Volume of uninsured natural disasters is growing

The author Mikko Sinersalo is a risk expert at FIN-FSA Insurance Supervision and he is widely involved in regulatory initiatives on sustainable finance.

Have you ever imagined a world without insurance? Would you dare to have all your possessions in an uninsured home and would you rather not purchase a car if car insurance was not available? And above all, would you be willing to finance projects for which it is impossible to obtain insurance protection against unexpected loss and damage?

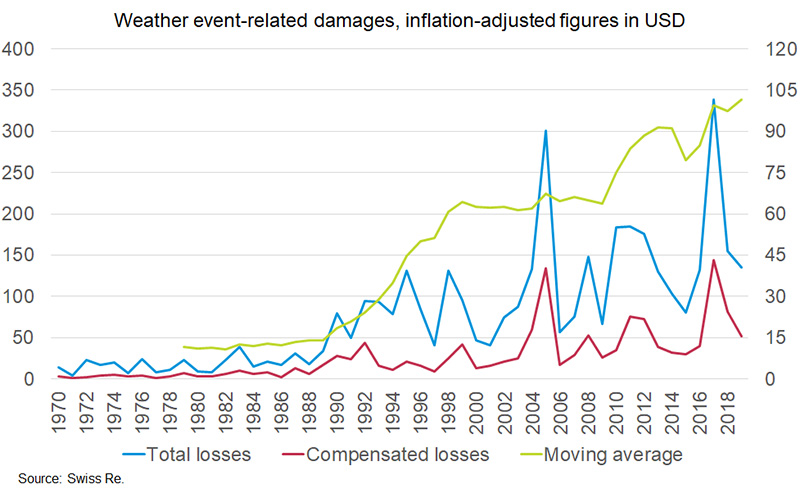

The protection gap is the difference between total losses and insured losses. The larger the difference, the higher the share of loss-induced costs that have to be covered by private citizens, companies and in some cases also governments. Losses caused by natural disasters, in particular, are monitored more closely. In Western countries, insurance coverage of these is nearly 50%, but in the poorest countries it is only some 5%1. For example, the protection gap for weather events has grown at an alarming pace globally, as shown by the graph below. Climate change is expected to fuel this negative trend further.

Next, I will give a concrete example of the economic impact of the protection gap. Let’s assume that there is a plan to build a factory in India and, for logistic purposes, the factory would be located on the coast. The cost of flood-induced loss and damage has risen significantly, however, due to more severe storms as a result of climate change. At the same time, the price of insurance cover for these losses has risen to unsustainable levels. Or maybe these types of policies are no longer provided at all. In any case, it is, in practice, impossible to obtain for the factory financially reasonable insurance against flood-induced loss and damage. How many investors would be willing to invest in a project like this? Is there a bank that would be ready to finance an uninsured factory? In this scenario, the factory would probably not be constructed.

This example shows the importance of insurance activity for the economy, both on the micro- and macro-level. The diversification of unlikely but enormous risks is a key foundation of sound economic activity. If insurance activity ceases, all economic activity will gradually wither. Even profitable innovations will not be implemented.

And how does this affect insurance companies?

For insurance companies, the situation is mixed: as a result of climate change, the demand for and price of insurance cover will increase. On the other hand, natural disaster-related insurance activity may eventually become unprofitable for all the parties concerned. Customers have a certain threshold for insurance costs, and when this threshold is exceeded it is no longer financially possible to take out an insurance policy. As the pricing of insurance policies is already now partially restricted by regulations, in future it will no longer be profitable for insurance companies to offer their products in all situations.

The European Insurance and Occupational Pensions Authority (EIOPA) has been studying2 the effects of the protection gap for a some time now. It is currently developing monitoring tools that will improve supervision. EIOPA’s work understandably focuses, however, on Europe, and therefore the most vulnerable regions, for example some Asian countries and Africa, are excluded from the study. It is easy to predict that Western countries will be able to resolve, for example, the growing flood risks in Miami and the Netherlands, but the ability of the poorest countries to prepare for future risks is much weaker. Today, the global economy is a network of interdependencies and therefore problems in developing countries will eventually also be reflected in Western countries. And this applies not only to the insurance business, because European insurance companies are also exposed to risks in emerging economies via their own investments.

What about the future?

The insurance sector not only plays an important role in risk diversification, but also in the development and use of natural disaster modelling. Insurance companies have the best expertise in the modelling of natural disaster risks. This expertise can be used both in forecasting and minimising inevitable loss and damage. The problem is that natural disaster models are based on historical data, and risks caused by climate change are not reflected in this data. Uncertainties are also increased by future regulatory changes and their impact on climate change and insurance business in general.

In future, insurance companies will not be able to bear this growing burden alone. It is therefore important to improve the overall level of risk management. This will enable both governments and the private sector to prevent the worst losses – is it really necessary to build a factory on that particular river bank? Moreover, they will be able to prepare for risks that will inevitably materialise sometime in the future. Enhancing dialogue between the various parties will be increasingly important in future, and the know-how of insurance companies must be used even more than before. Effective and appropriate pricing of insurance policies benefits society as a whole.

1 In the United States, the protection gap has averaged 46%, whereas in Africa, it has been as large as 91%. Source: Swiss Re.

2 For example, EIOPA Staff Discussion Paper Protection gap for natural catastrophes. EIOPA-19/485 September 2019.