3. Prospectuses and takeover bids

In a FIN-FSA prospectus review, we scrutinise and approve the prospectus related to the offering and listing of securities. Our takeover bid team scrutinises and approves offer documents related to public takeover bids and, among other things, makes interpretations in matters concerning takeover bid regulation. Our supervision is mainly related to supervision of compliance with the Securities Markets Act and the Prospectus Regulation. We do not, however, have the power to supervise compliance with the provisions of the Limited Liability Companies Act, nor do we supervise, for example, corporate law procedures on share issuances, nor issues related to dividend payment or other decision-making under the Limited Liability Companies Act.

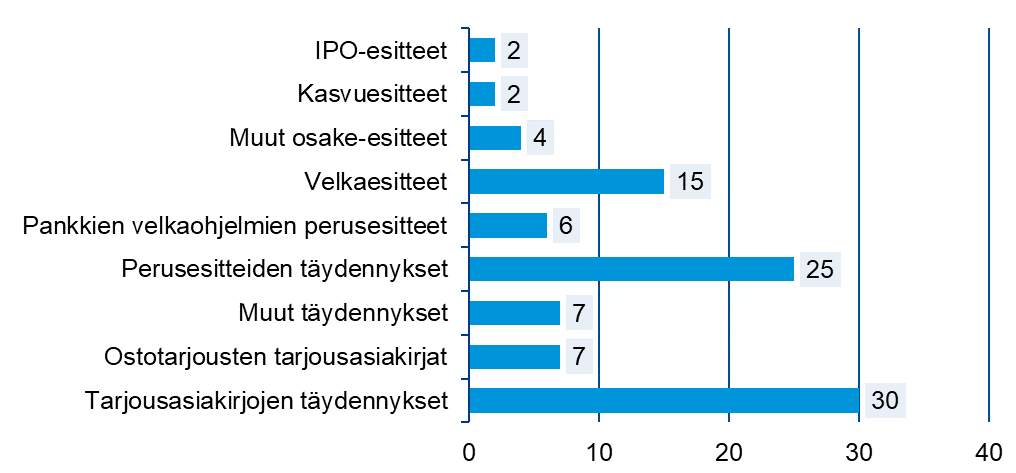

Number of prospectus and takeover bid cases processed in 2023

In 2023, we scrutinised a total of 29 prospectuses and 32 prospectus supplements. We particularly discussed with the authors of the prospectuses the requirements for the disclosure of financial information. We scrutinised seven takeover bid offer documents, and a total of 30 supplements related to them. In connection with four takeover bids, of which some were consortium bids, we paid particular attention to the assessment of equivalent treatment.

Figure 1. Number of prospectuses and takeover bids in 2023

Source: Financial Supervisory Authority.

Prospectus review priorities in 2024

As part of our scrutiny of prospectuses, we will continue to pay particular attention to prospectuses’ justifications for the adequacy of working capital. The justifications must be carefully prepared, and consistent with the content of the prospectus.

We will assess the disclosure of sustainability information in prospectuses in accordance with ESMA guidance1. The guidance contains detailed requirements, particularly for prospectuses concerning ‘use of proceeds’ bonds or ‘sustainability-linked’ bonds. For more details, see Market Newsletter 3/20232.

In 2024, the comprehensibility of prospectuses is one of the priority areas defined by ESMA. In addition to the comprehensibility of prospectuses, we will also pay attention to the comprehensibility of supplements to prospectuses. Supplements must clearly indicate what supplementary information has been added to the prospectus. In order for the scrutiny and approval of supplements within five working days to take place smoothly, a careful assessment should be made already at the preparation stage of supplements as to which sections of the prospectus are to be affected by the supplemented information.

We will continue to try to scrutinise and approve prospectuses within 10 working days (IPO prospectuses within 20 working days) if there are no further comments on the draft prospectus at the end of this period. If necessary, a new scrutiny period of ten working days is calculated for the delivery of a new draft prospectus in accordance with the Prospectus Regulation. We ask entities to inform us in advance of all prospectus applications (e.g. type of prospectus and preliminary schedule), even if there are no specific questions related to the prospectus. In order to enhance our scrutiny of prospectuses, we will continue to develop and utilise an artificial intelligence tool.

We will monitor the progress of prospectus-related regulatory reforms (e.g. the Listing Act and the EU Green Bond Regulation) and will seek to report on upcoming changes and their potential impact on prospectus scrutiny in a Market Newsletter, once the content and impact assessment of the new regulations are confirmed.

It is the intention to repeal FIN-FSA Regulations and guidelines Securities offerings and listings in spring 2024. Up-to-date guidance will be added at the same time to the Offering securities and prospectuses section of the FIN-FSA website.

We will also participate in ESMA’s upcoming follow-up evaluation of supervisors’ prospectus scrutiny process, which relates to the peer review report published by ESMA in 20223.

Observations on takeover bids

In recent years, most of the interpretation issues referred to the FIN-FSA with regard to takeover bids have concerned equivalent treatment. Equivalent treatment is one of the key principles to be followed in a public takeover bid. When approving an offer document, we pay particular attention to the terms of the offer, the equivalent treatment of security holders, and whether the offer consideration meets the requirements of the Securities Markets Act.

The FIN-FSA should be contacted in good time if it is planned to make a takeover bid as a consortium bid or if there may be interpretation issues regarding equivalent treatment connected with the bid. The duration of the processing of interpretation issues will be impacted by the structure and complexity of the issues and the underlying arrangements as well as how clearly the arrangement is described, and whether the FIN-FSA needs further clarification in the matter. We emphasise that the descriptions of the arrangement in the offer documents must correspond and be consistent with how the matter has been presented to the FIN-FSA in connection with interpretation issues.

When scrutinising offer documents, we aim to pay attention to the comprehensibility and clarity of supplements to offer documents, so that the points being supplemented are clearly evident in the supplement documents.

Changes to takeover bid regulations are also on the way. Amendments have been proposed to the Securities Market Act (HE 3/2024 vp) that would also extend the obligation to launch a bid, the code of conduct provisions to be followed in public takeover bids, and the flagging obligation to apply to the multilateral trading facility (First North companies). In practice, this means that, through the amendments, the offer documents and their supplements for takeover bids made for FN companies would also come to the FIN-FSA for approval, and if the holding of a shareholder of an FN company exceeds limit of the obligation to launch a bid, they would be obliged to launch a bid. The shareholders of FN companies would have to submit a flagging notification to the target company and the FIN-FSA when an ownership or voting share would exceed, fall below or reach the flagging threshold, and the target company would have to publish the flagging notification it has received. It is also the intention to amend the definition of persons acting in concert of chapter 11, section 5 of the Securities Market Act so that the definition of persons acting in concert would not lead to inappropriate situations in relation to other financial market legislation that have been identified in market practice. The amendments will also result in changes to FIN-FSA Regulations and guidelines Takeover bid and the obligation to launch a bid.

For further information, please contact:

- Marianne Demecs, Senior Supervisor, marianne.demecs(at)fiva.fi or tel. +358 9 183 5366

- Sari Helminen, Head of Division, sari.helminen(at)fiva.fi or tel. +358 9 183 5264

1 Statement on the sustainability disclosure in prospectuses

2 Sustainability matters in prospectuses - Market Newsletter 3/2023 – 24.11.2023 - www.finanssivalvonta.fi

3 Peer review of the scrutiny and approval procedures of prospectuses by competent authorities