Benchmarks Regulation

The EU Benchmarks Regulation provides for the administration, contributors and use of indices (for example reference rates, foreign exchange rates as well as equity and commodity indices). The purpose of the Regulation is to ensure the accuracy, integrity, reliability and independence of the process of determining benchmarks. The background of the Regulation consists of cases of severe manipulation of benchmarks for interest rates, such as Libor and Euribor, and claims of manipulation of benchmarks for energy, oil and currencies. Failures in, or doubts about, the accuracy and integrity of indices used as benchmarks can undermine market confidence in general, cause losses to consumers and investors and distort the real economy.

Who does the Benchmarks Regulation apply to?

The Benchmarks Regulation concerns the administrators, contributors and users of benchmarks.

Benchmarks subject to the Benchmarks Regulation, according to the definition of the Regulation, comprise indices,

- by reference to which the amount payable under a financial instrument1 or a financial contract2, or the value of a financial instrument, is determined, or

- used to measure the performance of an investment fund3 with the purpose of tracking the return of such index or of defining the asset allocation of a portfolio or of computing the performance fees.

According to the Regulation, an index is any figure

- that is published or made available to the public;

- that is regularly determined:

- entirely or partially by the application of a formula or any other method of calculation, or by an assessment; and

- on the basis of the value of one or more underlying assets or prices, including estimated prices, actual or estimated interest rates, quotes and committed quotes, or other values or surveys;

1 Financial instruments refer to instruments defined in the Investment Services Act, for which a request for admission to trading on a trading venue referred to in the Act on Trading in Financial Instruments has been made or which is traded on a trading venue or via a systematic internaliser.

2 Financial contracts refer to consumer credit contracts.

3 Investment funds refer to UCITS funds under the Act on Common Funds and alternative investment funds (AIFs) under the Act on Alternative Investment Fund Managers.

According to the Regulation, the administrator of a benchmark is the natural or legal person that has control over the provision of a benchmark. The administrator must apply for authorisation or registration by the competent authority (see below). The European Securities and Markets Authority (ESMA) maintains a public register on authorised and registered administrators of benchmarks, which is available on the ESMA website. Administrators are subject to different requirements depending on the type of benchmark.

The Regulation divides benchmarks into the following six different types:

- Critical benchmarks: benchmarks used as a reference for financial instruments or financial contracts or for measuring the performance of investment funds having a total value of at least EUR 500 billion or recognised as being critical in a Member State on grounds provided in the Regulation. The Commission maintains a list of critical benchmarks.

- Significant benchmark: benchmarks used as a reference for financial instruments or financial contracts or for measuring the performance of investments funds having a total average value of at least EUR 50 billion, or having no or very few appropriate market-led substitutes and, in the event that the benchmark ceases to be provided, there would be a significant and adverse impact on market integrity or stability in one or more Member States.

- Commodity benchmarks: benchmarks whose underlying asset is a commodity within the meaning of Commission Regulation (1287/2006) on the implementation of MiFIR. Commodity benchmarks are subject to special requirements in Annex II of the Regulation, unless they are regulated-date benchmarks or a majority of the contributors of the benchmark are supervised entities. Commodity benchmarks are not subject to the provisions of the Regulation on significant and non-significant benchmarks.

- Regulated-data benchmarks: benchmarks determined by the application of a formula from input data contributed from trading venues as defined in the Regulation, such as stock exchanges. Regulated-data benchmarks are not subject to the provisions of the Regulation on critical benchmarks and certain other provisions.

- Interest rate benchmarks: benchmarks determined on the basis of the rate at which banks may lend to, or borrow from, other banks, or agents other than banks, in the money market. Interest rate benchmarks are subject to the specific requirements of Annex I of the Regulation and not subject to provisions on significant and non-significant benchmarks.

- Non-significant benchmarks: benchmarks used as a reference for financial instruments or contracts or for measuring the performance of investments funds having a total average value of at less than EUR 50 billion, provided that they are not commodity or interest rate benchmarks.

- EU Climate Transition Benchmarks: benchmarks which are labelled as EU Climate Transition Benchmarks and which fulfil the other requirements of the Regulation.

- EU Paris-aligned Benchmarks: benchmarks which are labelled as EU Paris-aligned Benchmarks and which fulfil the other requirements of the Regulation

Contributors as defined in the Regulation mean natural or legal persons contributing input data to administrators for the determination of a benchmark. Contributors which are supervised entities are subject to certain requirements laid down in the Regulation concerning governance and control. The Regulation regulates other contributors than supervised entities indirectly through requirements concerning code of conduct.

In accordance with the Regulation, supervised entities include credit institutions, other consumer lenders, investment firms, life, non-life and reinsurance companies, investment funds and their management companies, alternative investment fund managers and institutions for occupational retirement provision (for more detail, see Article 3(1)(17).

The use of a benchmark means, in accordance with the Regulation

- issuance of a financial instrument which references an index or a combination of indices;

- determination of the amount payable under a financial instrument or a financial contract by referencing an index or a combination of indices;

- being a party to a financial contract which references an index or a combination of indices;

- determining a consumer credit interest rate calculated as a spread or mark-up over an index or a combination of indices and that is solely used as a reference in a financial contract to which the creditor is a party;

- measuring the performance of an investment fund through an index or a combination of indices for the purpose of tracking the return of such index or combination of indices, of defining the asset allocation of a portfolio, or of computing the performance fees. According to ESMA's interpretation, however, the mere comparison of an investment fund's return to the return of an index or a combination of indices does not constitute the use of a benchmark.

Supervised entities (see above) may not, after the transition period, use indices which are benchmarks under the Regulation, unless the administrator of the benchmark is included in the ESMA register. This prohibition also applies to indices from third, non-EU countries. Supervised entities using a benchmark must also have a continuity plan in place for the event that the benchmark changes materially or its provision ends, and it must and shall reflect this plan in the contractual relationship with clients.

Information provided on consumer credit contracts within the scope of application of the Regulation shall indicate the name of the benchmark and its administrator as well as the potential impacts of the use of the benchmark on the consumer.

Where the object of a prospectus to be published under the Securities Markets Act or Act on Common Funds is transferable securities or other investment products that reference a benchmark, the issuer, offeror, or person asking for admission to trade on a regulated market shall ensure that the prospectus also includes clear and prominent information stating whether the benchmark is provided by an administrator included in the ESMA register.

Authorisation and registration of an administrator of benchmarks

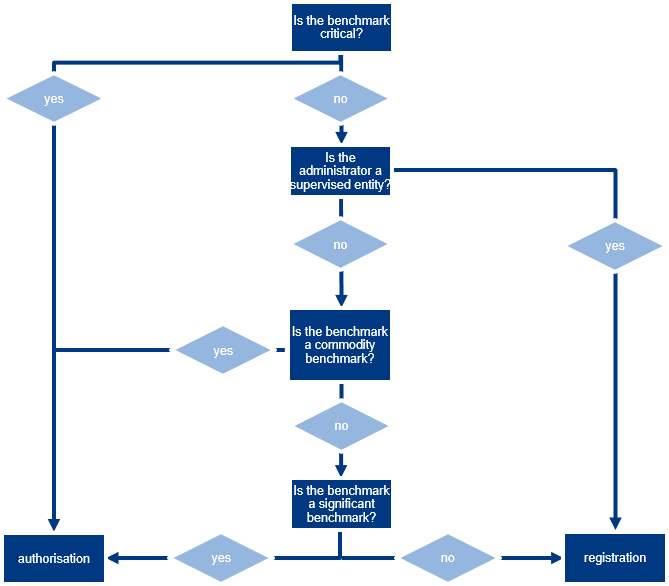

Benchmark providers based in an EU member state must either have an authorisation or be registered. The following chart indicates in a nutshell, which requirement is applicable.

Benchmarks from third countries

Supervised entities within the EU may use benchmarks whose administrators are from third countries, that is, outside the EU, only if the benchmark and its administrator are included in the register maintained by ESMA. There are three ways of ensuring this:

- equivalence, meaning that the administrator of a benchmark is from such a third country where the regulation of administrators has been found equivalent to the Benchmarks Regulation by a decision of the Commission and the administrator notifies its approval to ESMA for the use of the benchmark in the EU

- recognition, meaning that a third-country benchmark administrator obtains an advance recognition from the competent authority of the member state of reference and meets the requirements of the Regulation

- approval, meaning that an administrator authorised and located in the EU or a supervised entity located in the Union with a clear and well-defined role within the control or accountability framework of a third country administrator, which is able to monitor effectively the provision of a benchmark, applies for the relevant competent authority to endorse a benchmark provided in a third country for their use in the EU subject to certain prerequisites provided in the Regulation.

The Benchmarks Regulation is directly applicable regulation in the Member States.

The Regulation entered into force on 30 June 2016 but, excluding certain exemptions on critical benchmarks, it was not applicable until 1 January 2018.

Administrators located in the EU that provided benchmarks already before 30 June 2016 may continue the provision of benchmarks without authorisation or registration under the transitional provisions until 1 January 2020 or, if the benchmark is a critical benchmark, until 31 December 2021. Supervised entities may also continue the use of benchmarks until the end of the transition periods. In accordance with ESMA's interpretation, the same also applies to administrators that begin the provision of benchmarks after 30 June 2016 but before 1 January 2018, but not to new benchmarks provided by them after 1 January 2018.

According to ESMA's interpretation, such benchmarks provided by an administrator located in a third country that are not included in the ESMA register may also be used by supervised entities until 31 December 2023, but thereafter only if the reference to such a benchmark for the financial instrument or contract or the measurement of performance of an investment fund is concerned with the period before 31 December 2023.

Supervised entities must have continuity plans required by the Regulation in place from 1 January 2018, and subsequently they must also be referred to in new client contracts. According to ESMA's interpretation, supervised entities must also do their best to seek to align client contracts concluded before 1 January 2018 with the Regulation wherever practicable.

Securities prospectuses approved before 1 January 2018 do not need to be updated and aligned with the requirements of the Benchmarks Regulation. In contrast, fund prospectuses approved before 1 January 2018 must be updated and aligned with the requirements of the Regulation was soon as possible and at the latest by the end of 2018.

The requirements of the Regulation concerning consumer credit contracts also took effect in Finland on 1 January 2018.

Regulation (EU) 2016/1011, of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds and amending Directives 2008/48/EC and 2014/17/EU and Regulation (EU) No 596/2014 (Benchmarks Regulation, in some sources also Benchmark Regulation)

Delegated regulations and implemented regulations provided by virtue of the Benchmarks Regulation (link to the EU Commission's website)

ESMA Q&A on the Benchmark Regulation

HE 151/2017 Government proposal to the Parliament on Acts amending the Investment Firms Act and Act on Trading in Financial Instruments, and on certain related Acts (in Finnish)

See also