State of financial markets

The Finnish economy saw gradual improvement in 2024, although the Bank of Finland expects GDP to have contracted from the previous year in 2024.1 The sluggish cyclical development of the economy and intensification of geopolitical tensions weakened the operating environment of the Finnish financial sector and kept risks at an elevated level. The strong solvency of the financial sector, however, provided protection against the risks brought about by the deteriorating operating environment.

The Bank of Finland is forecasting that a turning point in economic conditions is at hand. The decline in interest rates will support a recovery in private consumption and investments, while exports will grow. Despite the pick-up in house sales, the state of the housing, construction and real estate investment markets has remained weak, which has also increased the credit, investment and liquidity risks of the financial sector and challenged asset valuations.

The decline in interest rates and expectations of future policy rate cuts by central banks have supported stock prices and thereby, among other things, insurance companies’ investment returns. However, financial market sentiment has been vulnerable to rapid shifts due to negative news or the increase in uncertainty.

Uncertainty is keeping the risks of the Finnish financial sector at high levels. The prospect of a brighter operating environment is overshadowed by many downward risks, such as an increase in geopolitical tensions, uncertainty related to trade policy, high indebtedness, protracted high inflation and a weakening of the employment situation. In addition, an increase in hybrid and cyber attacks has also highlighted the need for preparedness and operational risk management.

Moreover, financial sector operators are also challenged by several trends, such as the impacts of climate change (ESG risks), demographic change, digitalisation and new technologies as well as the development of new types of products and operating models (e.g. cloud services and artificial intelligence). These trends alter the ways of operation, competitive landscape and cost structure in the financial sector, and they may also create new earnings opportunities. At the same time, they may also introduce new kinds of risks, the control of which necessitates the development of risk management in the financial sector.

Profitability of the banking sector improved on the back of good profit performance, and capital adequacy ratios remained strong

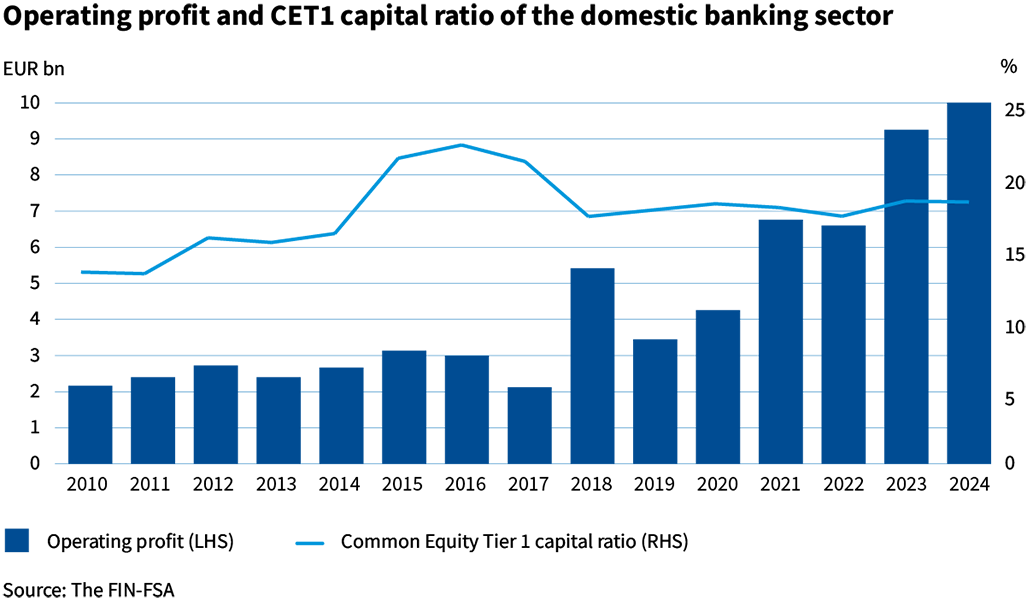

The capital adequacy of the banking sector remained stable in the review year. The own funds of the banking sector grew due to solid profit development, which compensated for the negative effects of adjustments to capital adequacy calculation models on capital ratios, in particular. The surplus of own funds of the banking sector relative to the total capital adequacy requirement weakened due to tightening macroprudential requirements. Banks continued to have ample capital relative to the requirements, however. Their capital ratios remained above the European average levels.

The operating profit of the banking sector increased further due to growth of net interest income but, towards the end of the year, the growth of the net interest income petered out due to the decline in interest rates. Net interest income was the most important income item for Finnish banks.

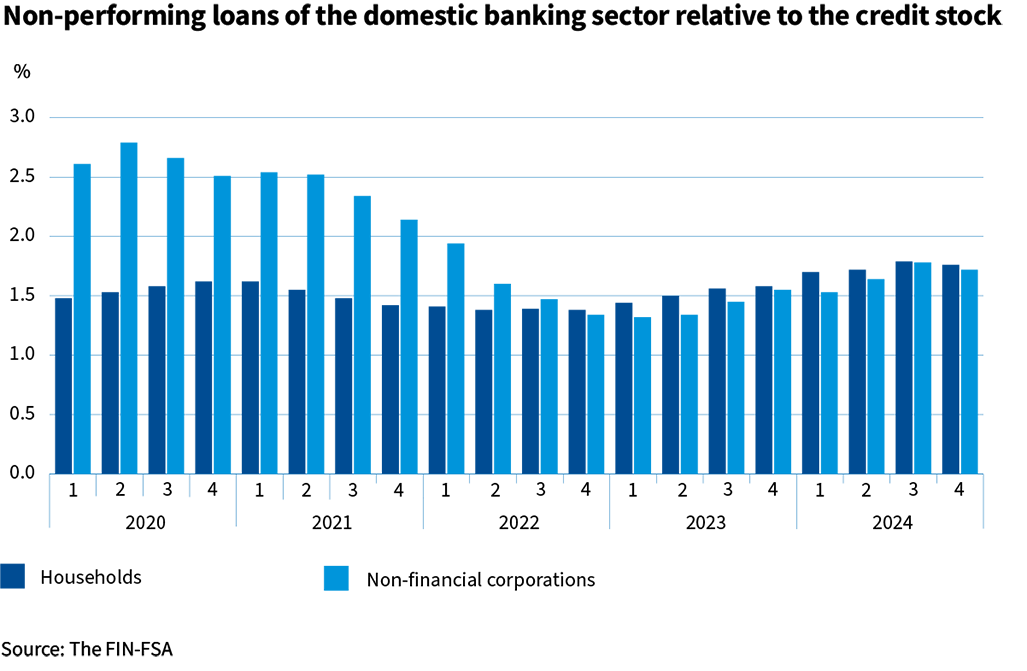

Non-performing loans in the banking sector remained at a low level and among the lowest in Europe, although there was marginal growth both in non-performing corporate and household loans. There was also more migration of credit into higher credit risk impairment categories than vice versa, signalling an increase in credit risks. Signs of a deterioration in the quality of the credit stock were particularly evident in certain segments suffering from the weak cyclical situation, such as consumer credit and construction as well as wholesaling and retail.

The liquidity situation and liquidity position of the banking sector remained strong. Deposits from the public grew and growth of funding costs levelled off. However, the refinancing of debt issued during the period of low interest rates may increase banks’ cost of market funding. Diversified funding sources and banks’ strong capital adequacy improve the availability and conditions of market-based funding while providing safety against market disruption events.

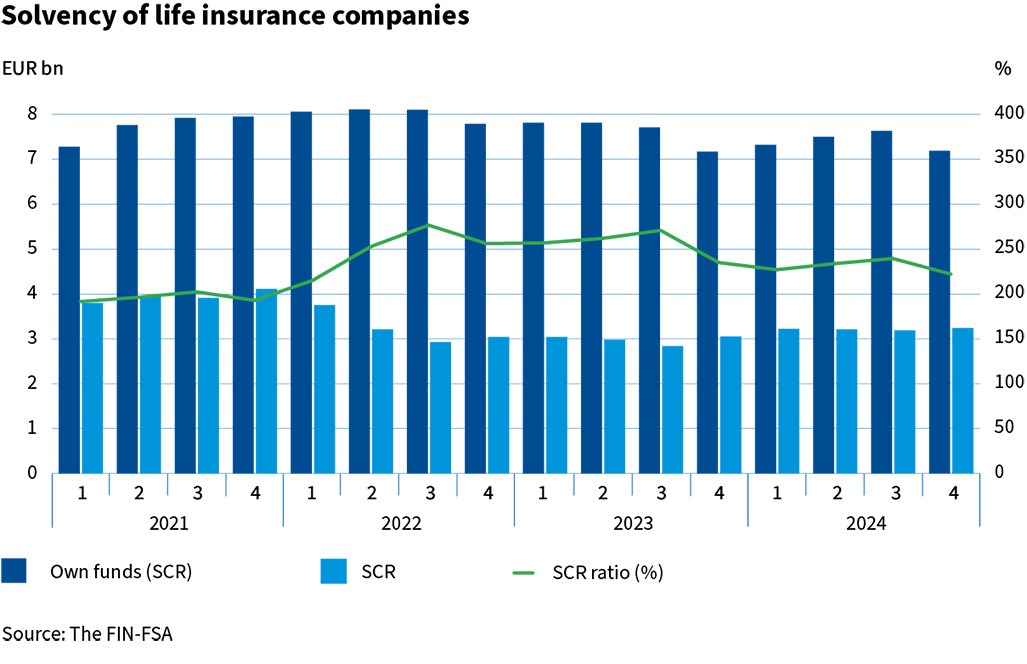

Life insurance companies’ solvency weakened towards the end of the year but remained solid

The solvency ratio of the life insurance sector declined from end-2023 to stand at 222.2% (12/2023: 235.1%). The decline in interest rates increased the amount of technical provisions and the expected dividend distributions from own funds reduced eligible own funds and weakened solvency in the last quarter of the review year. The Solvency Capital Requirement (SCR) grew year-on-year, which also weakened the solvency ratio. Despite the weakening, solvency remained at a solid level.

Life-insurance companies’ investment returns for the review year were positive (4.9%). The returns on fixed-income and equity investments were positive. Equity investments made a particularly solid return (11.5%), while real estate investment returns were negative at -0.3%. Premiums written on life insurance increased on the previous year, supported in particular by the strong sale of investment insurance policies. Claims paid increased slightly from the previous year.

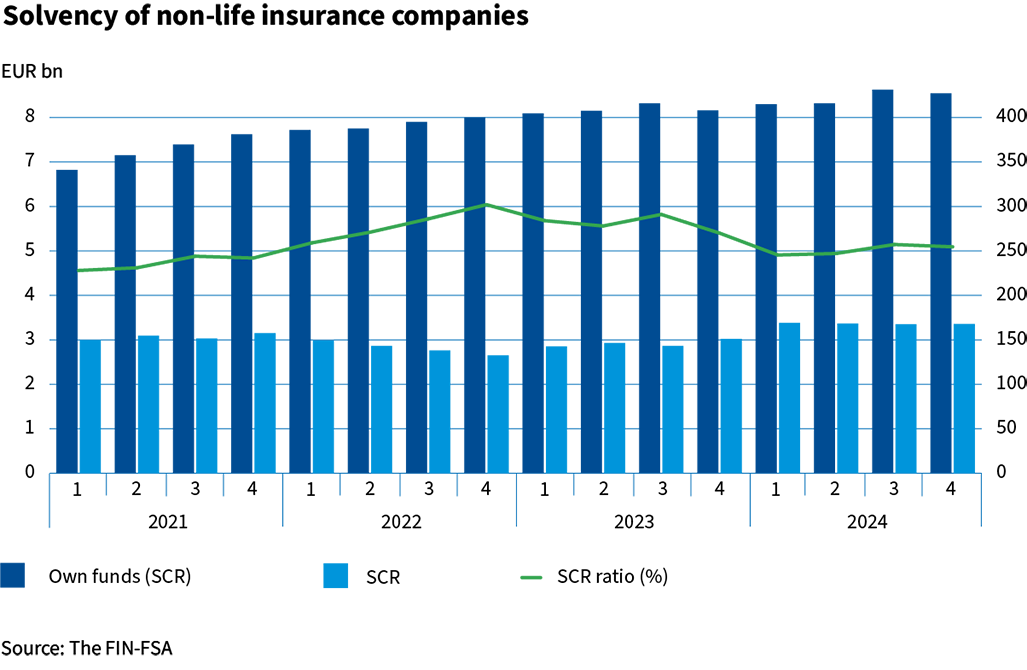

Non-life insurance companies’ solvency weakened, while remaining at a solid level

At the end of the review year, non-life insurance companies’ solvency ratio stood at 254.6%, down from the end of 2023 (12/2023: 265.5%). Despite the decline, the solvency of the sector remained at a good level. The solvency ratio was weakened by an increase of the solvency capital requirement reflecting, among other things, investment returns and a higher symmetric adjustment to the equity capital charge.

The investment returns of the non-life insurance sector amounted to 7.5% in the review year. The investment returns were generated mainly by equity and fixed-income investments. Real estate investment returns were low, but nevertheless positive. The slight growth in non-life insurance premiums written was accumulated in health and land vehicle insurance. There was a considerable increase in claims paid. Besides health insurance compensations, major damage in the early part of the year and challenging weather conditions had a negative impact on the claims ratio, but the ratio improved towards the end of the year. The profitability of the sector as a whole was at a solid level in 2024.

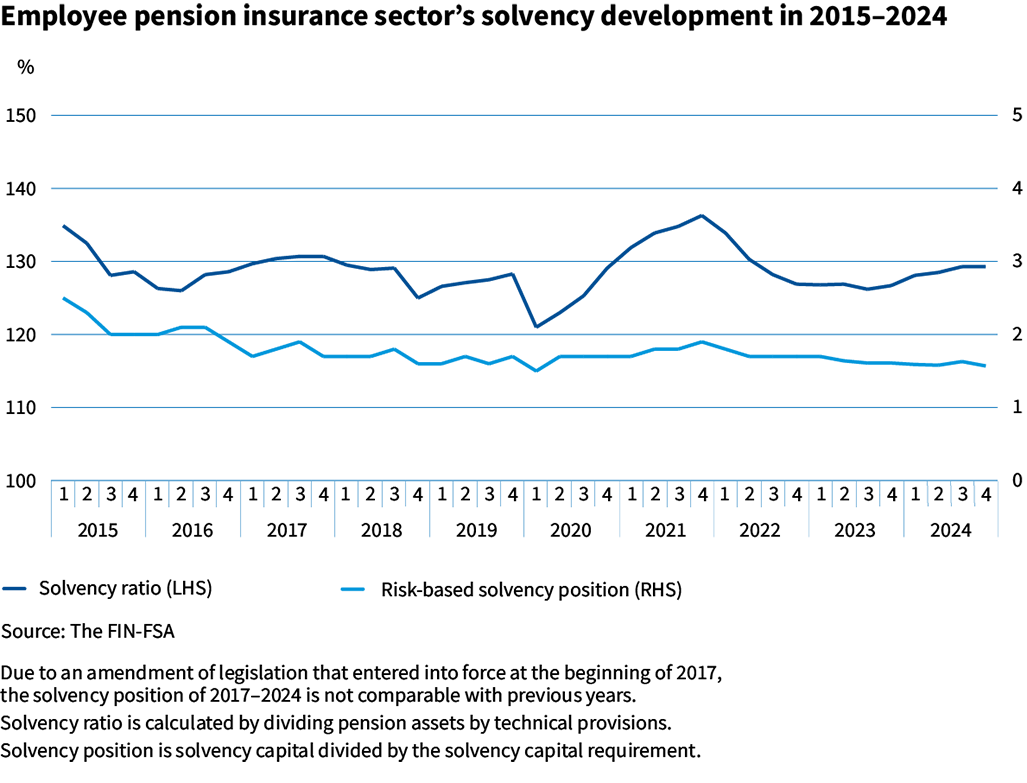

Solvency of the employee pension sector strengthened due to positive investment returns

The investment returns of the employee pension sector for the review year were significantly positive (9.1%), which also gave a strong boost to solvency capital. The solvency ratio, which indicates the ratio of solvency capital and insurance liabilities, strengthened during the year as solvency capital grew faster than insurance liabilities. The solvency position, which refers to solvency capital divided by the solvency limit, remained at the previous year’s level (1.6), although the solvency limit rose slightly faster than the solvency capital. The solvency limit was raised by the growth in investment assets and the higher equity allocation.

Among the asset classes, equities, fixed income and other investments had positive returns. Real estate investments made a negative return. During the review year, equity investments, which are also the largest asset class for employee pension institutions, reached the best returns. Employee pension institutions’ resilience to equity shocks remained broadly unchanged from the previous year, and was at a reasonable level.

FIN-FSA-related topics most visible in the media

1. Investigations related to Oma Savings Bank

2. Banks’ service breaks

3. Regulation of mortgage lending

4. Anti-money laundering

5. Availability and pricing of banking services

1 Further information on the state of the Finnish economy is available in the Bank of Finland’s economic review and forecast Finland’s economy will pick up gradually and Orastavaa kasvua Suomen taloudessa (in Finnish).