State of financial markets

In the fixed-income and equity markets, the review year was exceptional. Government bond yields fell to record lows and largely sunk to negative levels up to the end of September. During the autumn, interest rates rose slightly, and at the end of the year the yield of the Finnish ten-year government bond, for example, was close to zero. On the other hand, equity prices rose significantly during the year, and almost all of the main indices rose. Investors were looking for return opportunities in equities, and corporate earnings development remained favourable. All in all, the performance of fixed-income and equities meant good return opportunities but, due to elevated valuations, also increased risks.

The prospects of the international economy remained uncertain. The uncertainty reflected, in particular, the prolonged two-year trade war and tariff tensions between the United States and China as well uncertainties related to United Kingdom’s withdrawal from the EU. Towards the end of the year, the uncertainty eased slightly as preliminary agreements were reached both in the trade dispute and in the Brexit process.

The stimulative policies pursued by central banks supported the returns on government bonds and equities, as interest rates and interest rate expectations fell. In the euro area, the European Central Bank restarted securities purchases in November after a break of almost a year. In the United States, the Federal Reserve cut its policy rate three times.

Economic growth forecasts for both Finland and the global economy were downgraded. A key reason was the estimated impact of uncertainty on trade, investments and consumption. The upswing of the Finnish economy passed, but even so growth remained moderate.

Household indebtedness remained at a historically high level. In the Finnish housing market, the gap between prices in large cities and other regions continued to widen. Construction volume began to decline during the year, reflecting deteriorating cyclical momentum.

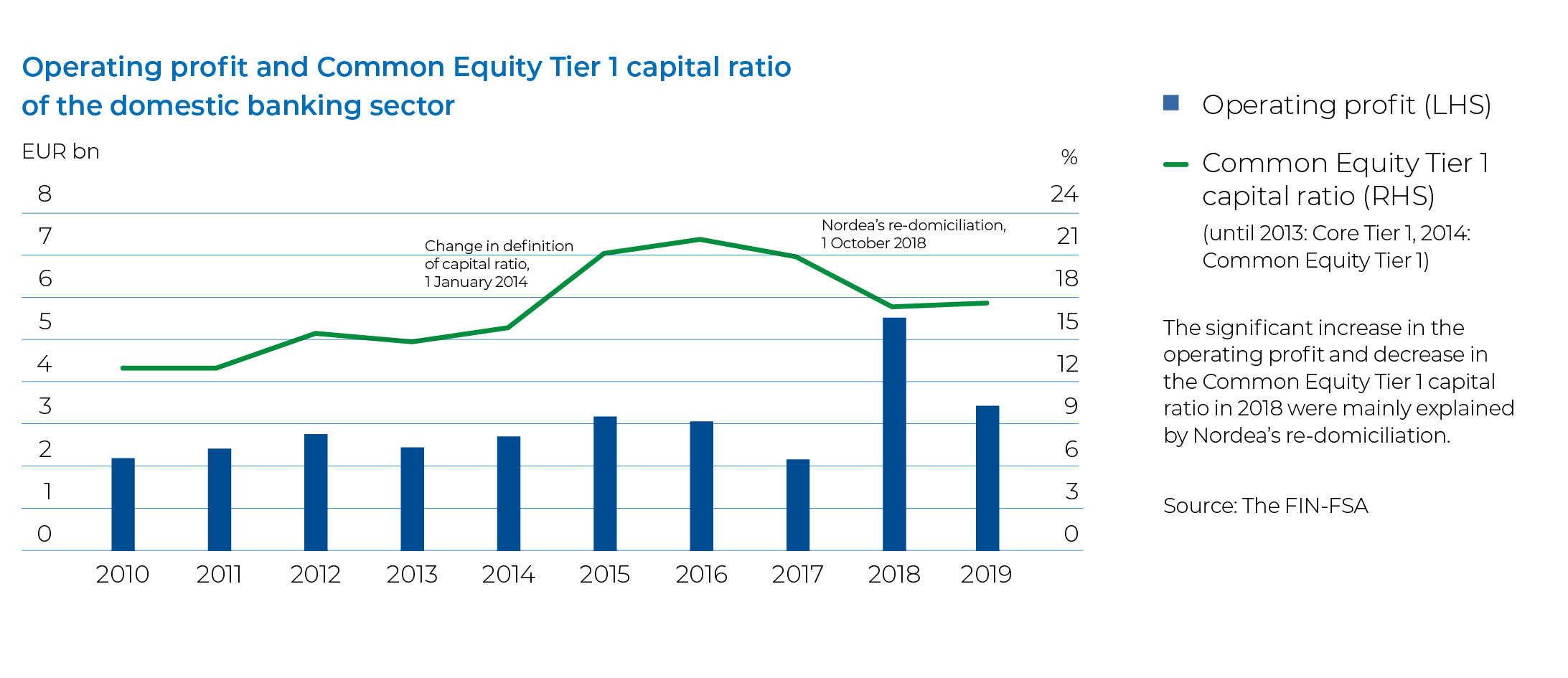

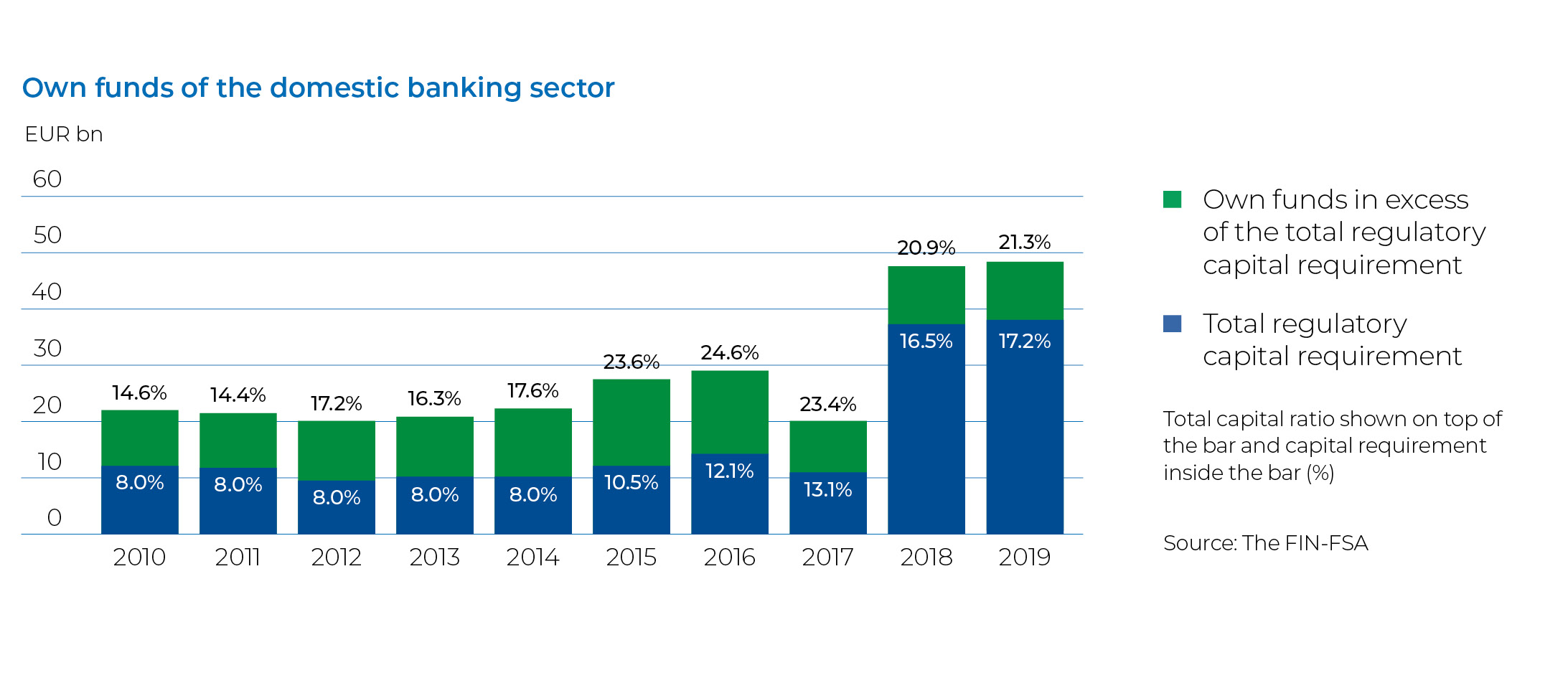

Capital ratios of the banking sector strengthened and remained above the European average – non recurring expense items reduced the operating profit of the banking sector

Risks in the operating environment of Finnish banks increased in the review year. This was due to elevated risks related to international economic development and reduced confidence among domestic companies and households. Despite the economic uncertainty, the capital adequacy of the Finnish banking sector and the quality of the credit stock remained strong. The risk-weighted capital ratios of the Finnish banking sector strengthened and remained above the European average. The non-risk-weighted leverage ratio also strengthened slightly and was higher than the average level for banks within the EU area. Finnish banks’ non-performing loans remained low in the review year. The level of non-performing loans in Finland is among the lowest in Europe.

The operating profit of the banking sector declined compared with the previous year. The result of the banking sector was burdened particularly by one-time depreciations and impairments. Net interest income increased slightly from the level of the previous year, as growth of the credit stock levelled off the negative impact of declining market rates and margins on interest income. The decline of operating profit was also cushioned to some extent by a decrease in personnel costs.

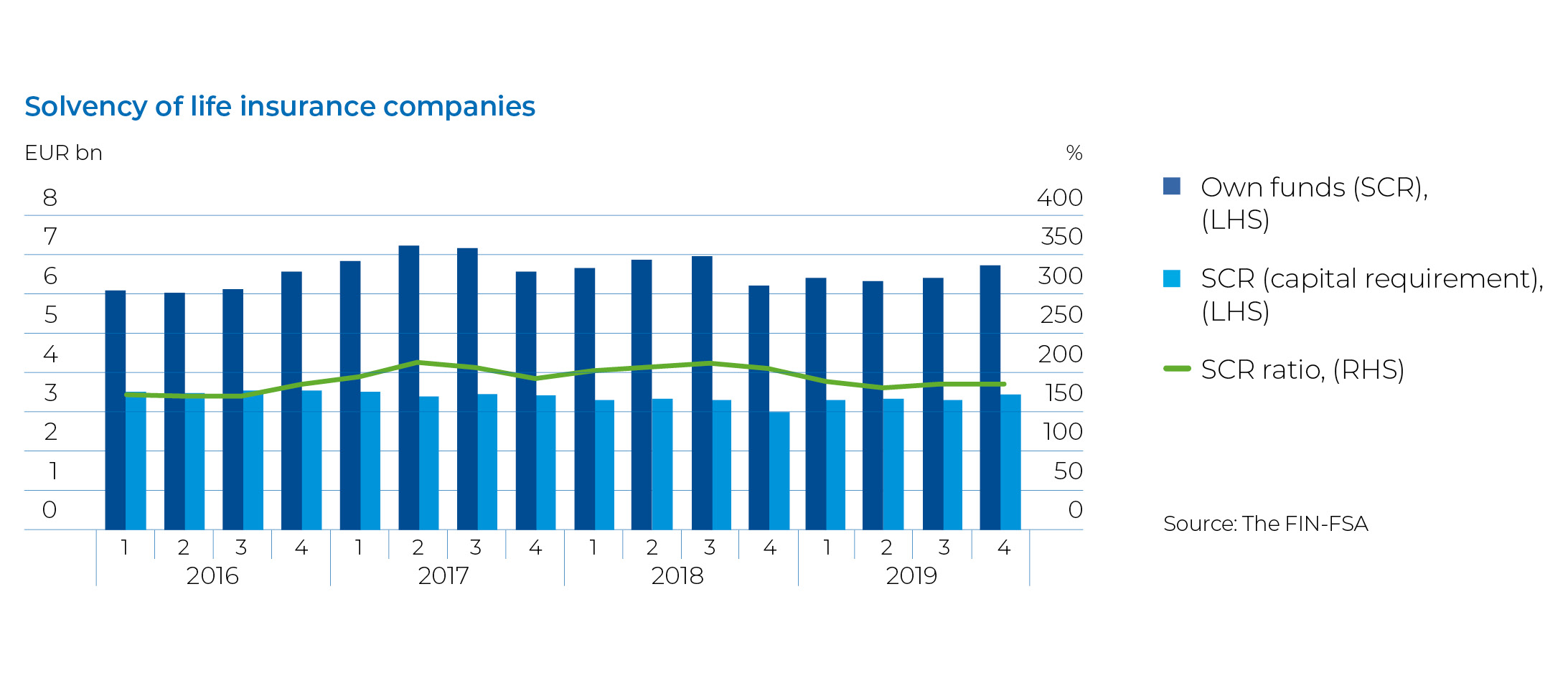

Life insurance companies’ solvency deteriorated from the previous year

The solvency ratio of the life insurance sector contracted in the review year but remained at a good level. The deterioration mainly reflected a rise in the solvency capital requirement. An addition of Tier 2 capital, however, reduced the negative impact and therefore the reduction in the solvency ratio remained smaller than expected.

Insurance companies’ investments made good returns during the year and fixed-income and equity investments, in particular, generated above-average returns. In contrast, the performance of the insurance business was unfavourable. Claims paid in direct insurance grew steeply and clearly exceeded insurance premiums. Net premiums written have indeed been negative throughout the review year. The capital redemption contract remained the most popular life insurance product.

In life assurance operations, customer behaviour was affected by changes in the operating environment that took effect at the turn of 2019–2020. The amount of policy redemptions increased as the tax treatment of investment policies changed. However, a majority of the redeemed funds was reinvested in new insurance policies.

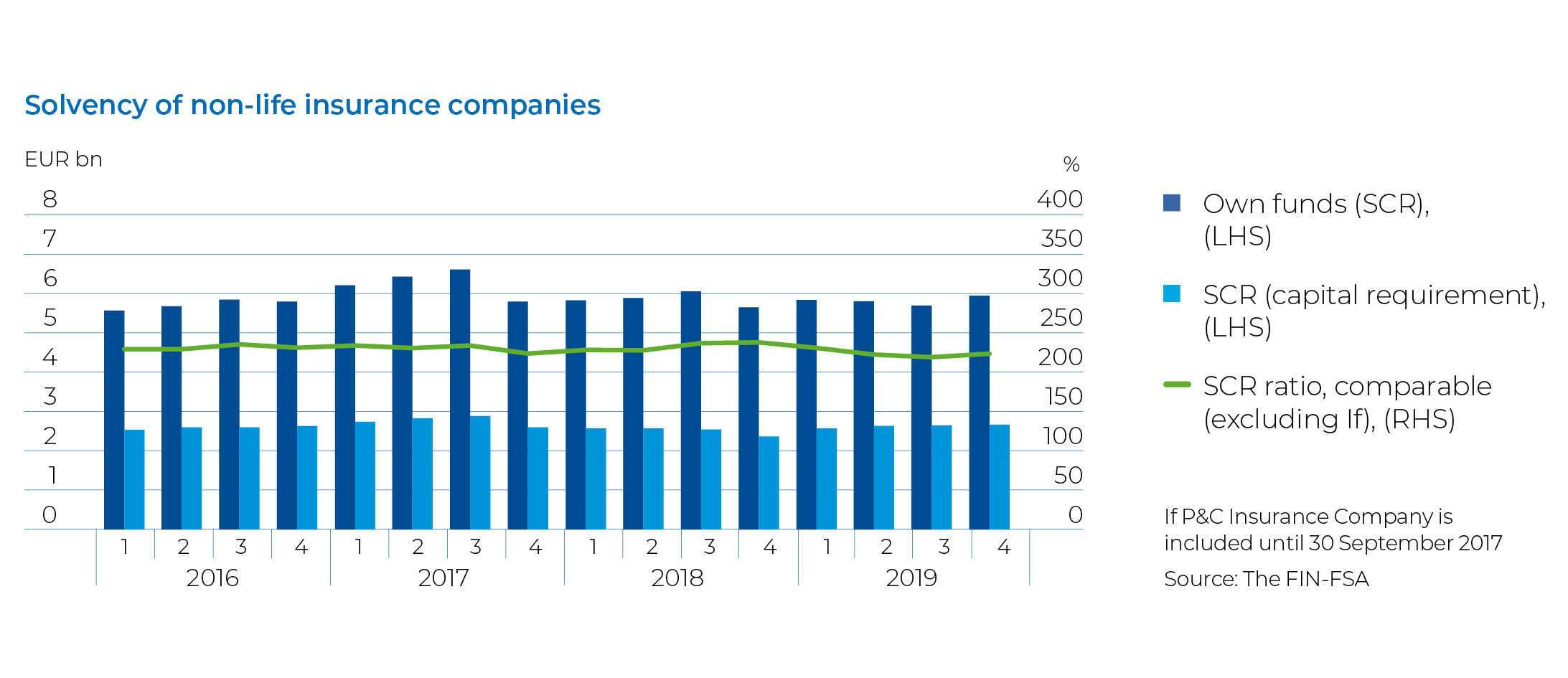

Fall in interest rates and appreciation of equity investments weakened insurance companies’ solvency

The solvency of non-life insurance companies remained solid in the review year, although it weakened from the record level of end-2018. The deterioration reflected the increase of solvency capital requirement due to the rise in equity prices. In addition, growth of own funds was sluggish as the negative impact of insurance liabilities offset the positive impact of investment market performance on own funds.

Insurance companies’ income mainly stemmed from investment income. In contrast, no margin was accrued from the insurance business. Profitability was undermined by unfavourable claims development. In addition, profitability weakened in the second half of the year as companies increased the prudence of technical provisions in accounting by reducing their applicable discount rates.

The growth in comparable premium income that began in 2018 accelerated. This stemmed partly from vehicle insurance and partly from workers´ compensation insurance. In addition, the brisk growth in health insurance continued.

Pension funds grew stably during the year

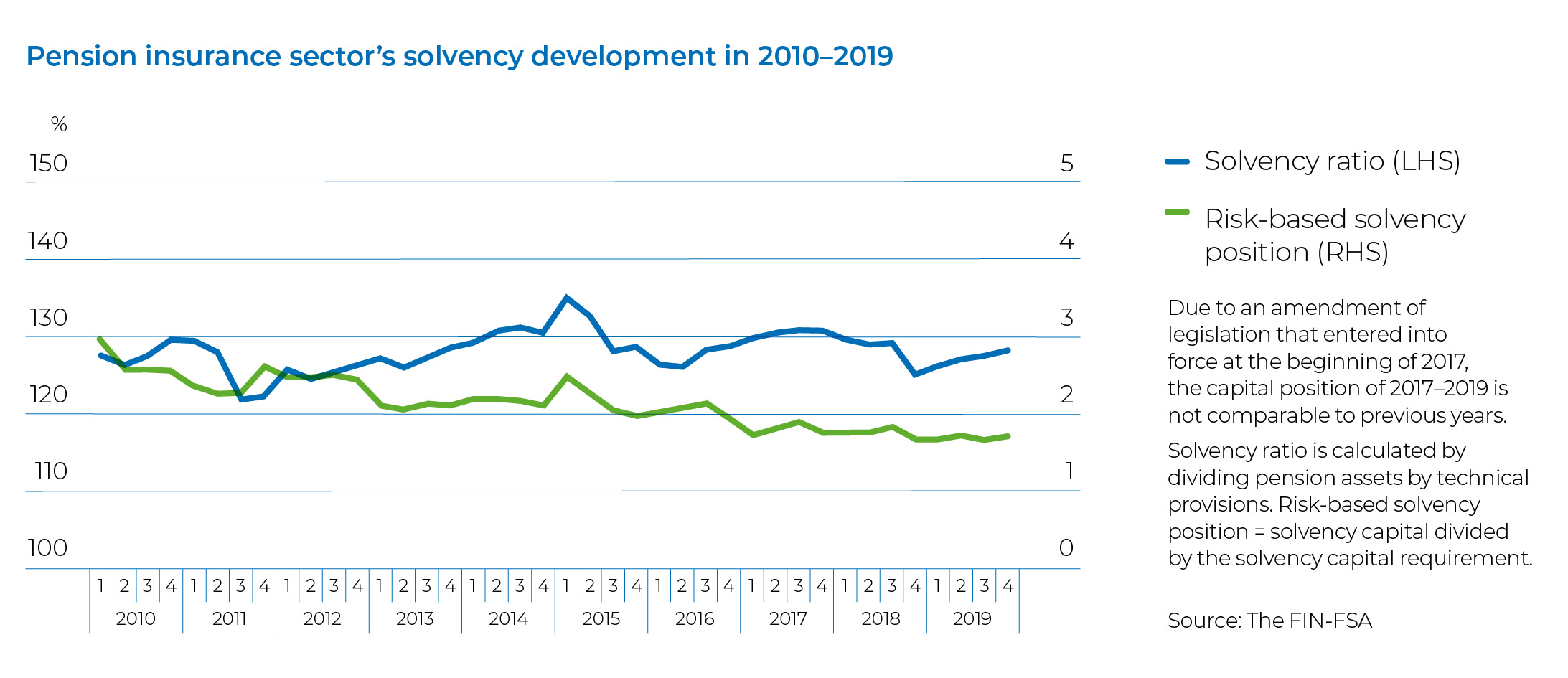

The solvency ratio of the employee pension sector, i.e. the ratio of pension assets to liabilities, improved throughout the year. The primary reason was that the return on investments exceeded the return requirement for technical provisions, mainly due to the strong performance of equities, but the improvement was also supported by the positive return on other asset classes. Risk relative to solvency capital did not change significantly during the year. The proportion of equities as the largest asset class increased further to 46.6% while the proportion of fixed-income investments decreased. Pension insurance companies’ premium income increased due to the growth of the wage bill of the economy.

Most prominent media topics brought to the public’s attention by the FIN-FSA

|

|

| 1. | Second Payment Services Directive PSD2 and strong authentication |

| 2. | Suspected money laundering and anti-money laundering measures |

| 3. | Appointment of LocalTapiola's CEO |

| 4. | Afarak Group |

| 5. | Mounting household indebtedness |