5. Monitoring of securities market trading

A requirement for the functioning of the securities markets is that investors have confidence in the markets and market participants. Market abuses, such as misuse of inside information and market manipulation, erode this confidence and are therefore prohibited by the Market Abuse Regulation (MAR). Our market surveillance team investigates suspicious transactions and possible abuses in the securities markets.

Supervision in 2023 and priorities for 2024

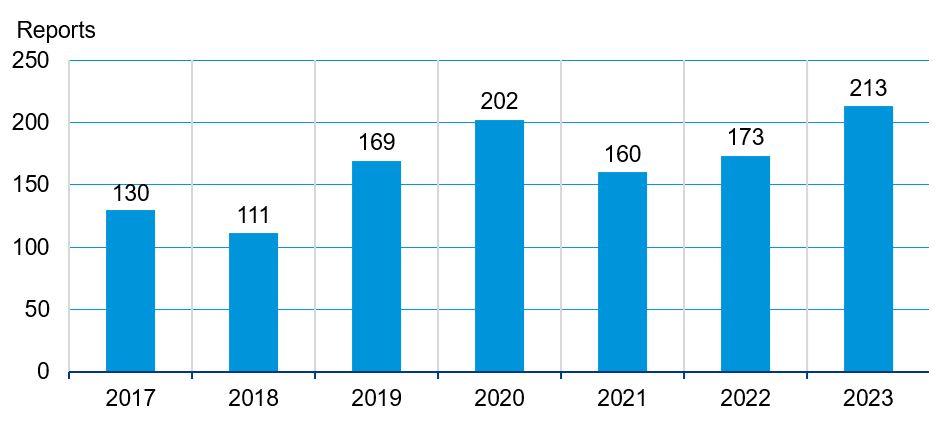

Monitoring of securities market trading is performed by many participants. In addition to the FIN-FSA, key actors include market operators such as stock exchanges as well as banks and investment firms that participate in receiving, transmitting or executing orders involving financial instruments. Under MAR, these actors are obliged to submit to the FIN-FSA a suspicious transaction and order report (STOR) without delay for transactions and orders that may involve insider trading and market manipulation or attempts to do so1. In 2023, we received 213 STOR reports, which is slightly more than in previous years (see Figure 2). Two-thirds of the STOR reports came from Finnish entities and one-third from foreign entities, forwarded to the FIN-FSA by other national securities market supervisors.

Figure 2. STOR reports submitted to the FIN-FSA in 2017–2023

Source: Financial Supervisory Authority.

In addition to STOR reports, any market participant, for example a retail investor, has the opportunity to submit reports of suspected infringement (so-called whistleblowing system) or informal market observations to the FIN-FSA2. In 2023, we received a total of 18 such observations or suspicions with regard to insider trading, market manipulation or managers’ transactions.

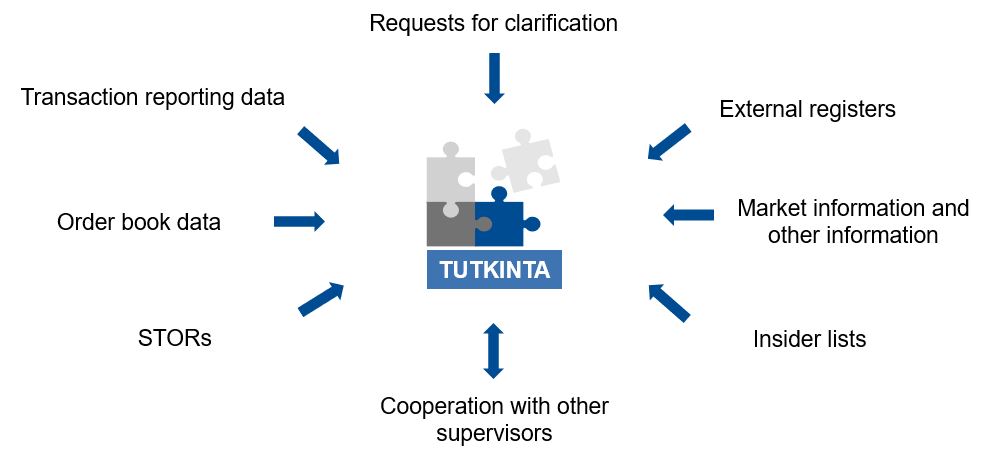

In addition to investigating reports of potential market abuse submitted to us by market participants, we screen and analyse such incidents using our own supervisory systems and procedures. In a more detailed investigation, we make use, in particular, of transaction reporting data3 and other detailed supervisory material and, if necessary, obtain additional information to clarify the issue or suspicion (see Figure 3). At the end of last year, the FIN-FSA organised an event for financial journalists where we made a presentation on market abuse monitoring as one of the topics (presentation material – in Finnish).

Figure 3. An investigation of market abuse combines and analyses data from different data sources

Source: Financial Supervisory Authority.

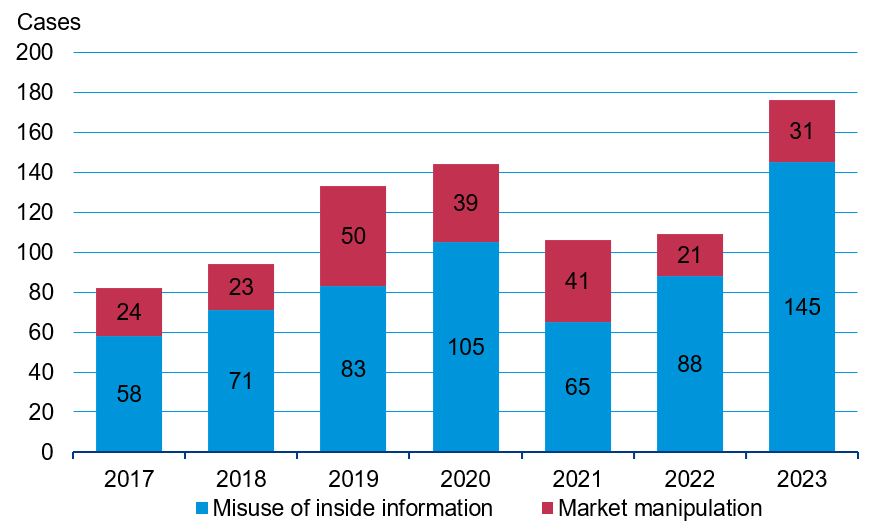

In 2023, the FIN-FSA investigated nearly 200 supervision cases related to securities market trading and disclosure obligations, which is 50% more than in the previous year. Most of the cases investigated concerned trading and, in particular, suspected misuse of inside information. The increase in the number of cases investigated is due to, among other things, the development of the FIN-FSA’s supervisory processes and methods, particularly in the investigation of misuse of inside information.

In monitoring of securities market trading, we have observed more delays than in the past in the reporting of managers’ transactions4. Reports are an important source of investor information, and the obligations and restrictions on trading by managers are intended to promote confidence in the market. In early 2024, the FIN-FSA imposed a penalty payment on a former board member of a listed company for trading during a closed period5.

In supervision of market manipulation, in 2023 we focused particularly on wash trades and trading in which the price of a financial instrument is repeatedly influenced by small trades. We wrote about wash trades, for example in the Market Newsletter, in order to draw the attention of traders to the types of transactions that may be wash trades and therefore prohibited market manipulation6. In addition, we reviewed the practices of investment service providers and the organisation of trading supervision. We will also continue to focus supervision on these themes during 2024.

Figure 4. Supervision cases related to misuse of inside information and market manipulation investigated by the FIN-FSA in 2017–2023

Source: Financial Supervisory Authority.

If, at the end of an investigation, there is reason to suspect misuse of inside information, market manipulation or another MAR violation, we intervene in the case either with administrative sanctions or by making a request for police investigation, if we have reason to suspect a crime.

We are monitoring the progress of regulatory reforms (e.g. Listing Act and Markets in Crypto-Assets Regulation, MiCA) and aim to report on upcoming changes and their impact in the Market Newsletter.

For further information, please contact:

- Hermanni Teräväinen, Senior Supervisor, hermanni.teravainen(at)fiva.fi or tel. +358 9 183 5346

- Sari Helminen, Head of Division, sari.helminen(at)fiva.fi or tel. +358 9 183 5264

1 Reporting obligation concerning the prevention and detection of market abuse - Issuers and investors - www.finanssivalvonta.fi

2 Report of suspected infringement - About us - www.finanssivalvonta.fi

3 Reporting - Transaction reporting - www.finanssivalvonta.fi

4 Managers’ transactions and the closed period- Issuers and investorst - www.finanssivalvonta.fi

5 Penalty payment imposed on former board member of listed company for violation of prohibition on transactions - 2024 - www.finanssivalvonta.fi

6 Wash trades prohibited as market manipulation - Market Newsletter 1/2023 – 25.5.2023 - www.finanssivalvonta.fi