State of financial markets

In the review year, significant changes occurred in the operating environment of the financial sector. Russia’s invasion of Ukraine led to a rise in energy prices and rapid acceleration of inflation to levels not seen in several decades. As a result, many central banks globally began to tighten monetary policy, ending a protracted period of expansionary policies. Central banks increased policy rates several times and announced a gradual termination of various purchase programmes. In addition to the uncertainty about the supply of energy, other COVID-induced production bottlenecks also weighed on consumer confidence and undermined companies’ prospects. Economic growth weakened and, towards the end of the review year, the threat of a recession loomed over the economy.

The change in monetary policy, continuation of the COVID crisis and uncertainty caused by Russia’s war of aggression led to a steep rise in interest rates and a deterioration of general risk sentiment. The uncertainty of the financial markets was evident in, among other things, tightening financing conditions and changes in the valuation of financial market instruments. For example, the yields on 10-year euro area government bonds and particularly the credit risk premia (so-called CDS) on high-risk corporate credit rose. At the same time, stock indices tracking the development of equity prices in major economic areas declined. The rising energy prices and cost of living added to concerns about, among other things, the sustainability of the debt of households, housing companies, non-financial corporations and governments.

Economic growth also weakened in Finland in the review year, although the situation for companies and investments remained reasonable. The cyclical turn was visible, however, in various confidence indicators. Companies’ and consumers’ confidence in the economy sunk to the lowest level on record. Towards the end of the review year, the prices of old flats declined, new drawdowns of housing loans fell short of the previous years’ levels, and the number of home sales decreased. In addition, residential construction decreased as the number of new construction projects and building permits declined. Household indebtedness continued to rise as debt grew faster than income.

Considerable uncertainty continues to overshadow economic development. All of the effects of the deterioration of the operating environment on the various sectors of the economy or the behaviour of households and companies are not yet visible.

In the longer haul, financial sector participants will be challenged by, in addition to the unstable economic operating environment, long-term trends such as the impacts of climate change (ESG risks1) and their countermeasures, demographic changes, digitalisation, new technologies, products and ways of operating (e.g. cloud services and cryptocurrencies) as well as cyber risks.

Capital position of the banking sector remained strong – growth of net interest income boosted profits

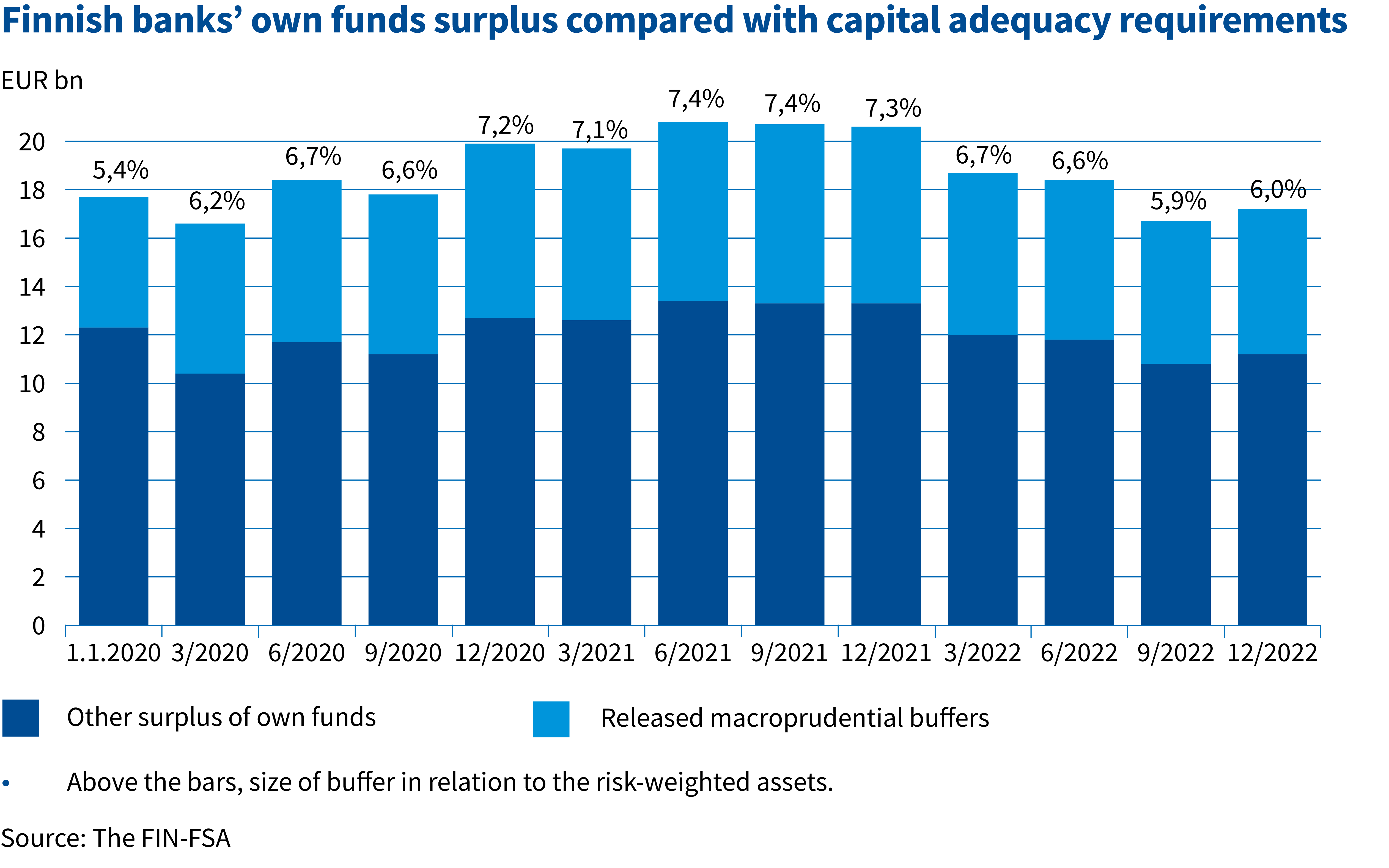

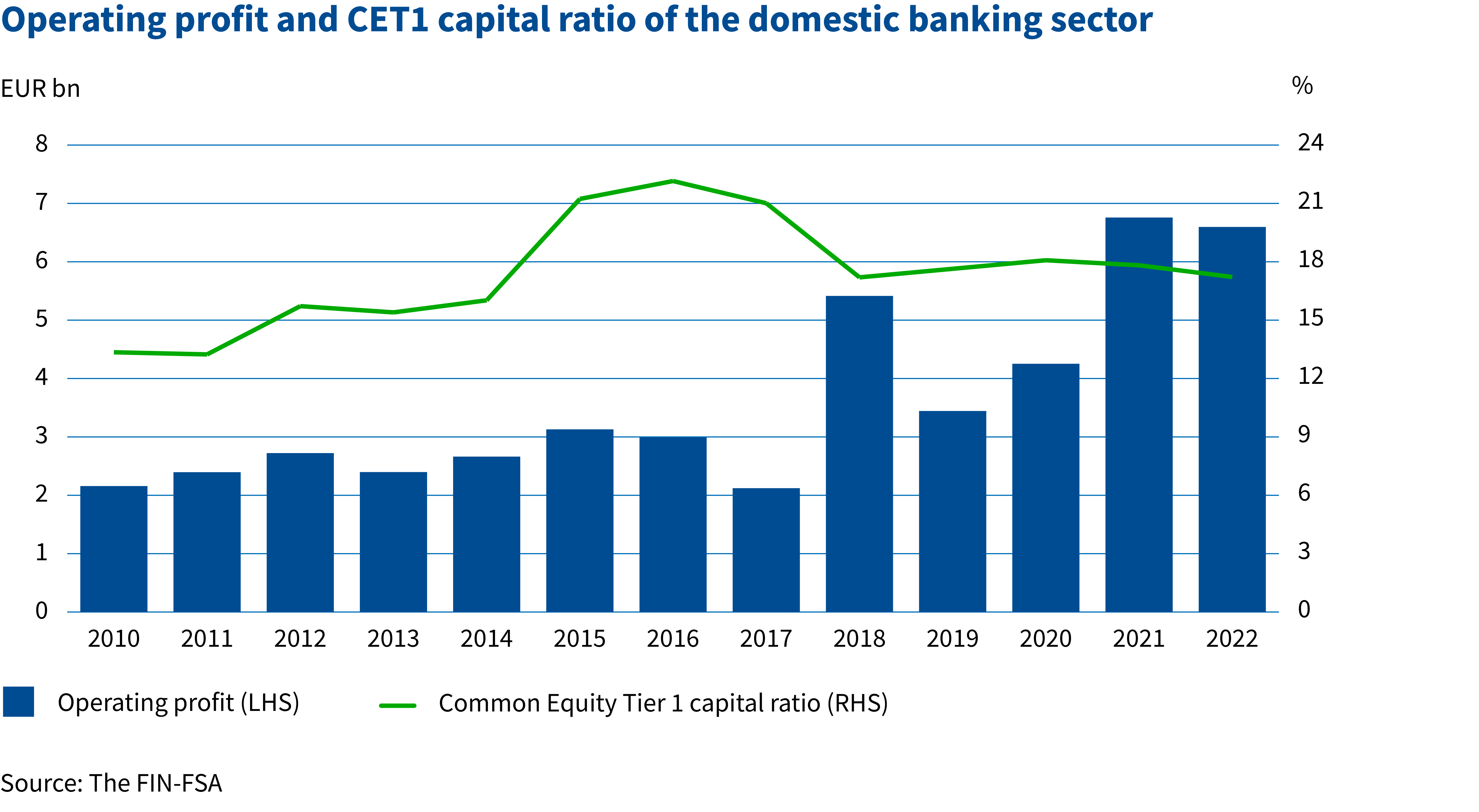

The capital ratios of the banking sector weakened slightly during the review year. This was primarily due to profit distribution, which reduced own funds. On the other hand, profit for the period accumulated own funds, and there were no significant changes in the amount of risk-weighted assets. Despite the reduction in own funds surplus relative to capital requirements, the banking sector continued to have ample capital relative to the requirements. The capital ratios remained higher than the European average in the review year.

The profit of the banking sector fell short of the previous year’s level. The uncertain market situation was reflected in securities-related income items. On the other hand, the increase in the interest rate level strengthened net interest income, and its share of total revenues continued to rise. Impairments remained at a moderate level, and there were no significant signs of weakening in the quality of the credit stock. In the review year, the banking sector’s non-performing assets relative to credit stock remained among the lowest in Europe.

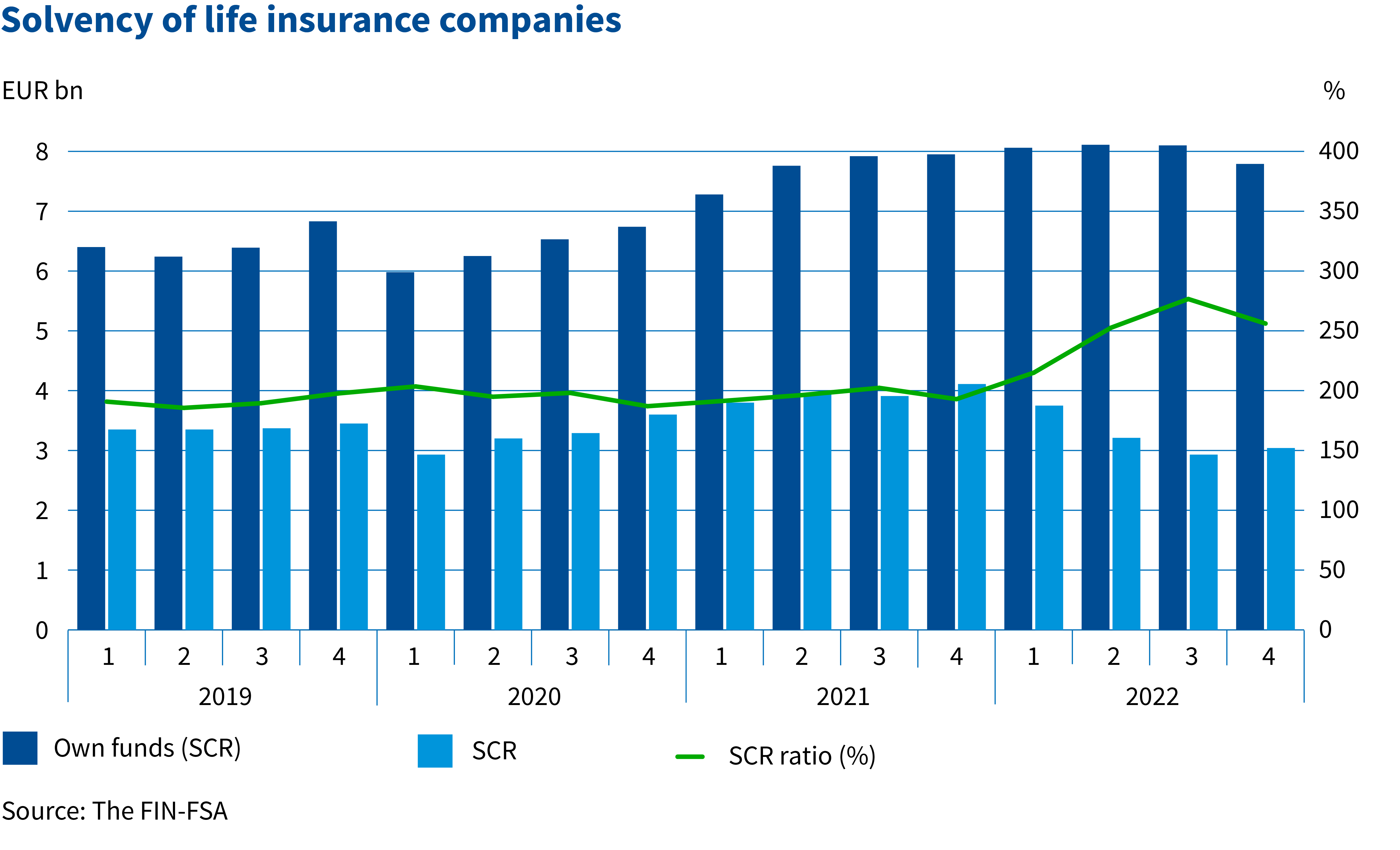

Life insurance companies’ solvency strengthened but profitability weakened

The solvency ratio of the life insurance sector improved considerably in 2022 as a combined result of the rise in interest rates and depreciation of investments. The solvency capital requirement (SCR) declined significantly from the previous year. At the same time, the own funds of the companies decreased slightly. Despite the strengthening of the solvency ratio, the excess of assets over liabilities of the life insurance sector remained at the same level.

Life insurance companies’ investments made a clear loss, but equity investments recovered slightly towards the end of the year. Real estate investments made a solid return during the year, although returns declined in the last quarter.

Premium income on life policies decreased and claims paid increased in 2022. High inflation and the loss-making investment market had a negative impact on the sale of investment insurance policies. Risk insurance policies continued to show stable growth.

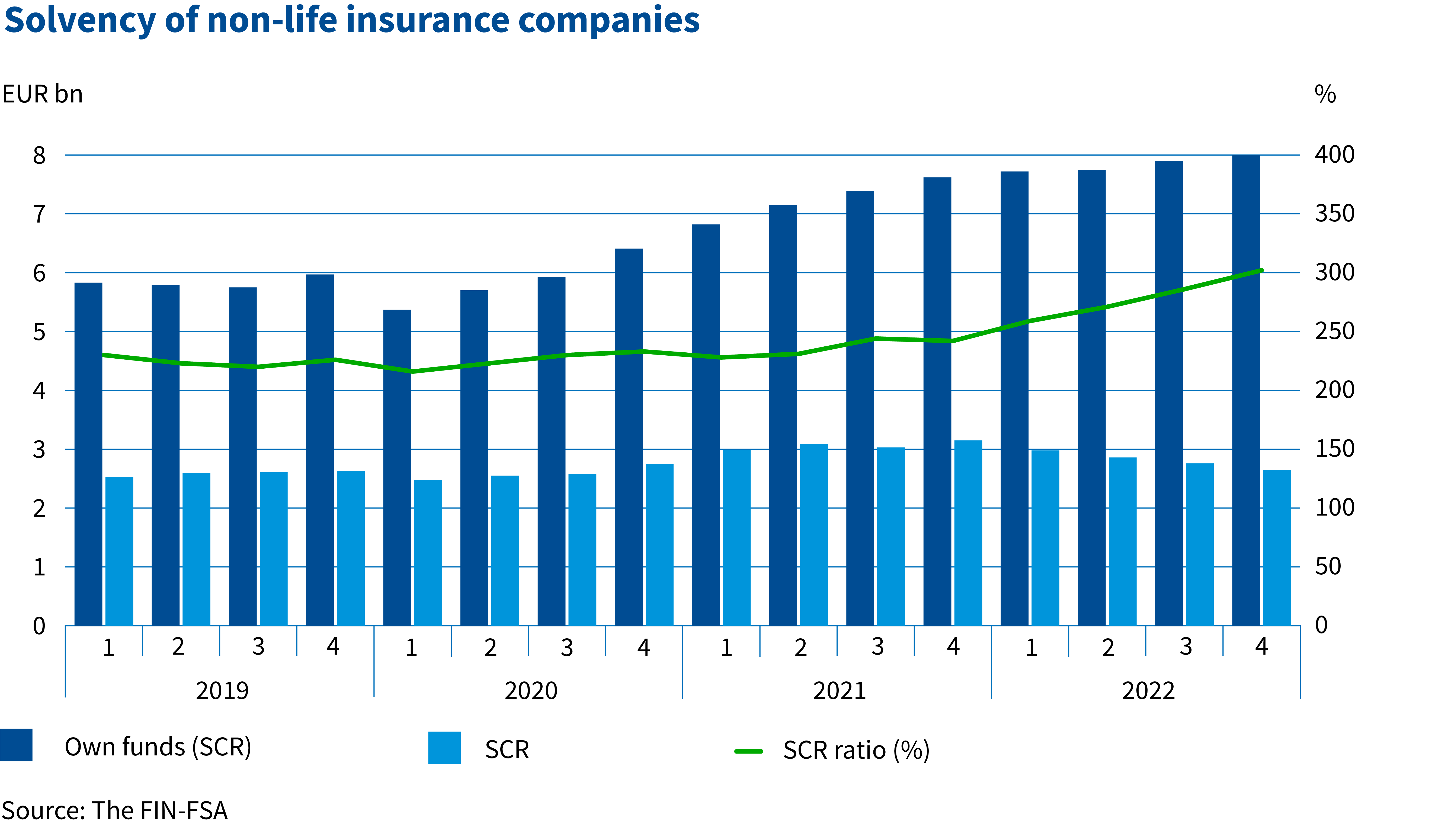

Rise in interest rates strengthened non-life insurance companies’ solvency

The solvency ratio of the non-life insurance sector strengthened significantly during the year, although the investments made a loss. Solvency was strengthened both by the growth of own funds and the decline of the solvency capital requirement. Own funds were increased by the decrease, due to the steep rise in interest rates, of the market value of insurance liabilities to their lowest level during the Solvency II regulation that started in 2016. Solvency was also strengthened because the decrease of the market value of equities and insurance liabilities reduced the capital requirement.

Investment returns were negative. Due to the steep increase in the level of interest rates and the decline in equity market values, both of these asset classes made a loss, and only real estate investments had a positive return.

Growth of claims expenses weakened the result of the insurance business. There has been a shift from fully remote work during the pandemic to hybrid work, and the increase in mobility has raised the claims expenses on vehicle insurance and the number of occupational accidents. Major claims increased the claims expenses of property insurance and business interruption insurance. The profitability key ratio, the combined ratio excluding the effect of changes in reserving bases, weakened from its the above-average level at the end of 2021.

Value of investment assets decreased, reducing solvency of employee pension insurance sector

The investment returns of the employee pension insurance sector were negative except for the last quarter, reflecting the general development of the financial markets. The solvency ratio of the employee pension sector weakened as the value of investment assets decreased. The value of investment assets was affected in particular by the negative performance of listed equities and bonds. The return on illiquid investments, such as real estate, was positive, balancing the total return performance. The risk-based solvency position deteriorated as solvency capital, impaired by the loss of investment operations, declined relative to the solvency limit. The change in the solvency position was cushioned by the reduction in the solvency limit due to changes in the amount and level of risk of investment assets.

The wage bill of the employee pension insurance sector grew from the previous year.

FIN-FSA-related topics most visible in the media

1. Housing loans

2. Russia and cybersecurity

3. Self-employed Persons’ Pensions Act (YEL)

4. FIN-FSA organisation

5. Sanctions

1 OECD = Organisation for Economic Co-operation and Development.