspections and assessments. Of Finnish banks, Nordea, OP Financial Group, Danske Bank and Municipality Finance are under direct ECB supervision, and the FIN-FSA conducts supervision in cooperation with the ECB. Where applicable, the FIN-FSA will also follow the same priorities in the supervision of smaller credit institutions under its direct supervision.

For 2026, the FIN-FSA has planned 35 new inspections (2025: 33) and 24 new thematic assessments (2025: 18In addition, 17 supervisory actions will continue from 2025.. The number of inspections also includes those conducted jointly with the ECB on banks under the direct supervision of the ECB.

Figure showing the distribution of inspections and thematic assessments by risk area:

The FIN-FSA publishes summaries of entity-specific inspections1 on its website. The summaries report the key findings of the inspections and thereby provide guidance to a broader group than the subjects of the inspections themselves with regard to the topics on which the supervisor’s inspections are directed on a risk basis as well as the issues on which the supervisor is focusing in inspections related to the topics in question.

As in the past, he FIN-FSA communicates thematic assessments directed at broader groups of supervised entities on a general level in the form of supervision or press releases. The findings of thematic assessments may lead to more detailed investigations or other supervisory actions.

For further information, please contact

Jyri Helenius, Deputy Director General of the FIN-FSA

See also

- Inspection and thematic assessment plan 2026:

- FIN-FSA supervision release 2 January 2025: Financial Supervisory Authority’s priorities in 2025 remain the soundness of supervised entities’ governance and responding to uncertainties in the operating environment – summaries of inspection results to be made available on website

- FIN-FSA supervision release 1 February 2024: Financial Supervisory Authority will focus in 2024 on risk resilience of supervised entities in a changing operating environment and on soundness of governance

- FIN-FSA supervision release 25 January 2023: Supervision focuses on economic uncertainty, cyber security and longterm changes in the operating environment

1Summaries are posted on the website only for inspections carried out at the FIN-FSA’s own initiative, in accordance with the inspection programme. Significant banks for the Eurosystem relevance are under the direct supervision of the ECB with regard to prudential supervision. The FIN-FSA cannot therefore publish anything about these inspections.