Listed companies carry out reporting on environmentally sustainable activities for the first time

Since 2021, large non-financial listed companies1 have been subject to the reporting requirements of Article 8 of the Taxonomy Regulation2 and the delegated regulations3 issued under it. The first-year reporting requirements were reduced, meaning that companies only reported on the taxonomy eligibility of their activities,4 and not yet on environmentally sustainable activities. The assessment of the taxonomy eligibility is carried out in accordance with the descriptions of activities within the technical screening criteria. The assessment of the taxonomy eligibility of an activity does not involve assessing whether the activity substantially promotes an environmental target, nor does it assess the implementation of the DNSH criteria5 or of minimum safeguards.

For 2022, companies had to expand the information they disclosed on their environmentally sustainable activity. Turnover, capital expenditure and operating expenditure had to be divided into environmentally sustainable, taxonomy-aligned activity and taxonomy-eligible but not environmentally sustainable activity. The activity was assessed with respect to two climate targets, i.e. climate change mitigation and climate adaptation.

Table 1. Main breakdown of reporting by non-financial listed companies under Article 8 of the Taxonomy Regulation

| Financial statements 20216 | Financial statements 2022 | |

| A 1 | Taxonomy-eligible activities | Environmentally sustainable, taxonomy-aligned activities |

| A 2 | Taxonomy-eligible but not environmentally sustainable activities | |

| B | Taxonomy-non-eligible activities | Taxonomy-non-eligible activities |

Table: Financial Supervisory Authority.

Reporting by European companies on environmentally sustainable activity in 2022 financial statements

On 25 October 2023 the European Securities and Markets Authority (ESMA) issued a report on information reporting by European companies that complies with Article 8 of the Taxonomy Regulation. The report is based on the observations of enforcers from 22 states regarding the reporting of 54 companies. The Financial Supervisory Authority participated in the study on taxonomy information. The focus of the European study was to evaluate the quality of taxonomy data, and how well companies have complied with the requirements of the new regulations. Due to the limited size of the sample, the outcomes of the evaluation should be considered as indicative only.

Standard templates and KPIs

Nearly all the companies in the sample reported the compulsory turnover, capital expenditure (CapEx) and operating expenditure (OpEx) KPIs. The average figures for environmentally sustainable, taxonomy-eligible activities for the different KPIs were 17 % (turnover), 28% (CapEx) and 18 % (OpEx). A more detailed distribution among the KPIs is presented on page 4 of the ESMA report (Figure 2 of the report).

The proportion of the companies that reported a value above zero for all the KPIs for taxonomy-aligned environmentally sustainable activity was 70 %, while 30 % of companies reported at least one KPI as zero. In all these companies, the OpEx alignment KPI was zero or not reported. One in four companies reported the turnover alignment KPI as zero, and 15 % reported the CapEx alignment KPI as zero. The proportion of companies that reported all the KPIs as zero was 15 %.

The Commission Delegated Regulation regarding the content and presentation of information to be disclosed by undertakings contains the standard templates7 that companies must use. Even if a company reports zero values, observing the format of the template is mandatory. A total of 30–40 %8 of European companies did not comply with the requirements of the Regulation because of missing information, parts of the standard templates having been missing, or because the company used a reporting method other than the standard templates. Reporting information in a way other than what is instructed in the Regulation makes comparability and access to the information more difficult.

In accordance with the foregoing, companies usually reported the OpEx alignment rate as zero or did not report it at all. In accordance with the Regulation, the company can opt not to report operating expenses aligned with the classification system (the numerator of the indicator) if the overall operating expenses (the denominator of the indicator) are not material for the company’s overall operations. Even in this case, the company has to justify why its overall operating expenses are not deemed to be material, in addition to which it has to report the overall operating expenses in accordance with the Regulation.9 European companies that had recourse to the materiality judgement complied with these requirements of the Regulation poorly.

Disclosure of qualitative information in addition to KPIs

In addition to KPIs, companies’ reporting in accordance with the Taxonomy Regulation requires detailed qualitative explanations of their taxonomy assessments and numerical factors. At least some of the qualitative information required by the regulations was missing or insufficient for over 40 % of the assessed companies.

Although the nature of taxonomy-aligned, environmentally sustainable activities was presented relatively well, the presentation of technical assessment criteria, DNSH criteria and the minimum safeguards for social factors was much less complete. For example, one in three companies provided no qualitative information on compliance with DNSH criteria.

Other general problem areas related to the application of the regulations included providing information on activities only in relation to one of the climate objectives, omitting information in relation to the connections or balancing related to financial or non-financial reporting, and the lack of an explanation of how double counting has been avoided by the company.10

The ESMA report also contains some good reporting practices. For example, some companies provided detailed explanations on the criteria that the activity did not meet either in relation to the technical screening criteria or the DNSH criteria.

On the basis of these observations, the ESMA reminds companies of the importance of providing all the quantitative as well as the detailed qualitative information as required by the delegated regulations, in order to enable users of the information to fully understand to which activities the quantitative information relates, how the different criteria were assessed, and how the company assesses the taxonomy alignment and eligibility of its activities.

Reporting by Finnish companies on environmentally sustainable activity in 2022 financial statements

The Financial Supervisory Authority looked through the taxonomy information tables of all the non-financial listed companies subject to an obligation to publish information. The information was presented either in a board of directors’ report or in a separate report such as a sustainability report. A review with a similar scope was not carried out on qualitative information. The observations regarding the qualitative information of individual companies are in line with the observations presented in the ESMA report.

Observations on use of standard templates and information presented in tables

Nearly all the companies published taxonomy information in one form or another. The information was missing altogether for three companies. The FIN-FSA points out that major listed companies with an average number of employees during the financial year of 500 are obliged to include the information pursuant to Article 8 of the Taxonomy Regulation and the delegated regulations issued under it in their board of directors’ report or a separate report.11

Most of the companies disclosed the taxonomy information in the table format required by the Commission’s Delegated Regulation (EU) 2021/2178. Less than half (43 %) of companies followed the standard templates precisely. The FIN-FSA points out that the Regulation requires the standard templates to be used, and these must not be modified. Changes should not be made even when the company’s whole activity is non-taxonomy-eligible, or if the company applies a materiality exception to operating expenses. The digitalisation of taxonomy information will be based on the templates, and complying with these before this is done will help companies when the information is subsequently digitalised.

There were also clear factual errors in the completion of the tables. In column 2 of the tables regarding codes, the activity codes of the Commission’s Delegated Regulation (EU) 2021/2139 should be used instead of NACE codes. If a company wants to provide NACE codes as well, these can be provided as additional information in conjunction with the name of the activity in column 1 or in the qualitative description of the taxonomy information. The codes must be provided in conjunction with all activities, both taxonomy-aligned and taxonomy-eligible activities, on the same row with the activity. Users of the information must be able to understand which of the delegated regulation’s criteria the company has used in assessing the taxonomy alignment or eligibility of its activities.

In the assessment of compliance with the DNSH criteria, it is necessary to consider that all the criteria do not necessarily need to be assessed for all the activities. The number of DNSH criteria to be assessed varies by activity, and the tables must be completed accordingly.

The careful completion of the tables facilitates their understanding. There was a wide variety of individual oversights. For example, table headings were missing, the units of figures in euros were not indicated, and the sum rows of tables did not match with the figures of individual activities. Judging by the large number of observations, companies should improve the accuracy of information.

Summary of KPIs on environmentally sustainable activity

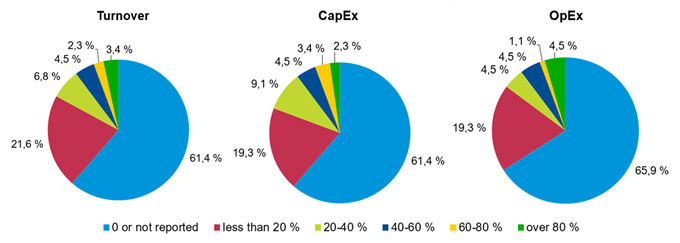

According to the summary of Finnish companies’ taxonomy KPIs, the average values of the taxonomy alignment KPIs measuring environmental sustainability were: turnover KPI 11 %, CapEx KPI 12 %, and OpEx KPI 12 %. The below image describes the more detailed distributions. In the ESMA’s sample, the corresponding averages for the different KPIs were 17 % (turnover), 28 % (CapEx) and 18 % (OpEx).

The proportion of companies that reported the turnover, CapEx or OpEx alignment KPI as zero or in which the KPI was not reported is significant, i.e. 60% for all the KPIs. In the ESMA’s study of European companies, the corresponding proportions of zero reporting were 24 % (turnover), 15 % (CapEx) and 30 % (OpEx).

Figure 1. Proportions of Finnish companies’ environmentally sustainable, taxonomy-aligned activity measured with the turnover, CapEx and OpEx KPIs

Source: Financial Supervisory Authority.

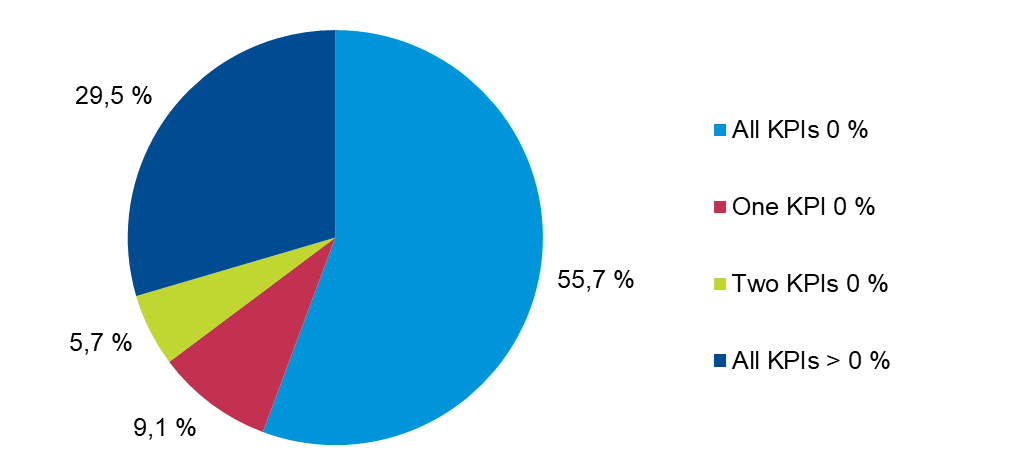

Figure 2 also illustrates the difficulty of the reporting: the proportion of Finnish companies that reported all the KPIs as zero was 56%. In the ESMA’s study the corresponding figure was 15 %. The share of Finnish companies that reported all the KPIs as higher than zero also diverged substantially from the corresponding figure for European companies (30 % vs. 70 %).

Figure 2. Zero reporting of environmentally sustainable, taxonomy-aligned activity by Finnish companies measured with the turnover, CapEx and OpEx KPIs

Source: Financial Supervisory Authority.

The application of broad and complex regulations for the first time probably influences the results. Some of the differences between the Finnish study and the ESMA study are also explained by the difference in the coverage of the target group. Finnish companies might have been cautious in their assessments, or alternatively, companies might have had difficulty identifying what activities can be reported as environmentally sustainable. Especially with respect to capital expenditure reporting, there is a striking difference between Finnish companies and the ESMA sample.

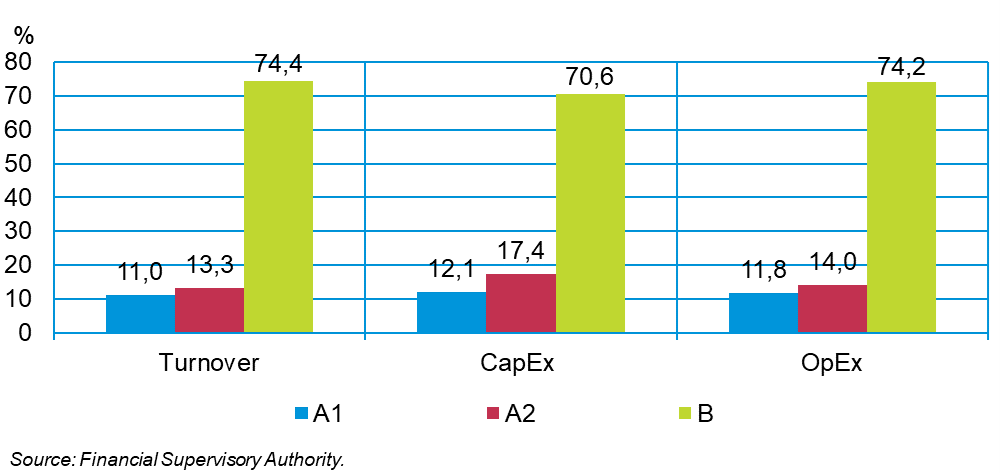

In Figure 3, the averages of the different KPIs have been summarised for taxonomy-aligned (section A1 of the reporting template), taxonomy-eligible (A2) and taxonomy-non-eligible activity (B). The study included 88 Finnish listed companies.

Figure 3. Average KPI values of Finnish companies for taxonomy-aligned (section A1 of the reporting template), taxonomy-eligible (A2) and taxonomy-non-eligible activity (B)

Changes to reporting of environmentally sustainable activity in 2023 financial statements

On 27 June 2023, the European Commission approved the delegated regulations related to the application of the Taxonomy Regulation, which are currently in the final stages of the legislative process. After the new delegated regulations are completed, the reporting obligations under them will be applied to information pursuant to Article 8 of the Taxonomy Regulation, to be published from 1 January 2024 onwards in 2023 financial statements.

The delegated regulations contain updates to the standard reporting templates. In addition, the technical screening criteria for additional activities are confirmed for the first two environmental objectives, and technical screening criteria and the associated reporting obligations are put into use for activities promoting the remaining four environmental objectives.12

With respect to the additions brought by the Regulations, during the first reporting year, companies only need to provide information on the proportion that taxonomy-eligible and non-taxonomy-eligible economic activities account for of their total turnover, capital expenditure and operating expenditure, and qualitative information regarding these. The ESMA reminds companies to monitor the completion of the legislative process and to prepare for reporting in line with the new regulations.13

|

The ESMA encourages companies to use the guidance and tools published by the European Commission, including guidance on the interpretation and application of certain criteria and disclosures, and online tools that help companies in their taxonomy reporting.14 The ESMA also notes that the communication issued by the European Commission in June 2023 underlines the role of the taxonomy as a "common language", which plays a central role in the EU's sustainable finance framework and which can be used by companies in planning investments and setting targets for the green transition15. |

For further information, please contact:

- Sirpa Joutsjoki, Senior Specialist, sirpa.joutsjoki(at)fiva.fi

- Nina Männynmäki, Chief Specialist, nina.mannynmaki(at)fiva.fi

1A large company pursuant to the Accounting Act with an average number of employees during the financial year of 500. A listed company is a Finnish company the shares, bonds or other securities issued by which are admitted to trading on a regulated market (the main list of a stock exchange).

2Regulation (EU) 2020/852 of the European Parliament and of the Council on the establishment of a framework to facilitate sustainable investment

3Commission Delegated Regulation (EU) 2021/2178, Commission Delegated Regulation (EU) 2021/2139, Commission Delegated Regulation (EU) 2022/1214.

4 Sections A1 and A2 of the reporting template combined.

5 Do No Significant Harm.

6 The wording of the Article has been simplified so that the financial period of companies is assumed to be a calendar year.

7 (EU) 2021/2178, Annex II.

8 The percentage varies for the three different reporting templates concerning turnover, capital expenses and operating expenses.

9 (EU) 2021/2178, Annex I, 1.1.3.2 final paragraph

10 (EU) No. 2021/2178, Annex I, 1.2.2.1(c) and 1.2.2.2(c).

11 In accordance with the valid Accounting Act, a separate report can still be made in the 2023 financial statements. In the 2024 financial statements the sustainability information, including the information pursuant to Article 8 of the Taxonomy Regulation, must be disclosed in the board of directors’ report.

12 Water and marine resources, circular economy, pollution prevention, biodiversity and ecosystems.

13 European common enforcement priorities for 2023 annual financial reports, Section 2.1: Priority 1: Disclosures relating to Article 8 of the Taxonomy Regulation.

14 Sustainable finance taxonomy FAQ and EU Taxonomy Compass (europa.eu)

15 Communication from the Commission on a sustainable finance framework that works on the ground COM(2023) 317