Changes to prospectus regulations 2024-2026 - Part 1: Prospectus exemptions

Changes to prospectus regulations significantly expand the opportunities for listed companies to offer securities to the public without a prospectus. The use of prospectus exemptions requires, however, that all regulatory requirements are met. This article is the first in a series of articles in which the FIN-FSA outlines the changes to prospectus regulations.

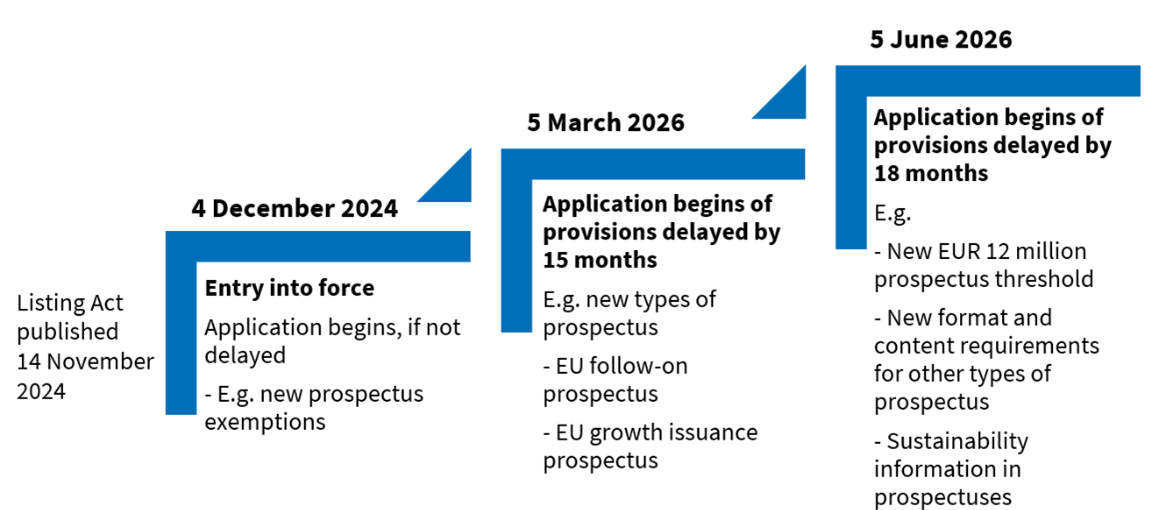

Schedule of changes to prospectus regulations

Prospectus regulations have been eased by the changes introduced by the Listing Act1. The changes will be applied in three phases. Some of the changes, such as new preliminary exemptions, already became applicable on 4 December 2024. Regulations on new types of prospectus, i.e. EU follow-on prospectus and the EU growth issuance prospectus, will become applicable from 5 March 2026. Amended content requirements for other types of prospectus will become applicable from 5 June 2026.

Figure 1 Summary of schedule of changes to prospectus regulations

This article only discusses changes to prospectus exemptions. Prospectus regulations, however, have also changed in other respects through the Listing Act, which entered into force on 4 December 2024. For example, the amendments to Article 16 on risk factors, Article 19 on information incorporated by reference in the prospectus, and Article 23 on supplementation and right of withdrawal have already become applicable.

General information about prospectus exemptions

Prospectus exemptions refer to exemptions from the obligation to prepare a prospectus that would otherwise arise when offering securities to the public or when applying for their admission to trading on a regulated market. In this context, it is worth noting that neither the Prospectus Regulation nor the obligation to publish a prospectus apply to the application for admission to trading of securities on a multilateral trading facility. When listing on the FN list2, for example, a company description is prepared in accordance with the rules of the stock exchange. Even in these situations, an obligation to publish a prospectus may arise if securities are offered to the public.

Prospectus exemptions related to the offering of securities are set out in Article 1(4) of the Prospectus Regulation and exemptions related to admission to trading are set out in Article 1(5). The Listing Act has introduced changes to both paragraphs. The changes significantly expand the opportunities for listed companies (both main list and FN companies) to offer fungible securities to the public and the opportunities for main list companies to apply for the listing of new fungible securities without a prospectus. The use of prospectus exemptions requires, however, that all regulatory requirements are met.

New prospectus exemptions

There follows a discussion of the new prospectus exemptions introduced to the Prospectus Regulation by the Listing Act and of the related document containing the information set out in Annex IX of the Listing Act (“exemption document”).3

New prospectus exemptions for listed companies related to the offering of securities

The exemptions described below related to the offering of securities are new.

The obligation to publish a prospectus does not apply to the following offers of securities to the public:

1. Offering exemption for additional tranches of less than 30%

An offer of securities to be admitted to trading on a regulated market or an SME growth market and that are fungible with securities already admitted to trading on the same market, provided that all of the following conditions are met:

i. the securities represent, over a period of 12 months, less than 30% of the number of securities already admitted to trading on the same market;

ii. the issuer of the securities is not subject to a restructuring or to insolvency proceedings;

iii. a document containing the information set out in Annex IX of the Listing Act (“exemption document”) is filed, in electronic format, with the FIN-FSA and made available at the same time to the public in accordance with the arrangements set out in the regulations.

(Please refer to Article 1(4)(da) of the amended Prospectus Regulation.)

2. Offering exemption for companies listed for at least 18 months

An offer of securities fungible with securities that have been admitted to trading on a regulated market or an SME growth market continuously for at least the 18 months preceding the offer of the new securities, provided that all of the following conditions are met:

i. the securities offered to the public are not issued in connection with a takeover by means of an exchange offer, a merger or a division;

ii. the issuer of the securities is not subject to a restructuring or to insolvency proceedings;

iii. a document containing the information set out in Annex IX of the Listing Act (“exemption document”) is filed, in electronic format, with the FIN-FSA and made available at the same time to the public in accordance with the arrangements set out in the regulations.

(Please refer to Article 1(4)(db) of the amended Prospectus Regulation.)

Amended/new prospectus exemptions related to the admission of securities to trading on a regulated market

The percentage exemptions for a listing have been extended by increasing the amount of an additional tranche from the previous 20% to 30%. The exemption for companies that have been listed for at least 18 months is new.

The obligation to publish a prospectus does not apply to the admission of the following securities to trading on a regulated market:

1. Listing exemption for additional tranches of less than 30%

Securities fungible with securities already admitted to trading on the same regulated market, provided that they represent, over a period of 12 months, less than 30% of the number of securities already admitted to trading on the same regulated market;

(Please refer to Article 1(5)(a) of the amended Prospectus Regulation.)

2. Listing exemption for additional tranches of less than 30% resulting from conversion

Shares resulting from the conversion or exchange of other securities or from the exercise of the rights conferred by other securities, where the resulting shares are of the same class as the shares already admitted to trading on the same regulated market, provided that the said shares represent, over a period of 12 months, less than 30% of the number of shares of the same class already admitted to trading on the same regulated market, subject to the second subparagraph of this paragraph.

(Please refer to Article 1(5)(b) of the amended Prospectus Regulation.)

3. Listing exemption for companies listed for 18 months

Securities fungible with securities that have been admitted to trading on a regulated market continuously for at least the last 18 months before the admission to trading of the new securities, provided that all of the following conditions are met:

i. the securities to be admitted to trading on a regulated market are not issued in connection with a takeover by means of an exchange offer, a merger or a division;

ii. the issuer of the securities is not subject to a restructuring or to insolvency proceedings;

iii. a document containing the information set out in Annex IX of the Listing Act is filed (“exemption document”), in electronic format, with the FIN-FSA and made available at the same time to the public in accordance with the arrangements set out in the regulations.

(Please refer to Article 1(5)(ba) of the amended Prospectus Regulation.)

Table 1. Summary of key new/amended prospectus exemptions

| Amendments to the Prospectus Regulation 1(4) and 1(5) |

Offering |

Offering db) listed for at least 18 months |

Listing a) additional tranche of less than 30% |

Listing |

| Requirement |

Additional tranche of less than 30% |

At least 18 months on the list | Additional tranche of less than 30% | At least 18 months on the list |

| Marketplace | Regulated and growth market | Regulated and growth market | Regulated market | Regulated market |

| Fungible Securities | Yes | Yes | Yes | Yes |

| Right Issues | Yes | Yes | Yes | Yes |

| Merger, division or takeover bid as an exchange offer | Yes | No | Yes | No |

| Company in restructuring or insolvency proceedings | No | No | Yes | No |

| Exemption document | Yes | Yes | - | Yes |

There remain interpretation issues related to the new prospectus exemptions on which the EU Commission is expected to take a position. ESMA is also expected to provide guidance on the application of the regulations. The issues relate, for example, to the scope of application of the exemptions and the content requirements of the exemption document.

Preparation and filing with the FIN-FSA of the exemption document

The exemption document4 must contain the information set out in Annex IX of the Prospectus Regulation. In addition, the following requirements apply to the document:

- The document must have a maximum length of 11 sides of A4-sized paper when printed.

- The document must be presented and laid out in a way that is easy to read, using characters of readable size.

- The document must be drawn up in the official language of the home Member State, or at least one of its official languages, or in another language accepted by the competent authority of that Member State.

The FIN-FSA does not check or approve these exemption documents. Exemption documents are filed, in electronic format, with the FIN-FSA and made available at the same time to the public in accordance with the arrangements set out in the regulations.

For the time being, exemption documents should be submitted to the FIN-FSA’s Registry at registry(at)fiva.fi. When submitting an exemption document, please mention that it is a document pursuant to Annex IX of the Prospectus Regulation.

For further information, please contact

- Marianne Demecs, Chief Supervisor, marianne.demecs(at)fiva.fi or tel. +358 9 183 5366

- Ossi Eräkivi, Chief Specialist, ossi.erakivi(at)fiva.fi or tel. +358 9 183 5262

- Jenni Granlund, Supervisor, jenni.granlund(at)fiva.fi or tel. +358 9 183 5470

- Minna Toiviainen, Senior Supervisor, minna.toiviainen(at)fiva.fi or tel. +358 9 183 5219

- Kirsi Vuorela, Senior Supervisor, kirsi.vuorela(at)fiva.fi or tel. +358 9 183 5399.

1) The Prospectus Regulation has been amended by Regulation 2024/2809 of the European Parliament and of the Council (Listing Act), which entered into force on 4 December 2024.

2) FN list refers to a multilateral trading facility. First North Growth Market is a growth market for small and medium-sized companies registered under the EU Markets in Financial Instruments Directive.

3) The Prospectus Regulation also contains other prospectus exemptions, and some of these involve the obligation to prepare a document required by regulations. The content requirements for such documents differ, however, from the content of the exemption document under Annex IX of the Prospectus Regulation discussed here.

4) Exemption document refers here to the document referred to in Article 1(4), first subparagraph, points (da) and (db) and in Article 1(5), first subparagraph, point (ba) of the Prospectus Regulation.