Owner control

The significant owners of the supervised entities of the Financial Supervisory Authority (FIN-FSA) must be fit and proper in accordance with financial market regulations.

The fitness and propriety of significant owners is regulated by legislation on credit institutions, investment firms, management companies, alternative fund managers, financial and insurance conglomerates, payment institutions, the stock exchange, the central securities depository, insurance companies and crowdfunding providers. See also further information under the subheading Regulation.

When assessing fitness and propriety, the criminal and fine register extracts, among other things, of the proposed acquirer are checked, as is the information that the proposed acquirer submits to the FIN-FSA in the owner control notification. The FIN-FSA assesses whether the proposed acquirer has, in their previously activities, been shown to be manifestly unsuitable to own a supervised entity.

The FIN-FSA assesses the fitness and propriety of the significant owners of supervised entities particularly in two situations:

- When granting authorisation or registration

- Upon receipt of notification of acquisition or transfer of shares.

As regards credit institutions, the fitness and propriety of significant owners are assessed in cooperation with the European Central Bank.

In addition, the fitness and propriety of the supervised significant owners of supervised entities is also assessed in ongoing supervision, and supervised entities are also obliged to notify the FIN-FSA at least once a year of the owners and sizes of holdings that fulfil the legal limits and to notify without delay any changes in the holdings that have come to their knowledge.

A significant owner is a person who directly or indirectly owns at least 10% of the share capital or of the voting rights conferred by shares. In addition to the 10% limit, the FIN-FSA also monitors the fitness and propriety of the proposed acquirer where there is an intention to increase a holding so that the person in question directly or indirectly owns at least 20, 30 or 50% of the share capital or voting rights. By way of derogation from the above, the owners of crowdfunding service providers are subject to only a 20% limit.

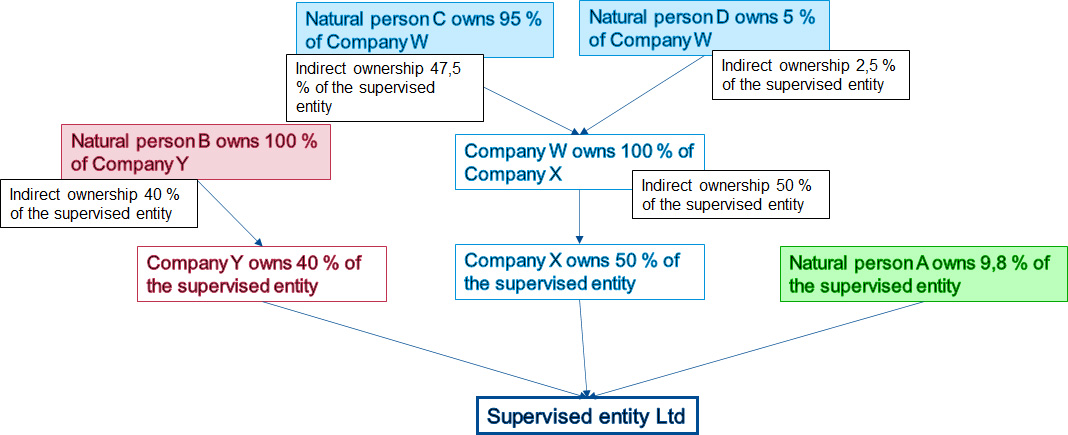

Indirect ownership refers to a situation where control is exercised through another entity. A person may be the indirect owner of a supervised entity where, for example, company Y owns 40% of a supervised entity and the person owns 100% of company Y. In that case, the person is the indirect owner of the supervised entity and the indirect holding is 40%, which must be reported to the FIN-FSA as a holding exceeding the 30% limit. The size of the indirect holding is determined by multiplying the holdings in the ownership chain.

Anyone who intends to acquire, directly or indirectly, a significant holding in a supervised entity must notify the FIN-FSA of this in advance.

The proposed acquirer shall give notice of their intention to acquire a holding that exceeds 10, 20, 30 or 50% of the share capital or of the voting rights conferred by shares.

The obligation to notify also applies to the transfer or reduction of ownership below the 10, 20, 30 or 50% limits.

The obligation to notify applies to all change situations in which a person exceeds or falls below the above-mentioned percentage limits. The obligation to notify also applies to situations where a company becomes a subsidiary or ceases to be a subsidiary.

By way of derogation from the above, in the case of crowdfunding providers and electronic money institutions the proposed acquirer shall notify their intention to acquire a holding of at least 20% of the share capital or of the voting rights conferred by shares of a crowdfunding service provider or electronic money institution as well as a reduction of ownership below 20%.

As regards entities other than credit institution, the notification is made using the forms available on the FIN-FSA’s website. Legal persons shall complete the Legal person notification form and, if necessary, in the case of indirect ownership, the Natural person notification form and the Target company notification form. Natural persons shall complete the Natural person notification form and the Target company notification form.

Notifications concerning acquisitions of qualifying holdings in credit institutions are made in the ECB’s IMAS Portal: IMAS Portal.

Notifications from other entities are to be submitted by email to kirjaamo(at)fiva.fi.

In the example in the image above, the following forms should be completed:

Company Y: Target company notification form and Legal person notification form

Natural person B: Natural person notification form (the Target company notification form is submitted by company Y)

Company X: Target company notification form and Legal person notification form

Company W: Legal person notification form (the Target company notification form is submitted by company X)

Natural person C: Natural person notification form (the Target company notification form is submitted by company X)

The procedures provided for in the Act on the Financial Supervisory Authority shall apply to the processing of a notification regarding the acquisition of a holding.

The FIN-FSA shall confirm its receipt of the notification without delay, no later than on the second weekday after its receipt of the notification. The confirmation shall indicate whether the notification contains the required clarifications or whether the notification must be supplemented before it is accepted by the FIN-FSA for processing.

Upon receipt of a notification regarding the acquisition of a holding, the FIN-FSA may prohibit the acquisition of the holding where ownership of the holding would jeopardise the operation of the target company or entity in accordance with sound and prudent business principles or, if the target company is an insurance company, the insured interests, on the grounds that there is justifiable cause to suspect that:

- the reputation of the entity subject to the notification requirement is compromised or its financial position is inadequate;

- the fitness and propriety of the management of the target company or entity, or other authorisation criteria, would be jeopardised by the acquisition;

- the capital adequacy or solvency or supervision of the target company or entity and related information sharing between the authorities would be jeopardised by the acquisition; or

- the acquisition is related to money laundering or the financing of terrorism.

The FIN-FSA shall make a decision on the acquisition of a holding within 60 weekdays after it has confirmed that it has received all the required information (processing time). The FIN-FSA may make a written request for any specific necessary additional information during ongoing processing, but not later than on the 50th weekday after the start of processing. A request for additional information will interrupt the processing period until such time as the requested additional information has been received, but for no longer than 20 weekdays.

The FIN-FSA shall notify the proposed acquirer if the FIN-FSA does not object to the acquisition. The proposed acquirer may then complete the acquisition. The FIN-FSA requests that it be notified of the completion or cancellation of an acquisition by a free-form notification to the FIN-FSA Registry.

When an acquisition is not approved, the FIN-FSA shall issue a negative appealable decision in the case. A negative decision shall be preceded by a consultation procedure.

As regards credit institutions, the fitness and propriety of significant owners are assessed in cooperation with the European Central Bank. The decision on a matter concerning the acquisition of a qualifying holding is made by the European Central Bank.

Acquisitions of significant holding are regulated by:

- chapter 3, section 1 of the Act on Credit Institutions

- Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions

- Regulation (EU) No 468/2014 of the European Central Bank establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (SSM Framework Regulation)

- chapter 6a, section 1 of the Act on Investment Services

- chapter 4, section 7 of the Act on Common Funds

- chapter 7, section 9 or chapter 14, section 9 of the Act on Alternative Investment Fund Managers

- section 11 on the Act on the Supervision of Financial and Insurance Conglomerates

- section 21a or 21c of the Act on Payment Institutions

- chapter 2, section 11 of the Act on Trading in Financial Instruments

- the EU Central Securities Depository Regulation or

- chapter 4, section 5 of the Insurance Companies Act

- Article 12, paragraph 3, subparagraph a) of the EU Crowdfunding Regulation1

The right of the FIN-FSA to prohibit the acquisition of a qualifying holding in a supervised entity is provided for in sections 32a and 32b of the Act on the Financial Supervisory Authority (878/2008). The FIN-FSA has the right to restrict the exercise of rights based on shares and participations in certain situations specified in section 32 c of the aforementioned Act for a maximum of one year at a time.

The FIN-FSA recommends compliance with the joint guideline of the European Supervisory Authorities (ESAs): “Joint Guidelines on the prudential assessment of acquisitions and increases of qualifying holdings in the financial sector (JC/GL/2016/01 EN)”. The objective of the guidelines is to specify clear and transparent procedures and criteria for the prudential assessment by the competent authorities of the proposed acquisition or increase of qualifying holdings in the financial sector.

See also

Q&A Owner control and Fit & Proper for Alternative investment fund managers (see tab in question)

Forms on Reporting section

1 See also Government proposal 228/2021 and the proposed Act on the Provision of Crowdfunding Services. Chapter 3 of the proposed Act deals with the acquisition and disposal, and the prohibition thereof, of a significant holding or voting right.